- Neil's Newsletter

- Posts

- Your IMPORTANT Weekly Briefing: (5th September 2025)

Your IMPORTANT Weekly Briefing: (5th September 2025)

The Neil McCoy-Ward Newsletter

Opening Note…

Welcome back to this week’s newsletter!

This week, I’ve been keeping an eye on Europe. As I explained in my video, France appears to be bracing for war, with a 20-page manual reportedly being given out to households, and its Health Minister warning that hospitals need to be ready for a “major military engagement” by March 2026. I really hope this turns out not to be the case, but Russia for its part seems to only be reacting with more threats. Putin stated that Western countries would be legitimate targets if boots were on the ground in Ukraine.

The geopolitical landscape is shifting and, elsewhere, the markets are shifting too. We’re in the so-called “postmodern cycle” being described by investment banks such as Goldman Sachs. What this basically implies is that asset values including equities and property may not yield returns as high as they previously have been. Inflation is set to continue as a persistent threat, driven by wage-price upward spirals, aging societies and rising energy costs.

As for the UK, this week I also updated you on the government’s plans to introduce digital IDs. The stated reason is to combat illegal migration by having a digital record of every legal resident, but many Brits have long been against digital ID cards for fears of government control, fears which I share. Not to mention, the billions it would cost to roll out…

Now let's break down the latest...

Table of Contents

1. Weekly Spotlight

Angela Rayner Resigns After Tax Scandal Rocks Labour Government

What happened:

On Friday, September 5th, UK Deputy Prime Minister, Angela Rayner resigned after admitting to underpaying around £40,000 in stamp duty on a £800,000 flat in Hove. She also stepped down as Deputy Leader of the Labour Party.

Rayner initially believed the property qualified as her main residence due to a trust arrangement for her disabled son, but later acknowledged that the higher second-home tax rate should have applied. She referred herself to the Prime Minister’s ethics adviser, Sir Laurie Magnus, who concluded she had breached the Ministerial Code. Rayner has agreed to work with HMRC to pay the outstanding balance and penalties.

Starmer called her resignation “very sad” but immediately moved to launch a cabinet reshuffle to restore stability.

Why It Matters:

This is a pretty serious blow. Rayner was Starmer’s number two, his Deputy Leader, shown as the poster girl (due to being from a working-class background). With her gone, that image is tainted. And suddenly, the gap between Starmer’s and Labour’s working-class left, looks much harder to cross. This is positive for the opposition parties who will seize the opportunity presented…

Labour prided itself on promises of competence, integrity, and accountability, which they claimed were the opposite of the other parties. But losing a Deputy Prime Minister over unpaid tax, just as she is raising taxes for the working class - is downright shocking.

The Conservatives & Reform are seizing the opportunity and this only weakens the labour party further.

And most importantly, at a time when families are struggling with soaring bills and sky-high rents, the sight of a senior minister dodging tens of thousands in tax is toxic. It sends exactly the wrong signal.

2. Quick Takes

Here are the top stories shaping the week:

Global Long Bonds Flash a Warning - Yields on long-term government bonds are spiking globally, signalling investor concern over rising debt levels and fiscal stability. The UK 30-year gilt yields hit 5.75%, the highest since 1998, while U.S. and Japanese 30-year bonds also reached multi-year highs. This surge reflects growing anxiety over deficits and the cost of debt servicing. The UK is particularly exposed, issuing record debt at higher costs. Rising yields threaten valuations in equities, real estate, and credit markets heading into Q4.

Florida to End All Vaccine Mandates – Surgeon General Dr. Joseph Ladapo, backed by Governor Ron DeSantis, announced plans to make Florida the first state to repeal all vaccine mandates, including those for measles, polio, hepatitis B, chickenpox, and DTaP. Ladapo said parents should decide what goes into their children’s bodies.

California, Oregon, and Washington Rebuke Trump’s CDC – The three Woke West Coast states announced a joint alliance to safeguard vaccines after rejecting new federal guidelines issued under President Donald Trump and Health Secretary Robert F. Kennedy Jr. The pact commits them to uphold school immunisation requirements for diseases like measles, polio, and whooping cough, expand public-health campaigns, and coordinate independent scientific reviews.

