- Neil's Newsletter

- Posts

- Your IMPORTANT Weekly Briefing: (6th February 2026)

Your IMPORTANT Weekly Briefing: (6th February 2026)

The Neil McCoy-Ward Newsletter

Opening Note…

Hi, welcome back again this week - it's great to have you here. And if you're one of the 3,000 new readers, a huge welcome to you also.

It's funny because I was only saying in last weeks newsletter how things have been going from strength to strength with more viewers and subscribers, and then the same pattern repeated again this week.

I wanted to really focus this week on producing less live streams, but more high-quality pre-recorded video content. And the results of that speak for themselves, the comments were very positive across all social media platforms and you’ve asked me to produce even more of this type of content.

So that's what I'll be delivering as a test in the coming weeks. I'll be trying out a lot more financial content as pre-recorded videos.

And the other reason I'll be delighted to do this is that a constant piece of feedback people have given me is that I stopped giving them financial tips, and instead focused too much on geopolitical content…

So I'm also taking this feedback on board and bringing in more finance content to help you with the things that are important… such as your pension, your investments, growing your income against the backstop of higher inflation, your family budget and more…

And I know it's been a while since I've offered any discounts on my programs, so here's a discount for you today:

Now, let's break down the latest...

Table of Contents

1. Weekly Spotlight

Trump's Tariff Machine: $287 Billion Collected, Supreme Court Says It's Illegal

One year into Trump's second-term tariff blitz, the numbers are genuinely wild. The US collected $287 billion in customs duties in 2025, up 192% from the year before. In Q4 alone, they pulled in $97.5 billion (a 281% increase). For context, that's more than the entire defence budget increase Trump's been demanding. That's serious income even in a $7 trillion federal budget.

But the fascinating part is, despite all the chaos, drama, and the constant threats... trade patterns barely changed. US companies mostly kept buying from the same places. And now the Supreme Court is evaluating whether Trump had the legal authority to collect most of that money. When Trump took office in January 2025, the US tariff rate was 2.5%. By April, three months later, it had hit 27%. The highest in over a century.

The Admin declared persistent trade deficits a "national emergency." Which allowed the US to bypass Congress and impose tariffs directly under the International Emergency Economic Powers Act (IEEPA). The result was 25% on Canada and Mexico. Up to 125% on China. 50% on steel, aluminium, and copper. 25% on cars. "Reciprocal tariffs" of 10-41% on basically everybody (but you already know this, it’s hardly new news).

But with all that chaos, you'd expect companies to fundamentally restructure their supply chains. Stop buying from China, start buying from Vietnam. Move production. Find alternatives, the usual … except… that didn't happen.

I was reading a report by the Peterson Institute that analysed 19 major US trading partners and found that ‘two-way trade with the US’ (as a share of total trade) - changed very little. Mexico, Canada, China, Europe, everyone mostly kept trading with the US at roughly the same volumes.

Why? Four reasons:

First, he kept granting exemptions. About half of all US imports were exempted from IEEPA tariffs by December 2025. When you announce 27% but exempt half the products, you're not really imposing 27%.

Second, constant delays. He'd announce tariffs for April 2, then push to April 15, then May 1. You don’t restructure based on announcements that might get walked back next week.

Third, minimal retaliation. Apart from China, most countries just tried to make deals rather than start tariff wars. I mean, can you blame them?

Fourth, everybody was waiting to see if this was legal.

The Supreme Court is and has been evaluating whether the US can use IEEPA, designed for freezing terrorist assets during actual emergencies, to impose tariffs because of trade deficits. Multiple federal courts already ruled that these exceeded a President’s authority. The Court of International Trade said the tariffs were "invalid as contrary to law."

The stakes on this are about 61% of the tariff increases, roughly $180 billion annually, come from IEEPA measures. If SCOTUS rules against these tariffs, the government might have to refund it all. However whats more likely is the US just ignores the ruling. Perhaps they say that the Supreme Court doesn't have jurisdiction.

