- Neil's Newsletter

- Posts

- Your IMPORTANT Weekly Briefing: (9th January 2026)

Your IMPORTANT Weekly Briefing: (9th January 2026)

The Neil McCoy-Ward Newsletter

Opening Note…

Wow! What an insane week… can you believe everything going on right now? It’s been a while since the news hit us this thick and fast each day. If it’s not actual warfare this week, it’s the threats of warfare or taking over land.

And now NATO doesn’t know how to handle Trump over Greenland and the UN definitely doesn’t know how to handle Trump after he pulled the US out of 66 UN accords this week.

And this is just the tip of the iceberg…

Let's break down the latest...

Table of Contents

1. Weekly Spotlight

The Venezuela Situation Just Got Complicated

I’m sure what happened in Venezuela will be turned into a blockbuster movie shortly. Of course, it’s really all tied to two things the world never stops fighting over, oil and gold.

On January 3, 2026, U.S. forces captured Nicolás Maduro in Caracas and flew him to the U.S. to face drug-related charges.

Then came the part that escalated things... As part of a wider U.S. push to choke off Venezuelan oil exports, U.S. forces (and lets not forget the British too) boarded and seized a Russian-flagged oil tanker named Marinera near Iceland after a long pursuit. The ship had reportedly changed its name and flag, which is basically the maritime version of changing your clothes and hoping nobody recognises you. As you can imagine, Russia blew up over it and called it piracy.

So the question you may be wondering is, why is all this happening now? Why go this hard? Well A big part of the answer is down to Venezuela’s vast resources.

Firstly OIL: Venezuela is sitting on roughly 300 billion barrels, which is roughly 17% of global oil reserves. So you may be wondering why they haven’t been using all this oil to its fullest potential. Well having oil in the ground doesn’t mean you can easily tap it or sell it profitably. Most of Venezuela’s crude is extra-heavy, meaning it’s thick like tar and needs expensive processing before it becomes usable fuel.

Because of years of mismanagement, sanctions, and lack of investment, the country now produces far less than it could, often less than a million barrels per day, which is a tiny fraction of its potential. There’s already talk of Trump getting US oil companies to go in and start extracting and refining, although - I think many will hold back… if I put my investor head on here for a moment:

It’s very risky for any oil company to invest huge sums of money into getting set up in Venezuela. Especially because by the time they get setup, Trump may no longer be in power (yes, it can take that long). And what if International law says that the company’s presence there is deemed illegal? It’s not as easy for a multi national company with assets spread across the World to try to avoid that.

It’s fairly easy for Trump to say ‘well, what are you gonna do about it?’ to the UN & NATO, because he has the World’s largest everything at his disposal (Economy, Military, etc). But for a company, they could get sued very badly and even have assets and bank accounts confiscated under International law. This is why I think we could see more caution than optimism…

Venezuela also has huge un-mined gold potential, mainly in the south in the area people often refer to as the Orinoco Mining Arc and the broader Guiana Shield. Estimates vary, but multiple reports in recent coverage put the in-ground figure in the 7,000 to 8,000+ tonnes range. Yes I did say TONNES (of GOLD!)

At current prices, that's over a $1 trillion value. If even a slice of that becomes a real, controllable output, it would create generational wealth.

Once you hold those two facts in your head, the story feels less random or chaotic. Maduro’s capture, the oil blockade, and the boarding of a Russian-flagged tanker all sit within the same bigger theme. This is about who gets leverage over a country that has a ridiculous amount of energy in the ground and a lot of hard money buried under it, too.

They will want you to think it’s about doing the right thing and removing a ‘bad man’ - but alas, there’s always a reason… (and then there’s the real reason).

