- Neil's Newsletter

- Posts

- Your IMPORTANT Weekly Briefing: (29th August 2025)

Your IMPORTANT Weekly Briefing: (29th August 2025)

The Neil McCoy-Ward Newsletter

Opening Note…

Welcome back to this week’s newsletter!

We may be heading towards cooler Autumn weather (or fall for my American readers), but on the flip side, things are heating up in the news this week. There’s a bit of an ongoing spat between the US and the EU, playing out. You may have seen in my video yesterday of the EU’s threatened “retaliatory measures” aimed at US tech companies in the wake of President Trump’s tariffs - well, according to Macron anyway...

It was the latest in the unfolding tensions as U.S. leaders JD Vance and Donald Trump ramped up their pressure on the UK and EU over digital surveillance, censorship, and (lack of) free speech laws, in a battle unfolding before our eyes into state control over our privacy. Personally, I doubt that the EU will be able to respond with anything other than empty threats, given the way we’ve seen world leaders scrambling to get an audience and agreement with the US President over tariff deals. And the fact that European leaders such as Macron have imminent governmental collapses to figure out themselves.

There’s simply so much happening in the news at the moment, and it reminded me that there’s so often a bias from mainstream news channels, particularly in the case of left wing narratives. Recently CNN was even exposed for putting an orange filter when showing Donald Trump’s face in its new coverage! This sort of active deception is why I love to research things deeply, reading multiple sources and getting to the bottom of what is really happening.

It’s also why I’m once again going into some UK and European cities for my “City Tours” YouTube series. Most people only visit the quaint touristic strips of these cities. But these areas don’t tell you the whole story for the families who live and suffer in them. With rampant crime, violence, poverty, graffiti, and rubbish - yes, piles of literal garbage - left on display in many places.

As you may have seen from my recent posts & videos, I’m looking for a bodyguard to accompany me on this trip. A few people left comments saying (here are a few good ones): ‘Why would you need a bodyguard?’ “Weren’t you trained in different martial arts since you were a kid?!” / “Didn’t you used to fight MMA/BJJ?” / “I thought you were a boxing champ in the British Army! I guess not!“ / “So much for 10 years Army experience in Iraq/Afghanistan”, etc etc!!! These comments made me laugh, so allow me to explain…

When I’m focused on my work (filming what’s in front of me), I’m NOT looking at what’s going on behind or to the side of me. I’m a typical man - I simply can’t multitask! (As my wife tells me most days, ha). I’m just one man and have been easily outnumbered multiple times in the past. And while I certainly don’t go looking for trouble (as some YouTubers do deliberately), trouble does find me sometimes. The last time trouble found me was in Birmingham, when I was almost chased out of the area by a gang for filming what was happening there. Before that was the City of Bradford, where the guys just didn’t want me filming...

So I hope that explains why I need a bodyguard with me on these trips. It’s just to have that extra set of eyes looking out so I can focus on getting the right shots. And also, it reduces the risk of me getting jumped for my camera equipment (this has also happened before where I had to literally fight 2 guys while holding onto my camera).

So if you’d like to help ‘watch my back’ during September and October, please let me know by replying to this email. We will be going to some dangerous areas (in the UK), so keep this in mind!

Anyway, back to the story…

Whatever your opinions of the man, it’s hard to deny that JD Vance is positioning himself well for the years to come. I doubt whether many people (especially this side of the pond) knew of him a few short years ago, but this year President Trump has already called him the heir to MAGA, likely signalling a 2028 presidential run for Vance. MAGA followers will hope it means they keep being “tired of winning,” as Vance’s ever-quotable mentor puts it.

What I take from JD’s example is that it’s an excellent idea to prepare now for the coming years in our own life goals. It takes careful planning and making good choices, such as some well thought through investment holdings, but also the simple things too. Where do I want to live in the future? What’s best for my family? Is this Country becoming more business/tax friendly or less friendly? Safer or more dangerous? etc - these are the things to ponder upon now, this weekend during your quiet time.

Now let's break down the latest...

Table of Contents

1. Weekly Spotlight

Weekly Spotlight: Britain, France, Germany UN "Snapback" Sanctions Mechanism on Iran

Britain, France, and Germany have launched a formal 30-day countdown to reimpose UN sanctions on Iran, under the “snapback” mechanism, which means it can automatically reinstate previously lifted sanctions unless a new resolution prevents it.