Whatever happens, it will create even more chaos. If companies don't know whether tariffs are legal or if new ones are coming next week, they can't plan. Uncertainty kills investment even more than actual tariffs. Knowing Trump though, he's not giving up that revenue stream no matter what any court says. If so, the US continues to win big in this area, and you should plan accordingly.

2. Quick Takes

Here are the other top stories shaping the week:

New START Nuclear Treaty Expires, Ending Arms Control Between US and Russia

The last nuclear arms control treaty between the US and Russia expired at midnight on February 5th, effectively ending decades of Cold War-era cooperation that prevented unchecked weapons buildup. New START, signed in 2010, had capped each country's deployed strategic nuclear warheads at 1,550 and included transparency measures like inspections and data sharing. Without it, there are now zero binding limits on the strategic nuclear arsenals of the world's two biggest nuclear powers. Trump seems unbothered, saying "if it expires, it expires" and promising a "better agreement" that includes China. Russia says it will "act responsibly" but reserves the right to take "decisive military-technical measures" if needed. Both countries are already modernising their nuclear forces and developing new weapons like hypersonic missiles and nuclear-powered torpedoes.

Russia Offers To Remove All Iranian Enriched Uranium As US-Iran Talks Stall

Russia has offered to take all of Iran's enriched uranium stockpiles off its hands, in what could be a major breakthrough to defuse nuclear tensions. Russian Foreign Ministry spokeswoman Maria Zakharova said Moscow's longstanding offer to export Iran's enriched uranium "is still on the table," stressing that Tehran has "full rights" to the material under the Nuclear Non-Proliferation Treaty. The problem is the US wants talks to cover far more than just nukes, demanding Iran cap its ballistic missile arsenal too, which Tehran has flatly rejected. Iran insists it won't negotiate away its conventional defences against Israeli strikes, leaving the talks "doomed to fail" before they even start. Trump has ramped up the pressure, telling NBC that Iran's Supreme Leader Ayatollah Khamenei "should be very worried" about US military action, though he stayed vague on specifics.

US Rallies 55 Countries To Break China's Grip On Critical Minerals

The US convened 55 countries on Wednesday for a critical minerals summit aimed at slashing reliance on China, which controls over 90% of global rare earths and magnet refining. Vice President JD Vance pushed for price floors to stabilise investment, calling the current market "failing" due to China's ability to flood supply and crater prices. The EU, Japan, and Mexico agreed to explore coordinated policies, with the US and EU targeting a deal within 30 days. The summit follows Trump's nearly $12 billion Project Vault stockpile initiative, which has already recruited GM, Boeing, Google, and a dozen other major manufacturers to hedge against supply shocks. Secretary of State Marco Rubio launched FORGE, a new partnership to diversify supply chains, though officials carefully avoided naming China directly. Beijing's spokesman Lin Jian hit back, opposing "small groups" that disrupt trade. Trump said he had a "long call" with Xi and plans to visit China in April. - China spent decades cornering the rare earths market while the West sleepwalked, and now everyone's scrambling to build alternatives that will take years and cost billions. This won’t be easy…

Germany's Gas Storage Hits Critical Low With Just Six Weeks Left Before Shortage

Germany's gas crisis is coming really fast (as predicted). Storage facilities dropped to 32.75% capacity on January 30th, barely above the legally mandated 30% minimum, leaving only about six weeks of reserves in a tight scenario. The problem is that Germany can't just order more gas when it runs out. Norway, the largest supplier, is already running pipelines near capacity limits and can't physically push more through in the short term due to pressure and infrastructure constraints. The Netherlands has even lower storage levels than Germany and will prioritise its own supplies in a crunch. US LNG won't save the day either because a freeze-off in America, where severe frost literally freezes valves and pipelines, has reduced production and export capacity just when Europe needs it most. Gas now accounts for 20.8% of Germany's electricity mix in January, well above the 13.8% annual average, because wind and solar aren't producing enough. A prolonged period of low wind and sun acts as a multiplier, forcing gas plants to run longer and draining reserves even faster. The colder it gets, the quicker the gas disappears. - This is what happens when you shut down nuclear plants and bet everything on renewables backed by gas that you can't reliably source. Let’s just pray they don’t have a severe cold snap; few will be prepared for that…

