- Neil's Newsletter

- Posts

- Your IMPORTANT Weekly Briefing: (8th August 2025)

Your IMPORTANT Weekly Briefing: (8th August 2025)

The Neil McCoy-Ward Newsletter

Opening Note…

Welcome back to this week’s newsletter!

Lately, President Trump has been zeroing in on a solution to the Russia-Ukraine conflict (to try to get this to end once and for all). One of the challenges though, is that war is an economic driver. And when one side is winning and growing economically as a result, it’s very hard to get them to stop.

The next one to watch out for is Taiwan and China.

From an investing standpoint, understanding how these risk cycles play out can be the key to your success.

For example, if you were thinking like an investor… When Taiwan restricts chip exports, most investors panic. Smart investors spot the winners—like non-Taiwan chipmakers set to grab market share—and position early. In my Ultimate Stock Market Investing Program, you’ll learn exactly how to use news like this to find undervalued stocks before the crowd. Yours today for 90% Off… Click Here. (30-day money-back, swap, or course credit guarantee).

In the weekly spotlight, we’ll follow the money and break down Trump’s 100% Chip Tariff. I hope that through each of these weekly briefings, you’ll take one step closer to clarity and begin to use these news stories to your advantage (even in uncertain times).

Let's follow the money...

Table of Contents

1. Weekly Spotlight

This Week’s Spotlight: President Trump Unveils 100% Chip Tariff

President Trump has announced a 100% tariff on all Chinese-made semiconductors. This is a pretty stern move and it seems like he’s trying to strengthen U.S. industrial independence. The policy includes exemptions for companies manufacturing in the United States, such as Intel's $20B Ohio plant and TSMC’s $40B Arizona investment, both of which are still ramping up production capacity.

To show a sense of scale, the United States imported over $65 billion in semiconductors in 2024, much of it from or through China. A lot of analysts are warning that the tariffs could lead to higher consumer electronics prices, disrupt existing supply chains, and intensify inflationary pressures, particularly in sectors like automotive, AI, and consumer tech.

Key economic indicators to watch:

CPI & Core Inflation: Expect upward pressure on tech-related goods.

U.S. Manufacturing PMI: Could tick upward if ‘on-shoring’ accelerates.

S&P 500 Tech Sector: Volatility likely as investors price in higher costs.

Trade Balance: Short-term import reductions may mask long-term inflationary impacts.

This announcement follows broader efforts to de-risk from China, including previous tariffs, CHIPS Act funding, and export restrictions. It also ramps up political pressure on global tech firms to choose sides in the emerging economic bifurcation of the 2 super powers.

2. Quick Takes

Here are the top stories shaping the week:

President Trump Names J.D. Vance as MAGA’s Heir

Speaking in Ohio, Donald Trump said Vice President J.D. Vance is "most likely" to carry the MAGA mantle forward. Vance, a Marine veteran and venture capitalist, was a vocal critic of Trump in 2016 but has since become his VP and most loyal ally.President Trump Threatens 35% Tariff on Europe

Trump warned EU leaders that if European firms fail to deliver on their U.S. investment pledges, particularly in the auto and energy sectors, a 35% tariff could be imposed. The threat targets countries like Germany and France that have delayed follow-through after promising post-Biden re-shoring deals.Democrats Declare Gerrymandering War Ahead of 2026

With redistricting windows open in key battlegrounds like New York, Illinois, and Maryland, Democrat strategists are reportedly pushing for “aggressive map-drawing” to offset recent GOP gains in southern states. Party insiders say the move is necessary to preserve House control as Republicans dominate rural growth zones.Rep. Kevin Kiley: Newsom’s Redistricting Scheme ‘Uniquely Corrupt’

California’s GOP Rep. Kevin Kiley blasted Governor Gavin Newsom’s plan to sidestep the state’s independent redistricting commission, claiming it would allow partisan control of congressional maps. The proposal comes after California lost a House seat in the 2020 Census for the first time in history.UK to Pay for Migrant Transfers Under New France Deal

Under a “one in, one out” agreement signed this week, the UK will foot the bill for transporting asylum seekers between France and Britain. Home Office officials confirmed that taxpayer funds will cover logistics and processing. The deal aims to reduce illegal Channel crossings.Energy Demand Outpaces Renewable Growth Globally