Why It Matters:

The sanctions package includes tough measures on Iran’s financial, banking, oil, defence, and arms sectors, with provisions for asset freezes, arms embargoes, and travel bans.

A primary reason for the trigger is Iran’s refusal to extend engagement or cooperate with the International Atomic Energy Agency (IAEA) following the June attacks on its nuclear sites.

Meanwhile, Iran has said the move is illegal and warned of possible withdrawal from the Nuclear Non‑Proliferation Treaty (NPT) or intensified military conduct.

The U.S. has expressed backing for the approach of Britain, France, and Germany.

This, of course, is being timed purposefully as they want the effect in place before October when Russia assumes the rotating presidency of the Security Council.

Why might this matter to you? One word: ENERGY. Iran’s a major oil player, and if its exports get choked off again, that means less supply on the global market. With energy prices already touchy and OPEC keeping things tight, this could easily push oil and gas costs higher. And when energy gets pricier, it trickles through everything from heating bills to food prices, keeping inflation stubborn and making life harder for households and businesses across Europe.

2. Quick Takes

Here are the top stories shaping the week:

Nvidia Faces Critical AI Test With Q2 Earnings

Nvidia teeters on a pivotal moment as it reports Q2 results this week, with the broader AI stock market under scrutiny. This comes after a wave of selling sent tech stocks lower, fuelled by a report saying 95% of AI pilots don’t boost revenues and OpenAI’s CEO warning about overhype. - This announcement will have ripple effects as investors begin to step into the AI sector…Harris' DNC Events Fall Short on Fundraising

With the DNC still paying off debts from her 2024 presidential campaign, during which a figure as high as $1.5 billion was spent, Kamala Harris’s recent fundraising events reportedly underperformed, failing to meet expectations for DNC support, raising concerns about donor enthusiasm ahead of a critical fundraising cycle. This could spell more trouble for the Democratic party in the next election cycle.Trump Signals Fresh Sanctions as Ukraine Conflict Escalates

With the Ukraine war intensifying, Trump hinted at new sanctions against Russia, signalling potential renewed pressure on global energy and geopolitical tensions. We’ve known this is his solution to try to control Putin… Will Russia come to the table?Fourth Russian Spy Plane Encountered Near Alaska This Week

For the fourth time in days, U.S. jets intercepted a Russian spy plane off Alaska, highlighting early signs of heightened Arctic and regional defence tensions.U.S. Lags Russia & Ukraine in Drone Warfare Development

Experts warn the U.S. significantly trails Russia and Ukraine in drone tech, noting U.S. drones are pricier, lower-quality, and delivered too slowly for fielding combat systems effectively. Investors, watch this industry as logic suggests the US will make an attempt to catch up…Venezuelans Turn to Crypto Amid Hyperinflation

In the face of runaway inflation and a collapsing bolívar, Venezuelans are increasing crypto adoption for transactions, signalling a deeper erosion of trust in their national currency. Those who have taken the Gold / Silver Investing Course understand how Gold & Silver could be even more important than crypto in scenarios of hyperinflation…China Blasts Record Coal Output Despite Renewable Push

A CREA report shows China burned a decade-high volume of coal in H1 2025, building and commissioning more capacity than at any time since 2015, even as renewables grew to cover 60% of installed capacity. - Meanwhile, the rest of the world invests huge sums in renewables (see chart below)…FEMA Staff Placed on Leave After Letter Criticising Overhaul

Thirty-six FEMA employees publicly signed a letter warning that recent sweeping changes could undermine disaster readiness. All have since been placed on leave. - FEMA lost much of its credibility in the wake of Hurricane Helene, which devastated North Carolina in 2024. Trump is essentially shifting disaster relief to states, which should improve readiness.Soros-Funded Dark Money Group Secretly Paying Democrat Influencers To Shape Gen Z Politics

A report reveals that the Sixteen Thirty Fund, tied to Soros’s Arabella network, secretly bankrolls over 90 influencers to push progressive narratives online. Contracts barred creators from disclosing payments, while Chorus, the program’s front-end, claimed control over their content and outreach. - With young voters trusting influencers over traditional media, this is essentially a plot to engineer the future, funded by billionaires… but Trump’s tweet about Soros, shows he could finally be in Trump’s crosshairs.