IMF Upgrades US Growth To 2.4%, While Europe Stagnates On Government Bloat

The IMF's 2026 forecasts show global growth at 3.3%, with no recession in sight, but there is a massive gap opening between the US and everyone else. The Fund had to more than double its US growth estimate to 2.4% for 2026 after getting it badly wrong last year, driven by AI investment, lower taxes, and reduced government spending. The US is now the only G7 economy escaping stagnation through 2027, while Europe limps along at 1.3% despite rate cuts and the Next Generation EU stimulus. Germany will barely hit 1.1% in 2026, France 1.0%, and Japan a dismal 0.6% in 2027, all propped up by government spending that's bloating debt and crushing productivity. The surprise winner is Argentina, projected to grow 4% in both 2026 and 2027, well above the global average and Latin America's weak 2.2%, thanks to President Milei's market reforms. China is slowing to 4.5%, while India powers ahead at 6%. The IMF credits "accommodative financial conditions" for resilience, but won't admit its doom predictions about US tariffs and immigration cuts were completely off. - Citizens still feel poorer because net real wages remain below pre-pandemic levels in most places, as government spending inflates GDP numbers while taxes hammer investment. The answer couldn't be more obvious: shrink government, cut waste, cut regulations = grow faster. The EU, UK, Australia, Canada, etc - all have this backwards. They are doing the opposite. I predict bad things ahead for these economies…

Netherlands Set To Tax Unrealised Gains As EU Declares War On Private Wealth

The Netherlands is about to do something crazy. In March, parliament will vote on taxing unrealised capital gains, which means if your house, stocks, or crypto go up in value, you get taxed on that gain even if you haven't sold anything. You're basically paying tax on money you don't actually have yet, and it hits income and assets that were already taxed once before. Both right-wing and left-wing parties support it, which signals to me they're expecting a financial crisis and need cash fast. Here's the crazy part: the Netherlands only has 46% debt and borrows just 2% of GDP, so they're not even in trouble, yet they're still going after private savings, it doesn’t make much sense… If one of Europe's richest countries is doing this, imagine what's coming everywhere else. Norway already has a 1% wealth tax on assets above €160,000, Spain charges up to 3.5%, and Germany is preparing massive inheritance tax increases. Europe's economy is shifting away from making things and toward just taxing wealth as factories shut down, especially in Germany since 2018. Politicians are raiding citizen savings to avoid tough reforms on welfare spending, immigration, and dying industries. - Europe is building a command economy by sucking money out of private hands. When people finally snap, it's going to get ugly. REAL UGLY.

Bank of England Holds Rates at 3.75%, But Signals Cuts Ahead As Inflation Cools

The Bank of England kept interest rates at 3.75% but signalled more cuts are coming after forecasting inflation will drop to around 2% by spring. The vote was closer than expected, 5-4 to hold, with four members wanting an immediate cut. Governor Andrew Bailey said, "All going well, there should be scope for some further reduction" this year. Growth forecasts were downgraded to 0.9% this year from 1.2%, and unemployment is now expected to hit 5.3%, a four-year high. The Bank blamed Labour's employer national insurance hike and rising minimum wage for flatlining jobs over the past year, though it expects this to cool wage growth and keep inflation in check.

The Great Memory Crunch: AI Data Centres Are Eating Your Smartphone Supply

The AI boom is triggering a "great memory crunch" that's about to hit your pocket. Data centres are hoovering up high-bandwidth memory (HBM) chips, leaving scraps for smartphones, PCs, and consumer electronics. Qualcomm and Arm just confirmed the shortage will cap smartphone production this year, with Chinese manufacturers already slashing handset targets by up to 20%. Industry insider's advice is: "If you want to buy any consumer goods... do it now." The numbers are wild: a single RAM module jumped from $145 to $790 in six months, and TrendForce expects 70% of high-end memory chips to go straight to data centres. Intel's CEO says there's "no relief as far as I know." - There’s a little stock tip there for you…

NEIL’S TAKEAWAYS:

In The United States:

Big Tech companies are still pouring money into AI like there's no tomorrow. Alphabet just told investors it plans to spend somewhere between $175-185 billion in 2026, most of it on AI compute power, data centres, and networking infrastructure. When the stock dropped on the news, the worry came from the fact that they're spending too much, too fast, and no one's sure the payoff will come soon enough.