So far, Russia hasn’t named a specific consequence, and that restraint is deliberate. Russia has a lot to lose if this escalates into tit-for-tat actions on the oceans. Its economy depends heavily on oil exports, and many of its tankers already operate under heightened risk because of sanctions. Openly threatening retaliation could spook insurers, raise shipping costs, and hurt Russia more than the U.S. But if Putin doesn’t respond, he will look weak. So expect something somewhere in the middle…

2. Quick Takes

Here are the other top stories shaping the week:

Iran cuts off internet as protests spread nationwide

Iran is seeing fast-growing protests over economic pain and anger at the government, now stretching into a second week and reaching over 100 cities across all 31 provinces. Authorities have reportedly shut down most internet and mobile access, with monitoring groups saying the country is almost completely offline, and dozens of people, including security forces, have been reported dead and more than 2,000 detained.

President Masoud Pezeshkian has publicly urged police and security forces to show restraint and listen to people’s demands, even as officials point to violent attacks on officers and talk up the risk of foreign meddling. In Washington, Donald Trump has warned the US will hit Iran “very hard” if it starts killing protesters, while Vice President J.D. Vance is pushing Tehran to enter fresh nuclear talks after US strikes on key nuclear sites last June.The mix of street anger, a security crackdown, external pressure and talk of armed resistance is raising fears that the crisis could slide into something much more serious. - Given the scale of some of these protests and the fact that it isn’t getting any quieter, it makes me wonder how much longer the regime actually has…

Petro vows to “take up arms again” if US targets Colombia

Colombian President Gustavo Petro warned he would “take up arms again” if the US military moves against him or his country, after Donald Trump suggested Colombian drug traffickers could be the next US target. Petro accused US Secretary Marco Rubio of relying on false intelligence from corrupt Colombian police and politicians tied to the mafia, and denied any role in drug trafficking. Washington has blasted its government for record coca cultivation and cocaine production, sanctioned it for failing to curb the trade, and framed this as a failure of political leadership rather than the security forces. Petro defended his record by pointing to ordered bombings and operations against drug-linked armed groups, saying he tries to avoid killing civilians and children, and warned that indiscriminate strikes would spark a new guerrilla wave. He called on Colombians to “defend the president” against any illegitimate attack by winning power in every town, framing the confrontation as a fight for the country’s sovereignty and democracy.

UK and France pledge troops for post-war Ukraine, but Russia is still the roadblock

Britain and France have signed a declaration with Volodymyr Zelenskyy, saying they are ready to deploy troops to Ukraine once a ceasefire is in place, building military hubs across the country but staying well behind any front line. The plan is tied to wider “coalition of the willing” security guarantees, with Europe taking on ceasefire monitoring under US leadership. US envoys Steve Witkoff and Jared Kushner say American guarantees are rock solid, but admit the toughest issue in peace talks is whether Ukraine gives up territory, something Zelenskyy is still resisting. Several key European leaders, including those of Italy and Poland, have ruled out sending troops into Ukraine, and Germany says any contribution would be based in neighbouring states, not on Ukrainian soil. All of this still runs into one big problem: Moscow has repeatedly rejected a quick ceasefire, insists on a wider political deal, and flatly opposes any NATO-linked soldiers on Ukrainian territory.

Trump aide says US is entitled to Greenland as Europe lines up behind Denmark

Stephen Miller said the US has the right to control Greenland and argued that nobody would fight Washington militarily over the island, questioning Denmark’s claim and calling Greenland a natural part of US-led NATO security. His comments came after US strikes in Venezuela, while Denmark’s leaders warned that any US attack on a NATO ally would effectively end the alliance, and Greenland’s prime minister told Trump to drop his “fantasies about annexation” but said he was open to talks under international law. Six major European countries publicly backed Denmark, stressing that only Denmark and the people of Greenland can decide their relationship, even as the Trump team signalled it wants more than extra bases and is not interested in Denmark’s offer of more US military presence. Analysts are now floating ideas like paying each Greenlander $1 million as a “soft” route to US control, under a stretched version of the old Monroe Doctrine for the Arctic.Trump pulls the US out of the core UN climate treaty

Donald Trump has ordered the US to quit the UN Framework Convention on Climate Change, the basic global agreement underpinning all international climate action, making America the only country in the world outside it. In the same memo, he told the US to leave 65 other international bodies, including the UN’s top climate science panel and several clean energy groups, dismissing them as against US interests. Legal experts also warn it’s unclear whether a president can unilaterally walk away from a treaty approved by the Senate, with their main fear that the US could be shut out of climate diplomacy even after Trump leaves office. - I think Trump has made some of the most significant changes of any president in history. The fact that this was a minor story on MSM shows how much has happened this week!