UK Services Sector Hit by Cost Pressures and Low Demand

The CBI reports widespread pessimism among UK service firms as rising costs squeeze profits, causing reduced hiring and slashed investment—dimming hopes for a post-summer rebound. - Ask around your social circle, do you know anyone who is actually optimistic about the UK economy in any way? The headlines often ignore the glaring black hole, which I talked about in my recent video…Trump Claims $500 Wage Gain for Average Worker This Year

Trump asserted that the average American worker has seen a $500 pay bump in 2025, driven by historic blue-collar wage growth and easing energy and grocery costs. - ‘Fact Checkers’ will refute this, especially those in California, but we are seeing blue-collar jobs increase in value in the US. It’s interesting, as I’ve stated for 3 years that a tradesman’s job is one of the more protected ones against AI in the future.Trump Demands RICO Charges Against George & Alex Soros

On August 27, 2025, President Trump posted on Truth Social that George Soros and his “wonderful Radical Left son” should get RICO charges, accusing them of funding violent protests and broader efforts to destabilise U.S. politics, and warned, "We’re watching you."Tensions Rise Over Greenland Energy Resources

On August 27, Denmark’s foreign minister officially summoned the U.S. Chargé d’Affaires in Copenhagen. This was triggered by intelligence reports that three Americans (two with ties to Trump’s circle) were allegedly running “influence operations” in Greenland. The Danish government called the interference “completely unacceptable” and is boosting military and political presence in the Arctic to assert sovereignty.

This includes new surveillance, drone systems, and naval patrols around Greenland. Greenlandic leaders quickly reaffirmed their stance: they will not be swayed by outside powers, and polls show the public overwhelmingly rejects joining the U.S. (around 85% oppose it). - 85% is a lot, but when polls have numbers like this, I research the source… Shocker, it is from Greenland’s largest media outlet. Grain of salt applied. Nonetheless, the US will likely keep marching forward. How does this impact the economy…

NEIL’S TAKEAWAYS:

In the United States

On the foreign front, the White House is making use of secondary tariffs on India as a way to choke Russia’s oil revenues. At the same time, at home, Trump is moving away from decades of Republican free-market orthodoxy, instead of Reagan’s “hands-off” approach. The administration is taking equity stakes and exerting influence in companies like Intel (semiconductors), U.S. Steel (infrastructure and defence), and MP Materials (rare earth minerals critical for EVs and national security). These are not random picks: they’re clear investments into core industries for economic security.

Prepare: Government-backed companies could benefit from policy tailwinds, but carry the risk of heavy political interference. For investors, this is both a moment of strategic positioning and a warning: the old rules of Reaganomics are disappearing.

Across Europe

Europe was very mixed this week. UK inflation climbed to 3.8%, widening the gap with the Eurozone’s 2% rate, which has made things much harder for the Bank of England. Despite this, London’s FTSE 100 surged to record highs, with consumer stocks leading the charge; some of the gains were also supported by healthcare, aerospace & defence, and energy. Meanwhile, the Eurozone’s composite PMI rose to 51.1 in August, its highest in 15 months. This is thanks to stronger new orders for businesses.

Prepare: Don’t mistake stopgap trade deals for real growth. Keep a close eye on French 10-year bond yields and on France’s debt spiral. because if investor confidence cracks further, it could spill across the Eurozone.

On the Global Stage

In Asia, particularly Japan and South Korea, markets rallied on growing expectations of U.S. interest rate cuts. Meanwhile, India is under pressure after the Trump administration doubled tariffs to as much as 50%, triggering a sharp downturn in trade sentiment. However, strong domestic demand and resilient consumer confidence are helping cushion the blow. Another surprise to watch was Taiwan’s Deputy Foreign Minister compared China’s semiconductor ambitions to pre-war expansionism. This could spark some serious tension and show concerns over chip sovereignty and technology security.

Prepare: Rising tariffs, fragile supply chains, and China's strategic bid for tech dominance are all tension points we need to keep an eye on.

3. Important Video of The Week

🚨They’ve Just Unleashed Something TERRIFYING (& It Doesn't Blink...) Watch the Full Video On Youtube

4. The Top 10 Sectors for Foreign Direct Investment in 2024

Key Takeaways

The top 10 sectors attracted $1 trillion in FDI in 2024

Renewable energy led with 27% of the total FDI across the top 10, followed by the communications sector

The Asia-Pacific region was the biggest recipient of foreign investment in 2024…

Foreign investment in the electronic components sector saw the biggest fall, recording a 55% decrease from 2023. This decline was largely attributable to a sharp fall in investments in the battery sub-sector.