Meanwhile, Challenger's data put January layoff announcements at the highest level for any January since 2009. A lot of that comes from big companies restructuring staff, plus specific hits like UPS cutting jobs after losing a major contract with Amazon. Weekly jobless claims also ticked up to 231k. That's not a disaster by itself, but it matters more when the economy's already shifting from very strong growth to something more moderate.

Inflation's the other piece keeping investors on edge. Because the brief government shutdown delayed key January data, jobs numbers won't come until February 11 and CPI until February 13. So right now, markets are reacting to bits and pieces instead of the full picture.

Prepare: Watch the February jobs and inflation reports closely. If layoffs keep climbing while inflation refuses to budge, the first place you'll see trouble is probably consumer spending and credit, even if tech investment still looks solid on paper.

Across Europe:

This week, the ECB held rates steady at 2%. Inflation's dropped to about 1.7% in January, the lowest in over a year, but Christine Lagarde made it clear they're not rushing into cuts. They keep reiterating that data will decide what's next, especially with geopolitical risks and market volatility in play.

Growth has been decent enough to justify the pause. The eurozone expanded 0.3% in Q4 2025, slightly better than expected. But Germany's showing cracks, unemployment rose in January, and policymakers are pushing infrastructure and defence spending to prop things up.

Prepare: Keep an eye on wage growth and inflation trends; they'll drive the ECB's next moves. Also, watch Germany's job market closely. If weakness spreads, both fiscal and monetary policy could shift faster than we expect

On the Global Stage:

Crude is heading for its first weekly drop in seven weeks as traders watch upcoming U.S.-Iran talks in Oman. Even with tensions still high.

Shipping has also been raising concerns. Maersk warned it could post its first annual operating loss in a decade because the industry ordered too many ships during the post-pandemic boom, just as the Red Sea and Suez routes are getting back to normal. Lower freight rates ease pressure on goods prices worldwide, but they also squeeze profits and investment across the shipping sector.

On the demand side, private surveys showed Asia's factory activity picked up in January, with China's private PMI rising on stronger export orders. That's a good sign that shows global trade isn't collapsing, but it also means the world is more vulnerable if shipping lanes get disrupted again or commodity supplies tighten.

Prepare: The near-term test is straightforward. If oil and freight keep falling, inflation cools, and central banks get more room to cut rates later in 2026. But if diplomacy breaks down or shipping security worsens and costs jump again, the picture changes fast, even if growth holds up.

3. Gold Overtakes US Dollar In Central Bank Reserves For First Time Since 1996

Foreign central banks now hold more gold than US Treasuries in their reserves for the first time since 1996, marking a historic shift in global reserve management. The crossover happened in 2025, mostly by emerging markets like China, India, and Turkey massively ramping up their gold purchases between 2021 and 2025. Central banks are deliberately reducing dollar exposure as US debt levels explode and geopolitical tensions rise, viewing gold as a neutral, durable hedge against currency volatility and inflation.

This is exactly what I've been saying for years. When central banks dump Treasuries for bullion at this scale, it's a vote of no confidence in the dollar system itself.

4. Market Overview

S&P 500 (U.S.)

In the U.S., the S&P 500 was down slightly for the week despite a strong Friday rebound. Software stocks were crushed as fears intensified about AI disrupting their business models, with companies like Salesforce and ServiceNow plunging to 52-week lows. Amazon tumbled 9% after announcing plans to spend $200 billion on AI infrastructure this year, sparking concerns about capital expenditure outpacing revenue growth. Despite Friday's rally that pushed the Dow to a record high, the S&P finished the week down about 0.4%.