Trump steps up anti-fraud pressure on California

Donald Trump says a fraud investigation into California has begun, accusing Governor Gavin Newsom of running a state even more corrupt than Minnesota. His team is treating the Minnesota daycare welfare scandal and Tim Walz’s exit from the governor’s race as proof that aggressive investigations and online campaigning can expose huge abuse of benefits. In California, Republican congressman Kevin Kiley points to audits showing tens of billions lost or wrongly paid out in homelessness and unemployment programmes, while conservative activists claim total fraud under Newsom could run into the hundreds of billions. Newsom, of course, rejects this, but California is now firmly in the spotlight just as betting markets give him a real, if modest, shot at a 2028 presidential run, and Trump-world hints that Elon Musk could join the push. - If even a fraction of these fraud claims are accurate, it would be one of the biggest frauds in modern history. And if I know a thing or two about researching fraud… where there’s smoke, there’s fire. And what a coincidence the events happening this week in Minneapolis… a very convenient incident indeed for Waltz, taking the heat off his corruption scandal(s).

Trump admin freezes welfare funds to blue states over fraud fears

The Trump administration has halted or reduced billions in federal welfare funds to five Democrat-led states, citing fears that child care and social service benefits were being siphoned off fraudulently, including to non-citizens. HHS is blocking more than $7 billion in TANF money, nearly $2.4 billion in child care funds, and around $869 million in social service grants to California, Colorado, Illinois, Minnesota and New York, with Minnesota under particular scrutiny after viral footage of seemingly empty childcare centres still receiving subsidies. The clampdown follows the huge “Feeding Our Future” scandal in Minnesota, where prosecutors say hundreds of millions in Covid-era meal funding were stolen and some money was moved overseas, with dozens of people, many of them Somali-Americans, charged or convicted. Under pressure from the fallout, Minnesota Governor Tim Walz announced he will not run for re-election in 2026 (as if he could anyway!), Arguing he needs to focus on governing while accusing opponents of weaponising the fraud cases to stoke resentment.

Trump orders $200bn mortgage bond buying spree to push down rates

Donald Trump has told Fannie Mae and Freddie Mac to use $200bn of their cash to buy mortgage bonds, saying it will push mortgage rates and monthly payments down before November’s midterms. The two government-backed lenders have already been growing their pile of home loans and mortgage-backed securities they keep on their own books, which has helped fuel talk that they are quietly trying to lower borrowing costs. The move comes alongside Trump’s promise to ban big investors from buying single-family homes and a planned order that would let people dip into retirement and college savings to fund deposits. Supporters frame this as a big affordability push, while critics say it just pumps up demand, props up asset prices, and acts like a shadow version of money-printing. - I was only talking about this last week on the monthly Macro Patreon video, and how this practise should be illegal… ! I’m glad one Country has now taken a stand against the big corporations owning homes.

Starmer’s Labour slumps as Reform surges

Support for the Labour government has crashed to a new low, with a YouGov tracker putting its net approval at -59 and only 11% of voters backing its performance. Since winning in 2024, Labour’s vote share has fallen from 35% to about 17%, leaving it behind both Reform UK on 29% and the Conservatives on 19%. The slide is mostly from scandals over Angela Rayner’s tax affairs and Lord Mandelson’s Epstein links, plus rows over Keir Starmer’s stance on Trump’s removal of Maduro and US threats over Greenland. With local elections looming and some MPs already muttering about his future, Starmer is trying to rally his cabinet by framing the next general election as a choice between Labour “renewing the country” or a Reform movement that “feeds on grievance, decline and division”. - Let’s face it, the sooner we get Starmer out, the better!