DC Mayor Bowser Signs Order Aligning City with Trump’s Federal Police Takeover – Washington, D.C. Mayor Muriel Bowser signed an executive order to keep the city’s emergency operations centre open and continue cooperation with federal forces—including the FBI, DEA, ATF, Secret Service, and National Guard—even after President Trump’s 30-day emergency expires on September 10. Bowser framed it as a legal safeguard “to the maximum extent allowable by law.”

Trump Administration Ends Second Layer of TPS for Venezuelan Migrants – On September 3, 2025, the Department of Homeland Security announced it would terminate the 2021 Temporary Protected Status (TPS) designation for Venezuelan nationals, citing that Venezuela no longer met the necessary conditions to qualify. DHS justified the change by pointing to improvements in public safety, immigration, the economy, and foreign policy.

Sen. Eric Schmitt: H-1B Visa Program Is ‘Kneecapping White Collar Workers’ – Missouri Senator Eric Schmitt blasted the H-1B visa program, arguing it lets corporations replace American professionals with cheaper foreign labour. He said U.S. workers are often laid off and forced to train their replacements, calling the practice “kneecapping white-collar workers right before our eyes.”

Disney to Pay $10 Million Fine Over YouTube Data Collection – Disney agreed to a $10 million settlement after US regulators found its YouTube content illegally collected personal data from children under 13 without parental consent. The investigation revealed that Disney’s digital advertising practices tracked viewing behaviour and identifiers from kids’ channels, violating federal privacy protections.

Trump Pledges to ‘Stand with Warsaw’ During Meeting with Polish President – During his meeting with Polish President, Karol Nawrocki at the White House, President Donald Trump vowed to back Poland “all the way”. He also praised Poland’s top-level NATO defence spending and dismissed talk of U.S. troop cuts, even suggesting numbers could rise. His visit—without Prime Minister Donald Tusk’s ministers—came just after Poland scrambled jets in response to overnight strikes on Ukraine.

Duffy Expands Air Traffic Control Training Program – US Secretary of Transportation Sean Duffy announced an expansion of federal training to address the nationwide shortage of air traffic controllers, currently estimated at more than 3,000 positions. The program will add two new FAA training academies, increase class sizes by nearly 20%, and shorten certification timelines without lowering safety standards.

Europe Faces $1 Trillion Rearmament Bill as U.S. Weighs Troop Cuts – European leaders are preparing for defence spending to surge by over $1 trillion in the next decade if the U.S. follows through on plans to reduce its military presence. The estimate reflects the cost of building new air defence systems, expanding armies, and modernising equipment to meet NATO standards without heavy U.S. backing.

Putin Says Trump Asked Him to Hold Meeting with Zelensky – Putin claimed that President Donald Trump personally requested he hold direct talks with Zelensky. Putin said he is open to the idea but insisted any negotiations must reflect Russia’s security demands and the “realities on the ground.” No timeline for a potential meeting has been set.

EU Flag Ordered Removed From Polish President's Office: Report

Polish President Karol Nawrocki, a conservative sovereigntist, reportedly had the EU flag removed from his office soon after assuming office. The EU flag was noticeably absent during an August 27 cabinet meeting, where only Poland’s national flag appeared. The presidential spokesperson later stated the EU flag remains in the chancellery and is shown at official events, alongside NATO and Polish flags.

Farage Tells Congress UK Has Become Like North Korea – Testifying before the U.S. House Judiciary Committee, Nigel Farage attacked Britain’s Online Safety Act and use of the Public Order Act, saying they criminalise speech. He cited the arrest of writer Graham Linehan at Heathrow for social-media posts, and the 31-month prison sentence for Lucy Connolly over her X post. Farage warned U.S. citizens could also be targeted under these laws and told lawmakers the UK is sliding toward “North Korea-style” censorship.