FTSE 100 (UK)

In the UK, the FTSE 100 was mixed this week, ending roughly flat. Mining stocks weighed on the index as commodity prices weakened, with Glencore falling sharply after abandoning merger talks with Rio Tinto. Data and software stocks also declined on AI disruption concerns, with RELX, LSEG, and Experian all pulling back.

S&P/TSX Composite (Canada)

In Canada, the TSX fell sharply this week after hitting record highs earlier. The index plunged over 3% on Friday as precious metals crashed, with gold and silver giving back recent gains. Mining stocks led the decline, with names like NovaGold, First Majestic Silver, and Perpetua Resources down over 16%. Energy stocks also struggled as oil prices fell on easing U.S.-Iran tensions. Technology lagged as well, with Shopify and Celestica dropping sharply, though financials provided some support.

ASX 200 (Australia)

In Australia, the ASX 200 tumbled this week, falling 2% on Friday to slip into negative territory for 2026. Technology stocks were hammered, plunging over 4% and hitting two-year lows. Mining stocks also retreated sharply, with gold miners down nearly 4% as bullion prices fell and uranium stocks collapsing after AMD's disappointing guidance raised doubts about nuclear power demand. Major banks and consumer staples provided modest support but couldn't offset the broader selloff.

🇺🇸 United States – S&P 500

High: 6,990.76

Low: 6,780.13

🇬🇧 UK - FTSE 100

High: 10,477.49

Low: 10,170.81

🇨🇦 Canada – TSX Composite

High: 32,560.68

Low: 31,929.14

🇦🇺 Australia – ASX 200

High: 8,940.40

Low: 8,702.10

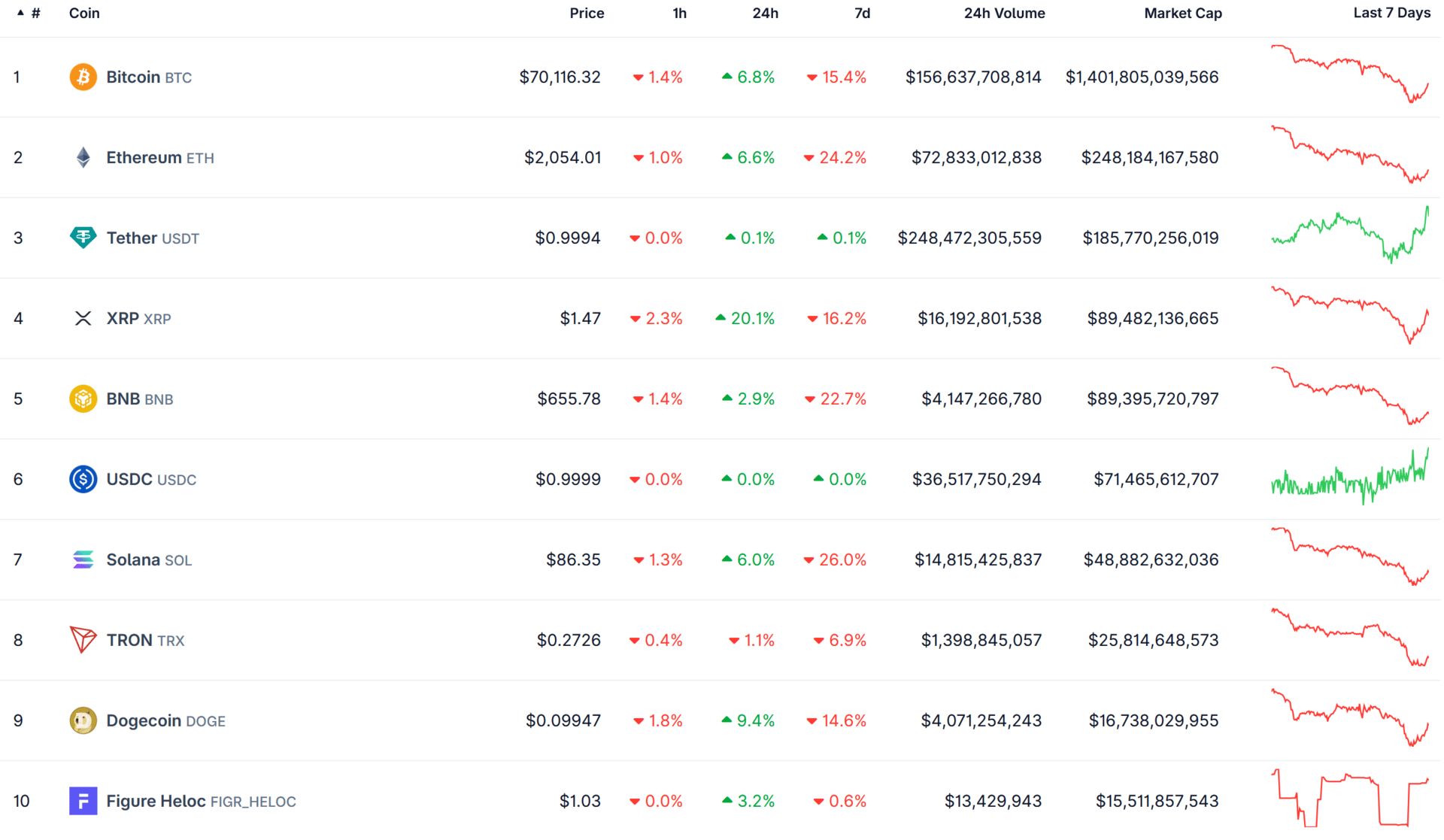

Cryptocurrency:

Bitcoin (BTC): -15.4%

Ethereum (ETH): -24.2%

Tether (USDT): 0.1%

XRP (XRP): -16.2%

BNB (BNB): -22.7%

USDC (USDC): 0.0%

Solana (SOL): -26.0%

TRON (TRX): -6.9%

Dogecoin (DOGE): -14.6%

Figure Heloc (FIGR_HELOC): -0.6

Metals Market:

Gold–Silver Ratio: ~63:1 The ratio widened significantly this week after a massive crash in precious metals. Both metals plunged from record highs (gold near $5,600, silver above $120) to around $4,900 and $76, respectively. Silver got hit harder, dropping over 40% compared to gold's 21% decline. Trading exchanges raised the money required to hold futures contracts, forcing traders to sell. Since silver is more closely tied to industrial use, it fell faster than gold, pushing the ratio higher.