A new analysis from OilPrice.com reveals that global energy demand in 2025 is growing at 2.4% annually, nearly double the pace of renewable expansion. Fossil fuels still make up over 81% of the global energy supply, and countries like India and China continue to add coal plants to meet industrial demand.Farmland Prices Hit Record Highs Worldwide

Global farmland values have surged in 2025, with U.S. cropland averaging $5,460 per acre, up 8.1% year-over-year (remember my previous forecast on how valuable farmland would become?) The price boom is being driven by food security fears, rising commodity prices, and investor interest from hedge funds and pension groups seeking inflation-resistant hard assets. Key word here: hard assets.Clintons Subpoenaed in Epstein Criminal Probe

The U.S. House Oversight Committee issued subpoenas to Bill and Hillary Clinton in connection with its probe into Jeffrey Epstein’s network. The committee is investigating potential knowledge or involvement of political elites in Epstein’s financial dealings and private flight logs, which include trips to his private island.Europe Can’t Send More Patriot Missiles to Ukraine

NATO countries have acknowledged that Patriot missile systems are nearly depleted across Europe. Germany and Poland confirmed that no additional systems can be spared as stockpiles are being held for domestic defence. (Read that last part again). Ukraine has requested at least 7 new batteries, but supply chain issues make delivery unlikely this year.Britons Back Zero Migration and Mass Deportations

A new poll from YouGov reveals that over 40% of Britons support zero net migration, while 39% back large-scale deportations of illegal migrants. Support for stricter immigration measures was highest among older voters and Conservative supporters. The findings highlight growing public pressure on the government to adopt tougher border controls amid rising concerns over housing, wages, and social cohesion. I don’t always believe these YouGov surveys, I think they always downplay the numbers. So if they are saying it's 40%, it's most likely a lot higher.Record Explosion In Student Loan Delinquencies Marks The Start Of Next Debt Crisis

In Q2 2025, U.S. household debt rose by $185 billion to $18.39 trillion. Mortgage, credit card, and auto loan balances all increased, with student loans reaching $1.64 trillion. However, the most alarming shift was a surge in student loan delinquencies, hitting a 21-year high of 12.9% in serious delinquency rates following the end of the federal payment pause. Overall delinquency rates rose to 4.4%, and bankruptcies increased to 131,000 cases. The worsening student debt crisis, especially among older borrowers, signals growing financial stress and may pressure the Fed to cut interest rates in September.

NEIL’S TAKEAWAYS:

In the United States

The Manufacturing ISM index, a monthly indicator of U.S. economic activity based on a survey of purchasing data at more than 300 firms, has been published for July and it has shown another drop to 48.0, marking five straight months below the critical 50 level. On top of this, consumer debt stress is worsening: over 4.4% of all household debt is now delinquent, and serious credit card delinquencies have climbed to nearly 7%, their highest level in years. When we hone in on lower-income areas, serious delinquencies are now exceeding 20%: that's 1 in 5 people!