NEIL’S TAKEAWAYS:

In the United States

Job openings dropped to 7.18 million in July, a 10-month low, and, for the first time since 2021, there are now fewer openings than unemployed workers. A clear sign that labour demand is cooling. Yet, spending is holding up, July PCE rose, but sentiment is softening.

Surveys and the Fed’s Beige Book are flagging caution as tariffs and uncertainty push up costs and hiring plans. Consumer confidence is fragile; just 25% still believe hard work leads to a better life, the lowest on record, and only 1/3 still believe the American Dream holds true. Persistent gloom can drag on spending, but with a lag. It leaves the Fed in a tricky spot. On one side, softer jobs data support. The markets are leaning towards a September cut.

Prepare: Look at high-quality defensive stocks, clean balance sheets and solid cash flow. We should keep an eye on how broad the weakness is in Friday’s August jobs report.

Across Europe

In Europe, inflation is nearly at target; August’s flash print came in at 2.1%. However, growth remains sluggish. US tariffs are starting to bite, especially for high-value exporters like chemicals. And the recent spike in long-dated yields is adding even more pressure.

Prepare: Watch Eurozone inflation prints and ECB signals. We can track the BTP/Bund and UK gilt movements for signs of stress. And if unemployment turns up, expect a hit to consumption.

On the Global Stage

This week, the global economy showed more signs of divergence. India’s still out in front, strong August PMIs and second-quarter GDP around 7.8% year-on-year. Meanwhile, global trade remains uneven with tariffs muddying the waters. Yet energy markets are giving mixed signals. The IEA now sees oil demand growth slowing, around 680,000 barrels per day in 2025, but with investment slipping, meaning longer-term supply risks aren’t going away. Geopolitics is also shifting again: Russia and China signed a new memorandum on the ‘Power of Siberia 2’ pipeline, tightening energy ties. In the background, advanced economies are navigating what some now call a “postmodern” cycle, marked by high debt, deglobalization, and stubborn inflation. I’ve been warning of this for some years. Developed economies have reached their ‘Limits of Growth’…

Prepare: Watch India’s PMI (Purchasing Manager Index - a leading indicator of whether market conditions are expanding, staying the same, or contracting) and GDP momentum; they’re setting the pace. Keep an eye on the oil balance: the IEA sees demand growth of 680 to 700 thousand barrels per day through 2025–26, but long-term investment is lagging. And pay close attention to how major banks are framing this so-called “postmodern” cycle, in which inflation is a greater risk than deflation and index returns are expected to be lower. The gap between market winners and losers should widen, as the next wave of leadership emerges beyond the usual U.S. mega-cap names.

3. Opportunity Of The Week… Rapid Cashflow Builder

🔥 Don’t Wait for the Next Paycheck… Create One Yourself!

Don’t miss your opportunity to take this 5-Star Course!

Here’s what you will discover:

How to adapt to AI and automation – While millions are worried about being replaced, you’ll be learning the skills and systems that put you ahead of the masses…

How to turn ideas into income quickly – You don’t need investors, a fancy office, or years of waiting. With the right blueprint, you can generate your first new stream of cashflow in weeks…

How to protect yourself from uncertainty – Layoffs, inflation, and market swings don’t hit as hard when you’ve built income that comes from multiple sources you control…

How to start lean and grow strong – These strategies don’t demand huge capital or risky bets. They’re designed so everyday people can start small and scale…

How to create freedom on your terms – Whether it’s covering the bills, funding a bigger dream, or simply buying back your time, you’ll gain options most people never have…

Every day, you have a choice to make that will bring you closer to your goals, or further away. Today, you can take this course risk-free, with a 30-day money-back guarantee, and learn how to solidify a financial future that the government is working quietly to erode. Start today!