5. Market Overview

Equities held firm this week, with the U.S. market moving higher after growth and corporate earnings were positive, though results were mixed. The U.K. market slipped, weighed down by sector pressures and weak sentiment despite earlier strength. Canada’s index pushed ahead to record highs on strong energy and resource demand, while Australia was little changed overall, with miners coming under pressure during the week.

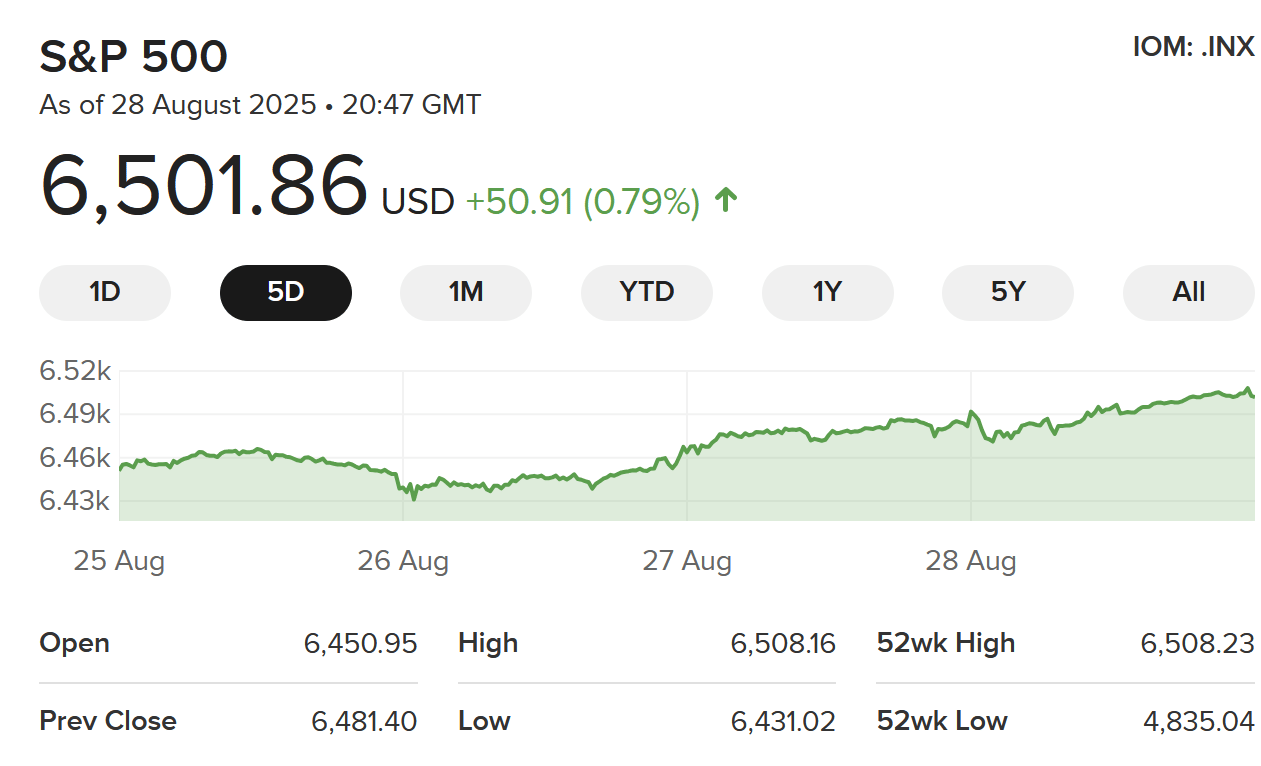

🇺🇸 United States – S&P 500

High: 6,508.16

Low: 6,431.02

🇬🇧 UK - FTSE 100

High: 9,299.73

Low: 9,194.05

🇨🇦 Canada – TSX Composite

High: 28,468.34

Low: 28,140.33

🇦🇺 Australia – ASX 200

High: 9,045.00

Low: 8,921.90

Cryptocurrency:

Bitcoin (BTC): $110,112 (▼ 2.6% over 7 days)

Ethereum (ETH): $4,373.59 (▲ 0.8% over 7 days)

XRP (XRP): $2.87 (▲ 0.0% over 7 days)

BNB (BNB): $856.96 (▲ 0.7% over 7 days)

Solana (SOL): $207.92 (▲ 12.9% over 7 days)