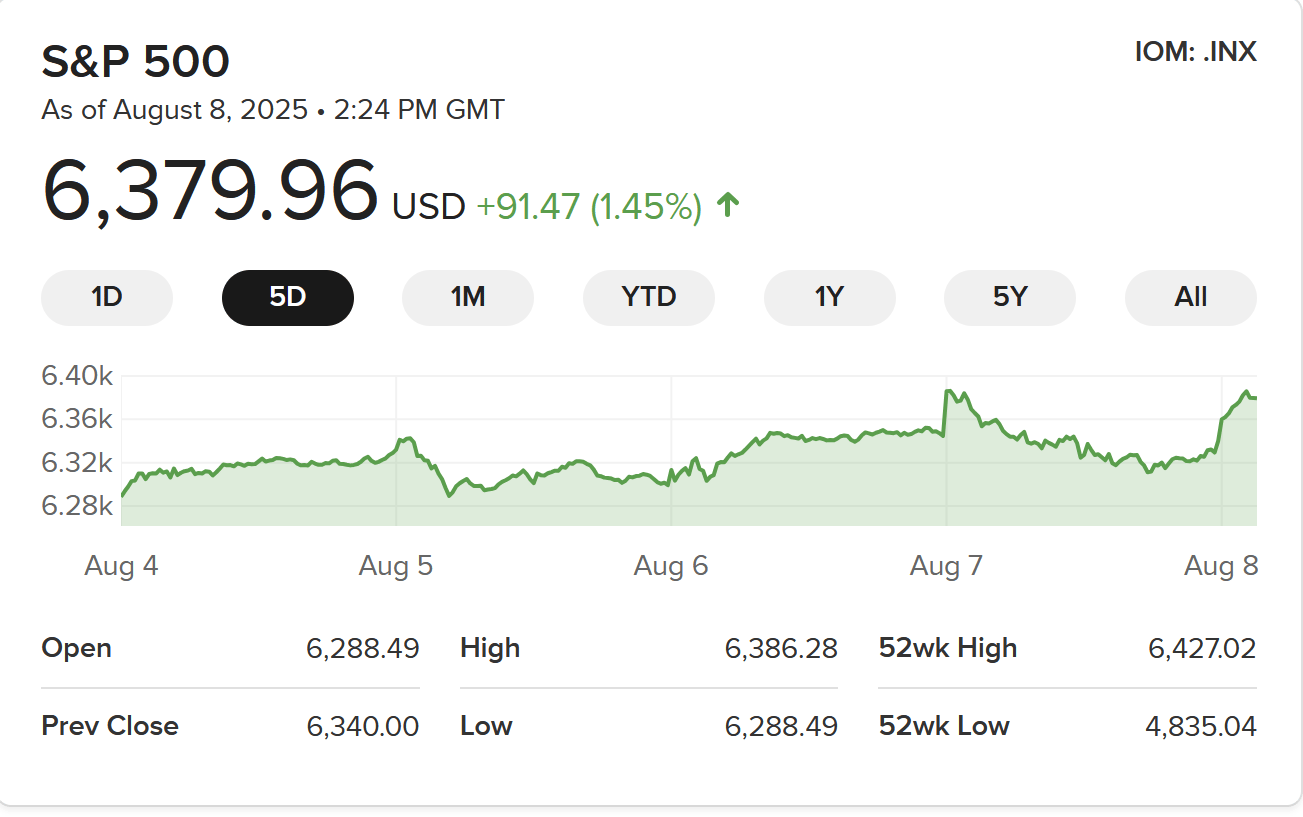

Prepare: If you look at the stock market, we are seeing all-time highs. It's quite a fascinating and growing disconnect between the stock market and the real economy. As I have said for a while now, it's important to prepare yourself for when the two reconnect. This could be quite a drastic change, and one that presents big opportunities for investors to seize upon.

Across Europe

European firms showed surprising strength this week despite growing pressure from U.S. tariffs. Banks, defence contractors, and industrials posted solid earnings, even as automakers and luxury brands felt the sting from global trade tension. Interestingly, the euro gained ground against major currencies. This seems to be from the hopes of a Fed rate cut and surprising resilience across parts of the economy. Even with German factory orders weakening, the upcoming retail sales data will be a key gauge of how confident European consumers really are.

Prepare: In the long run, I believe the course of the economy will be determined by the U.S.-EU trade developments and retail spending data. Both will shape Europe’s earnings outlook and the euro’s momentum heading into Q3.

On the Global Stage

This week, global markets digested fresh signs of stress from the East. China’s export growth slowed in July, rising just 5.4% year-over-year, while imports fell, which was due to the declining domestic demand. Manufacturing activity contracted for the fourth straight month, and the property sector remains fragile, with major developers facing restructuring and offshore bond stress.

Meanwhile, Japan’s yen slid to around ¥150.89 per U.S. dollar, its weakest level since March. The sharp depreciation prompted Japanese officials to issue warnings of potential currency intervention. And with the U.S. imposing new 30–50% tariffs on China, India, and key EU sectors, global trade routes are once again under threat. The re‑escalation of protectionist policy is already clouding corporate earnings forecasts and casting uncertainty over global supply chains heading into Q4.

Prepare: Track China’s export orders and monthly trade balances for signals on broader global demand. This is a good global indicator due to the volume of goods China produces. Another one to watch is the yen-dollar exchange rate; if Japan intervenes, expect FX ripple effects across emerging Asia.