P.S. There will be a day when this course returns to its full price of $2,000, and your potential cashflow-building opportunity will have slipped away. If you have a business idea you want to see flourish, take this course and make it happen, before it’s too late…

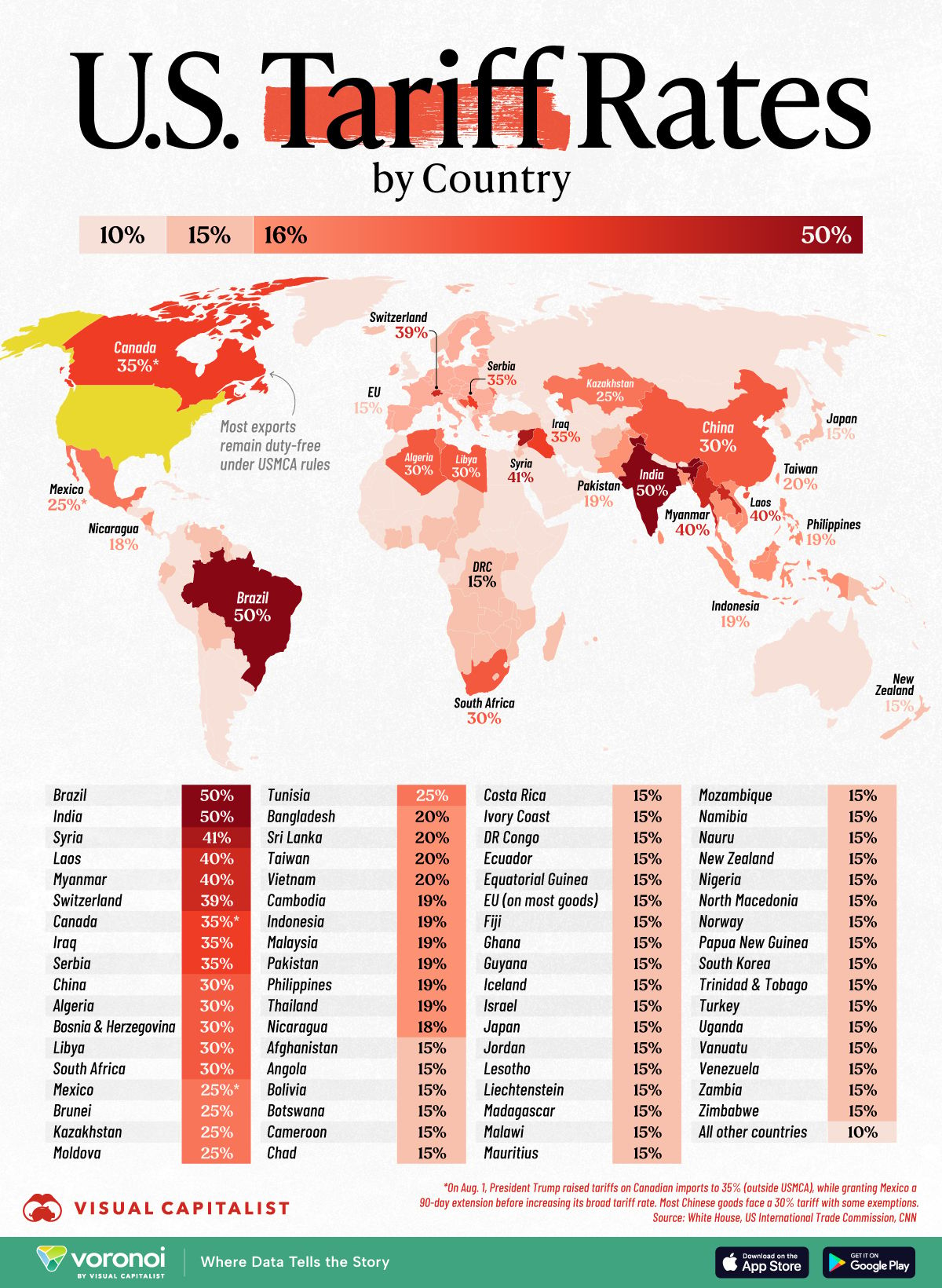

4. Chart Of The Week: U.S. Tariff Rates by Country

Many ‘experts’ still predict that the tariffs will weigh heavily on everyday Americans—(adding $2,100–$2,400 a year) in higher prices and reducing GDP growth by 0.5%. The policy is also boosting federal revenue and is aimed at cutting the U.S. trade deficit. The average effective tariff rate now sits near 19%, bringing in billions in collections. Trade with Canada and Mexico still left the U.S. with a $230 billion deficit in 2024.