NEIL’S TAKEAWAYS:

In The United States:

The US is starting to have a strong split. Looking at the services side (where most people work and where consumer activity shows up), its started to look healthier in December, with ISM Services rising to 54.4 and the services employment measure back above 50.

But the inflation signal in that same survey is the complication. Services “prices paid” stayed high at 64.3, which fits the idea that costs tied to wages and day-to-day operations are harder to bring down than goods prices. This year, there is a fair chance that inflation could stay where it is, even leading to rate hikes again. This is something I'll be watching over the coming months.

Meanwhile, factories are still in a slump. ISM Manufacturing is at 47.9, and new orders are still below 50 points due to soft demand for goods and uncertainty that makes companies cautious about rebuilding inventories or committing to new production.

Another thing I'm keeping an eye on is the January 30th, 2026, funding deadline, which is another near-term risk to confidence and planning. Even if a shutdown is avoided, the process can freeze hiring decisions and slow contracting, and any renewed disruption to government data would make it harder for markets to judge whether the economy is cooling smoothly or just zig-zagging. Especially so close to the last one.

Prepare: Services strength keeps growth stable for now, while manufacturing weakness is the drag. Watch whether service inflation pressures ease in the next round of data, and keep an eye on the Jan 30 funding deadline because that could make things turn for the worse quickly.

Across Europe:

Inflation is now close to where policymakers want it within the euro zone, with headline inflation around 2% (of course, in reality it’s higher for everyday households) and core not far above that. Now you might start to hear changes in the ECB’s tone with them pointing to governments and structural fixes rather than central-bank moves.

Germany is a good example of bad growth. Industrial orders jumped in the latest read, which sounds like a turning point, but a lot of it came from big categories like transport and defence-related items. That can help near-term production and sentiment, but it’s not the same as broad, steady demand returning.

In the UK, the pressure points are easing, but slowly. Firms are lowering expected wage growth and are a bit less aggressive on future price rises, which will help keep inflation lower. But expectations are still high enough to keep the Bank of England cautious, because services inflation tends to track wage pressure more than anything else.

Prepare: Watch whether the euro zone can turn better inflation news into better investment and hiring without relying on rate cuts. In the UK, the next signal is whether easing wage expectations actually shows up in calmer service prices, because that’s what would give the BoE room to move more confidently.

On the Global Stage:

Globally, lower energy prices are doing some of the inflation work that central banks spent the last two years trying to force through higher rates. The difference here is that geopolitics is shaping where barrels go and at what discount, which can change who gets the benefit of cheaper fuel and who feels the squeeze. For importers, softer oil is good for households and production; for exporters, it can tighten budgets and raise credit stress.

China has another risk growing in the background with its currency. This matters because it connects directly to trade balances: if the renminbi stays cheap in real terms, it supports exports and keeps the surplus large, which is exactly what irritates trading partners when their own growth is fragile. Any move toward faster currency strengthening could cool some trade tension, but it also risks adding strain to Chinese exporters and, therefore, their growth.

Prepare: Watch oil’s shifts in supply routes and sanctions that change who feels inflation relief over the next year. With everything that's been happening, it will likely be one of the main factors of this year.