3. Important Video of The Week

🚨 It’s Unbelievable How Many Are Leaving… Watch the Full Video On Youtube

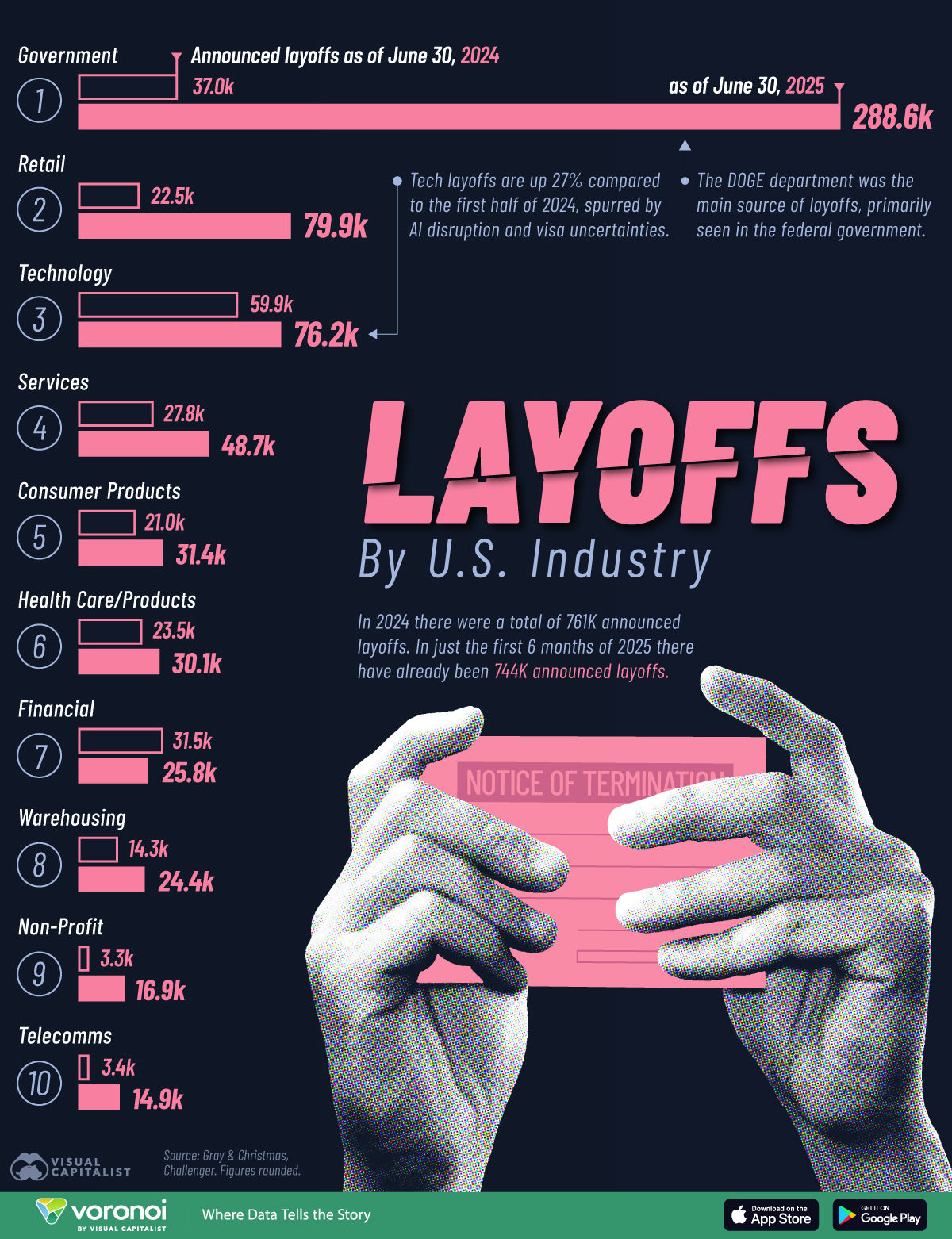

4. Chart of the Week: The Top U.S. Industries for Layoffs in 2025

Last week, we looked at the Industries that are using AI the most. It won’t come as a surprise to you, that the Tech Sector is using AI the most and has the highest amount of layoffs.

Other key data:

In the first half of the year, government layoffs made up 39% of terminations nationally, with the largest share in Washington, D.C.

Overall, 288,000 job cuts have been announced, largely driven by DOGE actions. Beyond these numbers, scores of employees in federal agencies are opting for early retirement or buyouts given the threat of layoffs.

Meanwhile, the retail sector has been particularly exposed to trade policy and its impact on consumer spending, with 79,900 layoffs overall. By comparison, total job cuts over the same period last year were less than a third of this total.

In tech, layoffs have jumped 27% from H1 2024 levels. Microsoft has axed at least 15,000 roles so far in 2025, and Intel just announced a 15% workforce reduction in efforts to cut costs.