While critics warn tariffs hurt households, no recent hard evidence confirms this; most claims rely on estimates rather than new data… Actually US GDP just had a huge Quarter (3.3%!)

5. Market Overview

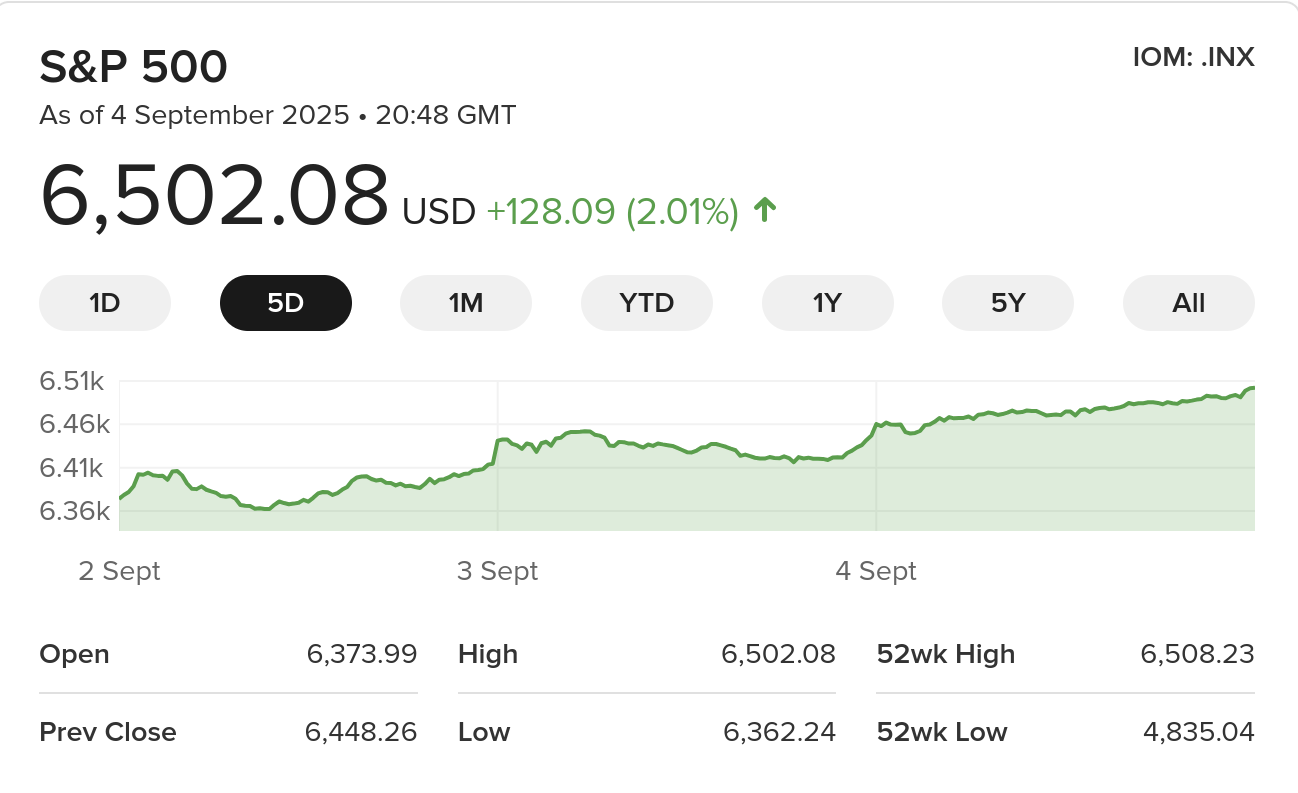

Markets leaned cautiously higher this week as investors bet on Fed easing and steadier growth. Optimism is there, but conviction remains unsteady…