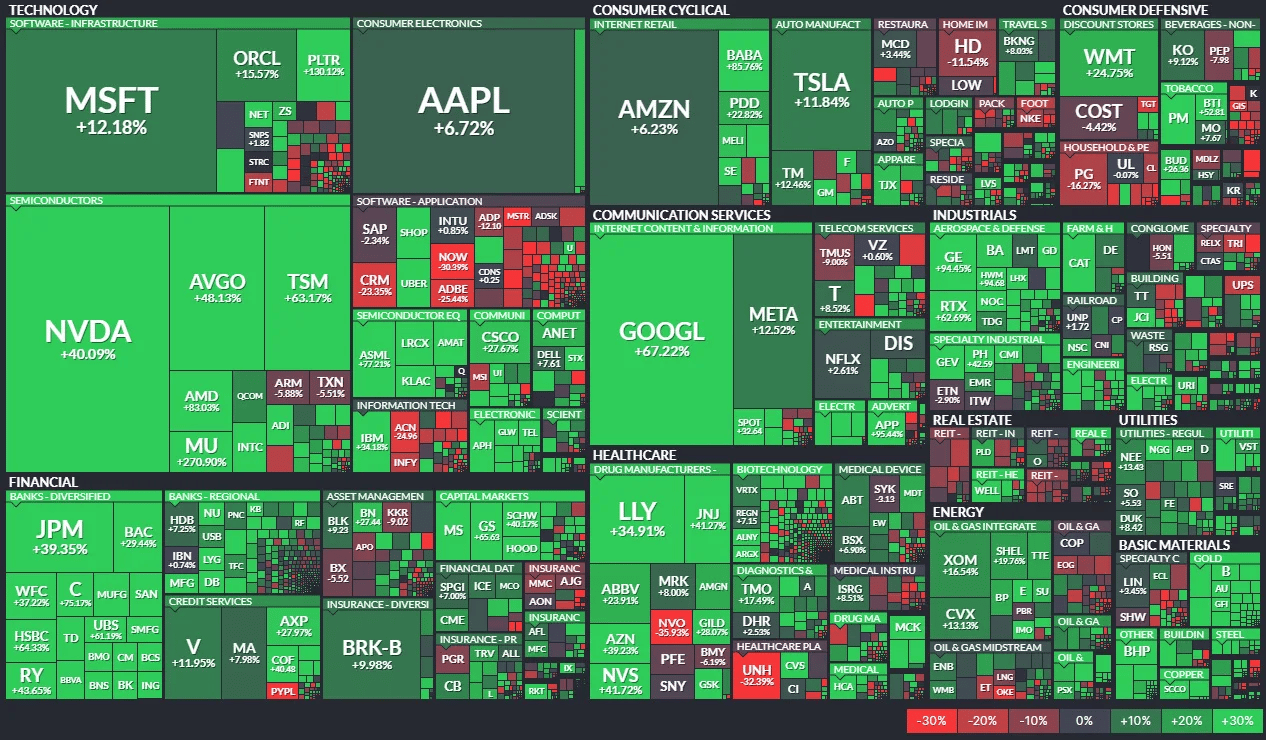

3. U.S. Stocks in 2025: AI, Chips and Defence Lead the Pack

The S&P 500 logged its third straight year of 16%+ gains in 2025, powered mostly by AI-related and data centre plays. Google was the standout big-tech winner with a 60%+ jump, helped by the launch of Gemini 3. Banks, chipmakers like Micron, Nvidia and AMD, and aerospace and defence names such as GE Aerospace and RTX all saw big double-digit moves as higher rates, AI infrastructure demand and rising defence budgets kicked in. Gold and mining stocks also climbed on record gold prices, while the weakest areas were rate-sensitive REITs, non-AI software names like Salesforce and Adobe, upstream oil and gas, consumer staples, and Fiserv, which crashed 67% on earnings and margin pressure.