Gold & Silver:

Gold: Rose about 4.02% with a Week High: $5,123.07 & Week Low: $4,410.02

Silver: was stable at -0.03% with a Week High: $95.99 & Week Low: $65.42

5. Faith & Success

“An anxious heart weighs a person down, but a kind word cheers them up.”

Many of the messages I've received this week we're all around the same thing: ‘anxiety’. People are generally feeling anxious about what's happening - not necessarily from a geopolitical perspective this week, but more from an economical and financial perspective.

This is understandable, because there's a lot happening in the financial markets, and a lot of assets are way below their all-time highs.

And I know it's easy to be anxious right now, but worrying about it isn't going to fix the problem. The only thing you really can do right now is to keep positive, and educate yourself as much as possible in whatever assets you own.

That's really all you can do, and if you've done the best you can, just let it go. Otherwise you'll be stressed and anxious about it until this whole thing is over. And that wouldn’t be wise, because this could go on and on for a long time at this rate…

And worst case, it could even result in a huge recession or financial crash… either way, there's not much we can do about it. We don’t have enough power or influence on the financial markets. So if there's nothing we can do about it, why worry about it in the first place?

All we can do is diversify and plan as best we can. If you've done that, you can sit back, and try to relax because an anxious heart weighs a person down… and a kind word, lifts them up.

Until next time,

God Bless,

Neil,

P.S. Why not share this newsletter with a friend?

Enjoying this Newsletter? Share with a Friend…

DISCLAIMER

This newsletter is 100% FREE & is designed to help your thinking, not direct it. These newsletters shall NOT be construed as tax, legal, or financial advice and may be outdated or inaccurate; all decisions made as a result of this information are yours alone.

Trading/Liability: Neil McCoy-Ward operates/trades under a private Ltd company within the Isle of Man.