🇺🇸 United States – S&P 500

High this week: 6,502.08

Low this week: 6,362.24

🇬🇧 UK - FTSE 100

High this week: 9,250.69

Low this week: 9,107.96

🇨🇦 Canada – TSX Composite

High this week: 28,921.98

Low this week: 28,388.17

🇦🇺 Australia – ASX 200

High this week: 8,967.90

Low this week: 8,731.80

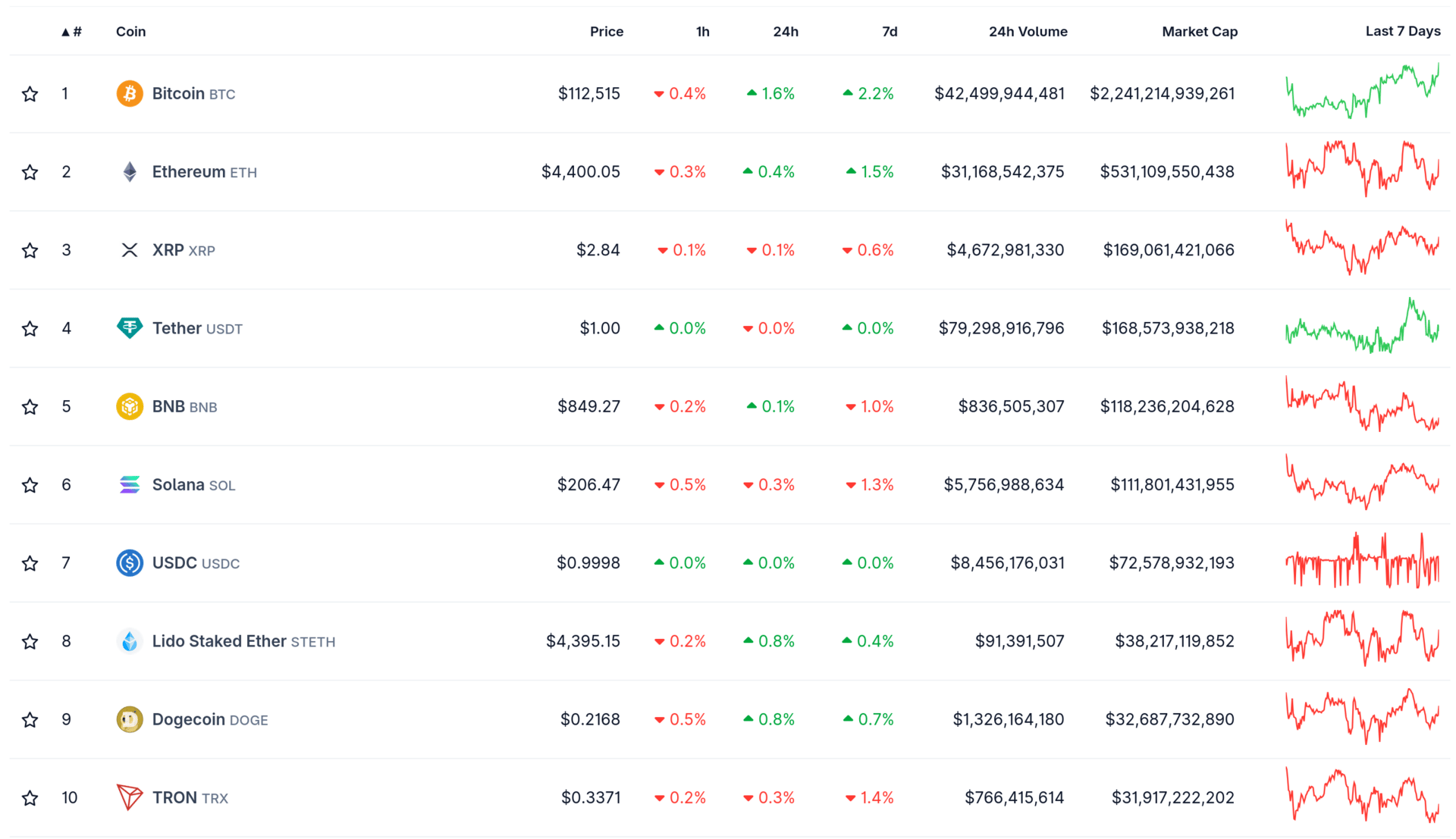

Cryptocurrency:

Bitcoin (BTC) – Trading around $112,515, little changed on the week (+2.2%), with a market cap above $2.2 trillion.