4. Market Overview

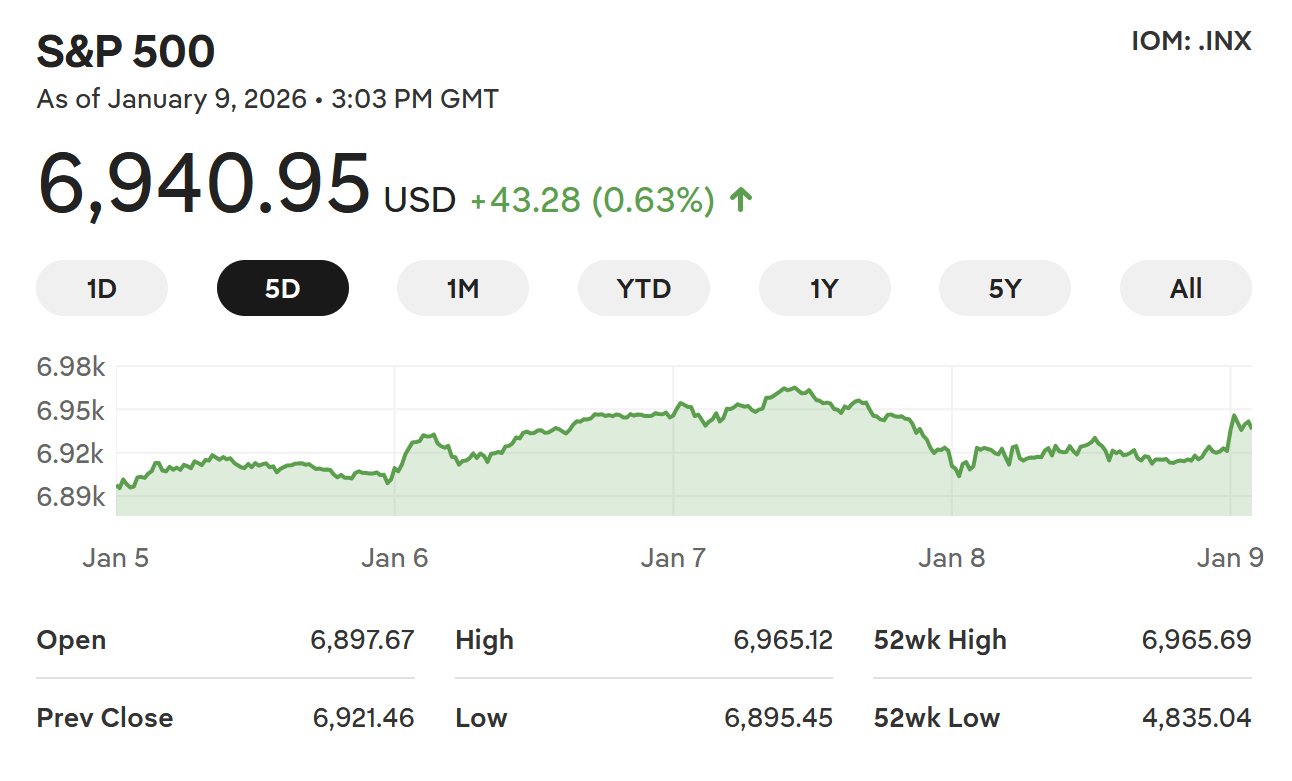

S&P 500 (U.S.)

In the U.S., the S&P 500 has been up modestly. The week started with a strong “new year” tone and was supported by cooler-than-feared labour data that kept rate-cut expectations in play, but day-to-day trading stayed choppy as investors rotated between AI/mega-cap tech and more cyclical/defence-exposed names after headlines around higher defence spending.

FTSE 100 (UK)

In the UK, the FTSE 100 has been up this week. Gains were driven largely by energy and mining-heavy which were helped by firmer oil prices and a burst of strength in miners after Glencore jumped on merger-talk headlines with Rio Tinto, which lifted the broader index even as some domestic stocks lagged.

S&P/TSX Composite (Canada)

In Canada, the TSX has been up over the past 5 days. The index was supported by a rebound in energy and broader strength across commodity producers, with better risk appetite helping offset any weakness in rate-sensitive areas.

ASX 200 (Australia)

In Australia, the ASX 200 has been roughly flat to slightly down over the past 5 trading days. The market was pulled in opposite directions: big miners were volatile (notably also due to that Rio Tinto - Glencore merger chatter), banks softened, while energy stocks held up on higher oil prices, leaving the index largely rangebound for the week.