5. Market Overview

Stock markets were mixed this week. U.S. equities gained, led by mega-cap tech stocks, while small-cap and broader indices lagged on cautious sentiment and valuation concerns. European markets edged higher, supported by steady consumer activity and resilience in core sectors, though the UK slipped slightly. Canadian and Australian markets were less visible this week, with no clear performance trends emerging. Under the surface, market breadth continues to narrow, and tech remains firmly in charge. Investors are cautious, quietly rotating into defensive sectors as economic uncertainty and tariff risks build.

🇺🇸 United States – S&P 500

High: 6,387.67

Low: 6,288.49

🇬🇧 UK - FTSE 100

High: 9,175.39

Low: 9,075.13

🇨🇦 Canada – TSX Composite

High: 27,951.45

Low: 27,404.26

🇦🇺 Australia – ASX 200

High: 8,840.90

Low: 8,636.40

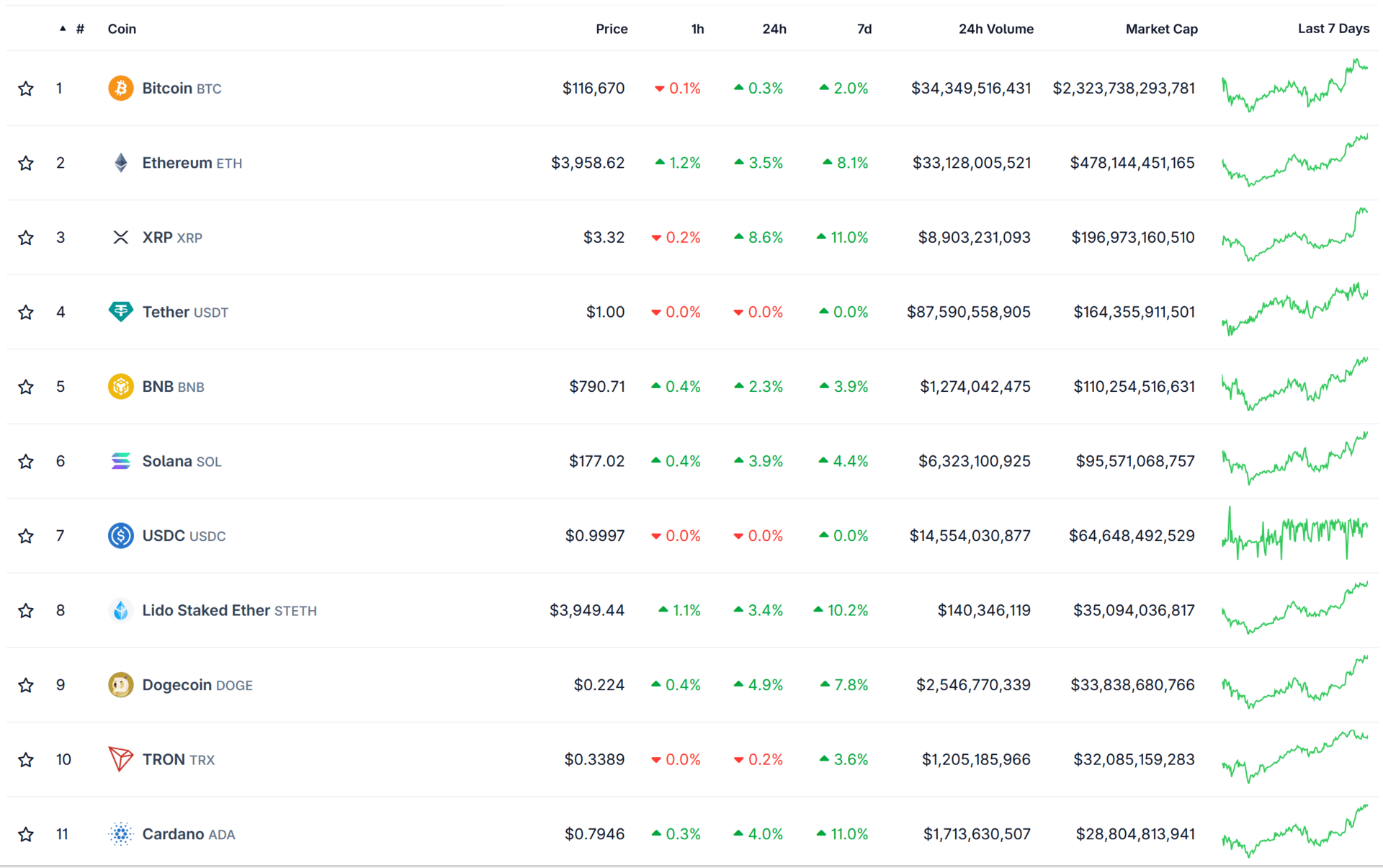

Cryptocurrency:

Bitcoin (BTC): Up 2.0% – now at $116,670

Ethereum (ETH): Up 8.1% – trading at $3,958

XRP: Up 11% – now $3.32

Tether (USDT) & USDC: Flat at $0.9999 – maintaining peg stability

BNB: Up 3.9% – sitting at $790.71

Solana (SOL): Up 4.4% – now at $177.02

Lido Staked Ether (STETH): 10.2%– trades near $3,949 (approximated with ETH)

TRON (TRX): 3.6% - 0.3389

Dogecoin (DOGE): Up 7.8% – now $0.2240

Summary:

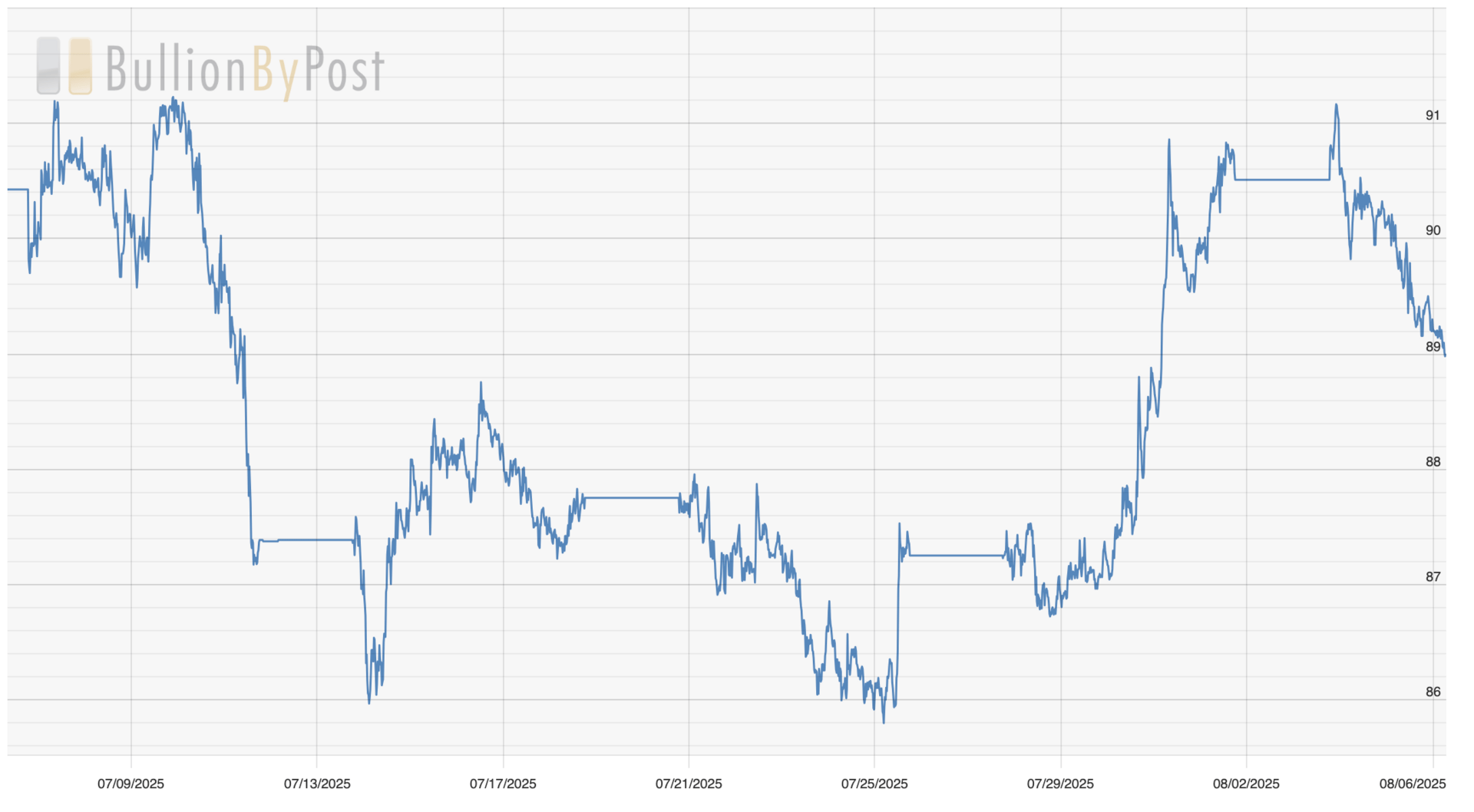

Metals Market:

Gold Silver Ratio:

Gold & Silver

Gold has held its ground near $3,393 per ounce, edging down a mere 0.1%. This slight dip came due to a stronger U.S. dollar and cautious positioning ahead of upcoming Federal Reserve nominations.

Silver is trading at approximately $38.30 per ounce, up about 0.5%. Although not far from recent lows, silver continues to benefit from its role as an inflation hedge and from investors seeking alternative liquidity as rate‑cut expectations grow.

Neil’s Investor Takeaways:

While I can’t provide financial advice via a newsletter, here are steps to consider:

Trim speculative positions and rotate into assets with consistent cash flow and real value.

Increase exposure to hard assets like gold and silver as a hedge against inflation and currency risk.

Hold more cash, T-bills or Money Markets (SHORT TERM) to stay liquid and ready for opportunity.

Focus on defensive sectors, healthcare, energy, and staples, while reducing risk in overbought tech.

Watch global developments closely, especially tariffs, energy prices, and central bank policy shifts.

Smart positioning is about preserving capital, staying flexible, and preparing for what’s next.

Here is your opportunity this week:

The Ultimate Stock Market Investing Program: 90% Off - CLICK HERE - with a 30-day money-back guarantee or swap guarantee onto another course.

6. Faith & Success

“But let endurance have its perfect work, that you may be perfect and complete, lacking nothing.” James 1:4

When pondering upon this verse today, I remembered the wording differently… Some translations say ‘patience’ instead of ‘endurance’ - which I think is more fitting. Patience requires us to be calm, and to wait diligently, while doing the right things at the right time. I think this word holds more value and power (to me).

The word ‘perfect’ here doesn’t mean without flaw, but rather mature or fully developed in character. ‘Complete’ adds the idea of being well-rounded, not lacking in any key area of personal or spiritual growth.

It reminds me of how I used to track certain areas of my life that I haven’t looked at recently. One of those areas was reading more biographies. I had completely forgotten how much I used to gain from the wisdom of some of the greatest minds who have ever lived. So this week, I'm going to pick up and start reading a new biography…

It’s also interesting that this passage says endurance has its ‘perfect work.’ Indeed… indeed.

7. Discounted Course Of The Week…

For a Limited Time – My Stock Market Course is Back…

Here’s what you’ll gain:

Spot Undervalued Stocks Early – Identify hidden gems before the masses drive up the price.

Time Your Trades Perfectly – Pinpoint entry and exit points to lock in maximum gains.

Proven, Step-by-Step Playbook – Remove all guesswork with a clear, repeatable strategy.

Profit From Market News – Turn economic events and breaking headlines into opportunities.

Crash-Resistant Portfolio Design – Protect your capital and keep it growing in any market.

Cycle & Trend Mastery – Anticipate market moves using powerful historical patterns.

Mistake-Proof Investing – Avoid the costly errors that wipe out beginners and pros alike.

Immediate Action Plan – Start executing winning trades from day one.

Whether you're struggling to make ends meet or simply want more freedom, this program gives you the blueprint to make your dreams happen.

Closing Thoughts 💬

We’re over halfway through the year, and the economy has had its ups and downs. We’re left with many questions, but also valuable conclusions. Now is the time when I like to look back at major forecasts and predictions to see what’s driving success, and what to look for next.

I hope this edition has given you some ideas that you can implement, and I appreciate your outreach and commentary on this newsletter. As always, I am here to provide you with value, so please feel free to respond with your thoughts about your weekly briefing.

Onward and Upward,

See You Next Time, God Bless,

Your Friend,

Neil,

DISCLAIMER

This newsletter is 100% FREE & is designed to help your thinking, not direct it. These newsletters shall NOT be construed as tax, legal, or financial advice and may be outdated or inaccurate; all decisions made as a result of this information are yours alone.

Trading/Liability: Neil McCoy-Ward operates/trades under a private Ltd company within the Isle of Man.