Ethereum (ETH) – At $4,400.05, up 1.5% over 7 days despite daily bounces.

XRP – Slipped 0.6% this week, now at $2.84, market cap about $169B.

Stablecoins (USDT & USDC) – Holding steady at $1.00 with negligible moves, together representing over $240B in market cap.

BNB – Slight dip this week (–1.0%), trading at $849.27.

Solana (SOL) – One of the stronger performers, down 1.3% this week at $206.47.

Lido Staked Ether (stETH) – Closely tracking ETH, up 0.4% this week.

Dogecoin (DOGE) – Up 0.7% on the week, now at $0.2168, market cap around $32.8B.

TRON (TRX) – Slipped 1.4%, trading near $0.337 with a $32B market cap.

Summary:

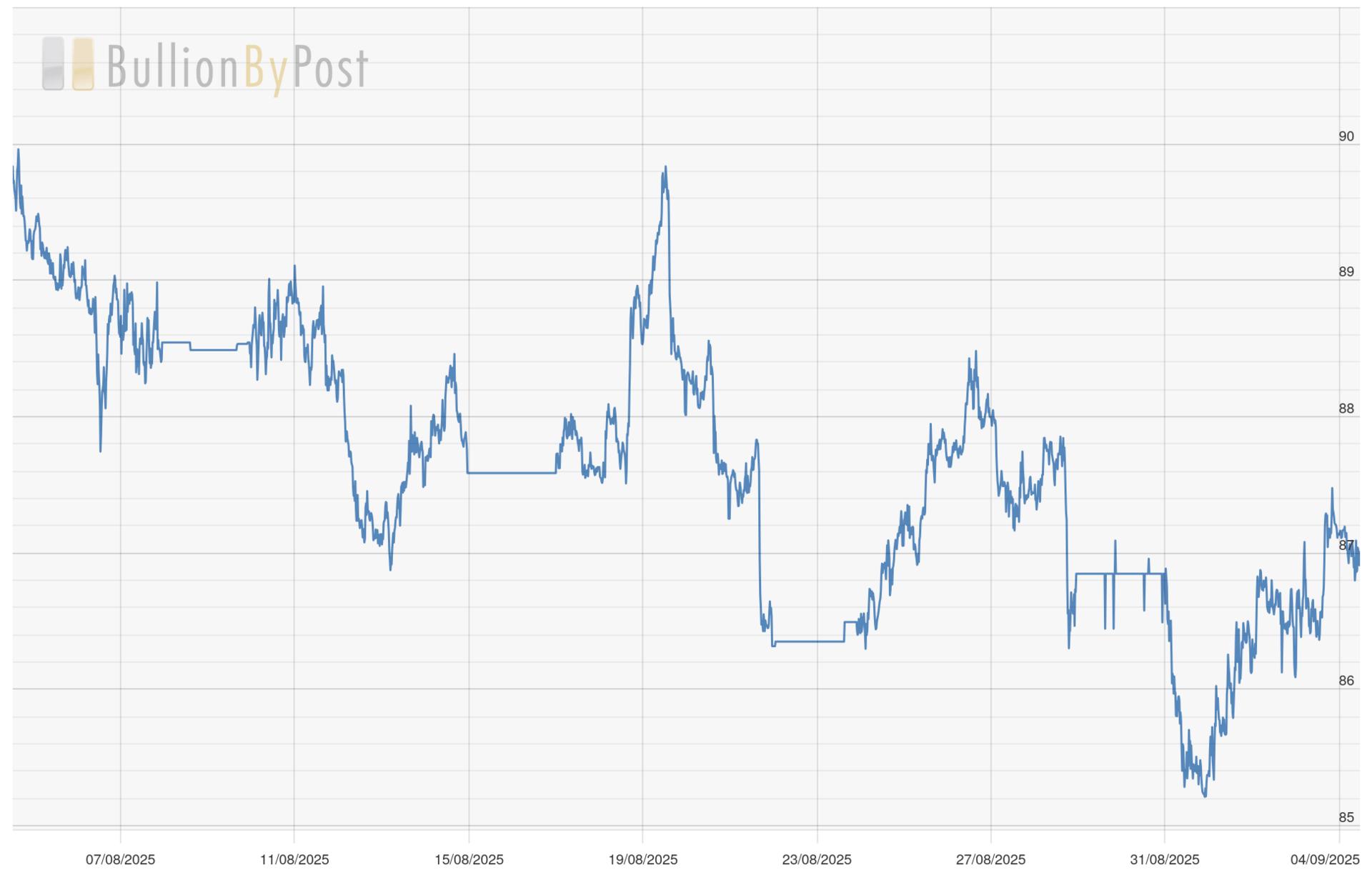

Metals Market:

Gold Silver Ratio:

Gold & Silver

Gold: Trading between approximately $3,546 and $3,582 this week (A new record high for gold!)

Silver hovered near $41 this week - if this holds, expect a new support level.

Neil’s Investor Takeaways:

Markets are moving on strong expectations that the Fed will cut rates this month. That belief is fuelling rallies in tech stocks and pushing bond yields lower in the US. At the same time, gold and silver have surged to new highs as investors look for hedges.

How to position:

Treat the current rally as an opportunity to rotate into quality companies with strong cash flow and low debt.

Take advantage of falling yields by adding exposure to bonds or bond ETFs, which tend to benefit directly from easing policy.

Keep some allocation to gold and silver, which are trading at multi-year or record highs. If Silver holds, we could see a new rally.

Be cautious about over-committing to highly cyclical sectors that may struggle if the slowdown deepens.

Sentiment is positive, but fragile. Smart investors will use this moment to quietly build positions in safe, durable assets.

Your Opportunity This Week…

Rapid Cashflow Builder: 90% Off - CLICK HERE - with a 30-day money-back guarantee or swap guarantee onto another course.

6. Faith & Success

“Do not wear yourself out to get rich; do not trust your own cleverness.” — Proverbs 23:4