🇺🇸 United States – S&P 500

High: 6,965.12

Low: 6,895.45

🇬🇧 UK - FTSE 100

High: 10,157.13

Low: 9,957.42

🇨🇦 Canada – TSX Composite

High: 32,603.66

Low: 31,981.86

🇦🇺 Australia – ASX 200

High: 8771.30

Low: 8690.40

Cryptocurrency:

Bitcoin (BTC): 0.7%

Ethereum (ETH): -0.1%

Tether (USDT): 0.0%

XRP (XRP): 9.4%

BNB (BNB): 1.7%

Solana (SOL): 6.4%

USDC (USDC): 0.0%

TRON (TRX): 3.4%

Lido Staked Ether (STETH): -0.1%

Dogecoin (DOGE): 4.0%

Metals Market:

Gold–Silver Ratio: ~57:1. The ratio moved this week mainly because silver prices have been swinging more than gold as traders react to big commodity-index rebalancing trades and have changing expectations for the U.S. dollar and interest rates.

Gold & Silver:

Gold: Rose about 3.87% (Week High: $4 496.10, Week Low: $4 485.71)

Silver: Rose about 9.30% (Week High: $84,04, Week Low: $71,72)

5. Faith & Success

“I am fearfully and wonderfully made; marvelous are these works, and my soul knows it very well.”

When I often think of the World (& the Universe), I can’t help but feel in awe of how magnificent it truly is… really, it’s so unbelievably complex that the architect is beyond comprehension…

But here’s the part most people miss: He designed you to carry that brilliance too. There’s strength in you. There’s purpose in you. There’s far more capacity than you’ve been giving yourself credit for. And I really mean that.

I was watching a medical show recently; and as each doctor gave our facts about the human body, it blew my mind. I just couldn’t get my head around the complexity of what was being explained.

Just think of our brain… 86 billion neurons, each forming thousands of connections. That’s trillions of synapses, more possible wiring patterns than atoms in the observable universe! And this was just one thing I write down…

Yet so often, we completely downplay who we are. We tell ourselves we’re just average. We say things like, “I’m not built for anything big. I don’t have what it takes. I’m missing something—skill, experience, confidence. The challenge in front of me is too overwhelming.”

And just like that, we talk ourselves out of the very future we were created for. And believe me, I’m more guilty than anyone else of this. Even as a child I always thought I was gifted/special - but whenever I would display this, I would be scolded by my teachers for being arrogant. So I just stopped trying. And I went from the smart kid, to the disruptive kid. Because I was bored stiff in class…

The same thing happened in the military, I was always faster, stronger and more effective than anyone else around me - but if I showed off in any way, I would get absolutely hammered. So I would do 100 push ups and 100 sit ups and simply stop. Even though I could have done more. On the 1.5 mile run, I would always come in about 9 minutes, even though on the weekends, I would run it in 7:30- 8 mins. Speed marches too, I’d never over-perform, I’d always hold back…

And because of this, I stayed small. I didn’t play the big games. I didn’t go for the selection processes and courses I knew I could ace until much later. I wasted my school years, and I wasted a good few of my Army years too. All because I didn’t want to shine and be scolded. I didn’t want to stand out - so instead I lied to myself and said 'ah, it’s just easier this way’

It’s so easy to justify playing small. Easy to retreat into comfort. Easy to settle for a life that feels safe but never stretches us…

But here’s the truth my friends: you were never meant to blend in. God placed His favor on you. You’re equipped, empowered, and called for impact. You weren’t created just to survive, scrape by, or get through the day. There are assignments in you that will surprise you. Wins that will shift your legacy. Breakthroughs that will elevate your family and open doors you never imagined!

When you confront what looks impossible and overcome it, something changes. Your confidence rises. Your influence expands. People begin to see you differently, and more importantly, you begin to see yourself differently.

So the real question is this: why live with a limited mindset when you are called to be strong, capable, and chosen? Why shrink back when you were built to stand tall and move forward like a warrior?

Don’t be like I was; I wasted so many years of my life playing small. You’re destined for greater things…

Until next time,

God Bless,

Neil,

Enjoying this Newsletter? Share with a Friend…

DISCLAIMER

This newsletter is 100% FREE & is designed to help your thinking, not direct it. These newsletters shall NOT be construed as tax, legal, or financial advice and may be outdated or inaccurate; all decisions made as a result of this information are yours alone.

Trading/Liability: Neil McCoy-Ward operates/trades under a private Ltd company within the Isle of Man.