We know that wealth doesn’t come from frantic striving or untested shortcuts. Many wear themselves out chasing the next big thing, relying on their own cleverness instead of steady, proven principles. Scripture reminds us that this path leads to emptiness. In fact, at the end of his life, King Solomon said that all is vanity.

True success comes from applying wisdom consistently—working diligently, managing resources wisely, and trusting in the methods that have stood the test of time. When you anchor your efforts in God’s truth and proven practice, you protect yourself from burnout and build prosperity that lasts. Remember, what God can do outweighs what we can do. When we practice patience and adequate rest, combined with trust, we let Him do his part in our lives.

7. Important Video of The Week

🚨Something BIG is Happening In Europe This Week Watch the Full Video On Youtube

Closing Thoughts 💬

I had an interesting realisation this week after I found myself extremely stressed and tired. I realise that I too was pushing myself too hard. It's part of my nature to want to help as many people as possible, but I can often forget about my own health in the process. This week, I realised that I needed to take a step back and focus my resources and time in a more effective manner.

I also feel much less stressed this week after deciding to drop my ambition to expand my media channels. I realised that the sheer pressure of training and managing people is not something that I enjoy anymore… (did I ever enjoy it?)

I decided instead that I will continue to make amazing courses for my students in order to improve their lives for the better. (Don’t forget to take the Rapid Cashflow Course Here if you haven’t yet.)

See you again next week!

Onward and Upward,

God Bless, Your Friend,

Neil,

Enjoying this Newsletter? Share with a Friend…

DISCLAIMER

This newsletter is 100% FREE & is designed to help your thinking, not direct it. These newsletters shall NOT be construed as tax, legal, or financial advice and may be outdated or inaccurate; all decisions made as a result of this information are yours alone.

Trading/Liability: Neil McCoy-Ward operates/trades under a private Ltd company within the Isle of Man.

1