Dogecoin (DOGE): $0.2143 (▼ 0.7% over 7 days)

Summary:

Metals Market:

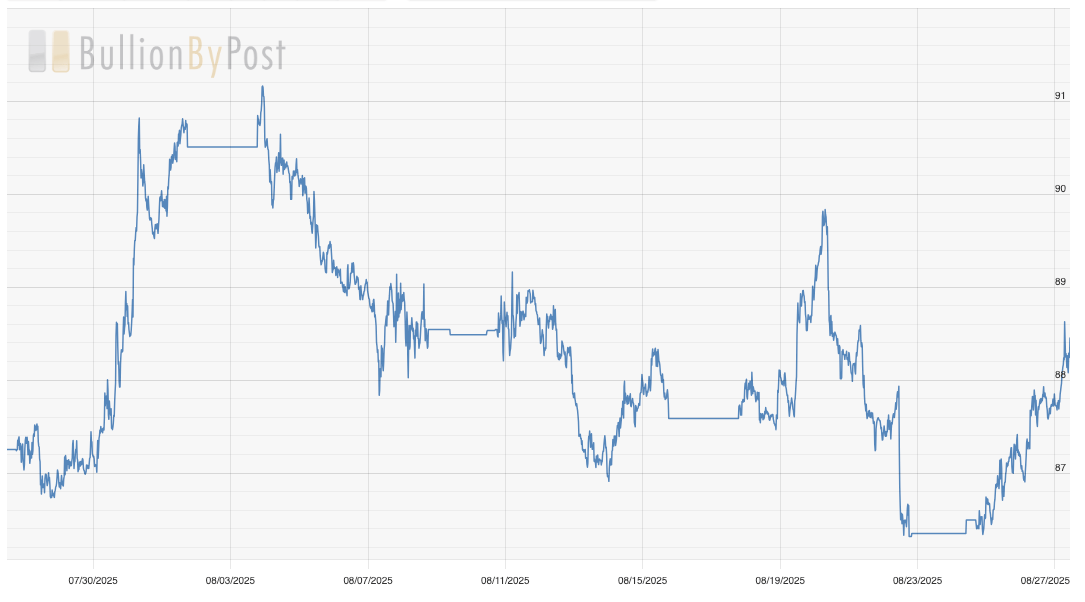

Gold Silver Ratio:

Gold & Silver

Gold: Trading between $3,360 – $3,420 per ounce

Silver: Trading between $38.32 – $39.10 per ounce

Neil’s Investor Takeaways:

U.S. equities gained modestly this week on earnings optimism. In commodities, energy continues to support export-heavy regions like Canada, while gold and silver held steady. In crypto, we are seeing increasing rotation with increasing momentum. Bitcoin dominance slipped to around 58%, down from over 65%. Whereas Ethereum and Solana have seen strong inflows. Intelegraph notes whales have funnelled hundreds of millions into Ether.

Prepare: Stay nimble, monitor commodities and central bank cues closely, because markets are shifting between relief rallies and deeper structural trends.

Your Opportunity This Week…

Gold & Silver Mastery Bundle: 90% Off - CLICK HERE - with a 30-day money-back guarantee or swap guarantee onto another course.

We are coming to the end of the Gold & Silver course promotion soon. After 6 months, I’ve finally finished recording all of the interviews and sessions so now I just need to edit and post them in the coming weeks.

6. Faith & Success

"Teach us to number our days, that we may gain a heart of wisdom." — Psalm 90:12

This verse is a reminder that time is our most valuable asset. Money can be gained or lost, but days never return once spent. Success is about making each day count toward something greater than ourselves. This fundamental mindset: shifting from focusing on money to focusing on productive time, can have a great impact on your success. Consider, as well, that we won’t be judged on how much money we had, but what we did with our time. We can also use our money in a way that is wise. If we have the wisdom, that is…

Reflection: How are you investing your days? Each choice you make is either a net negative or a net positive.

7. Opportunity Of The Week… Gold & Silver Mastery

Find out why these are the top metals courses on the planet!

Here are the details…

Gold & Silver Investing Course:

- Teaches you what metals to buy (Coins or Bars)

- How to buy at the best price

- How to avoid beginner mistakes

- Understand which vehicle is best for your metals purchase (Physical ownership vs others)

- The history of Gold & Silver and why it is more important today than ever

- And many many more things, we are just scratching the surface here…

Gold & Silver Advanced Course:

- Expert Interviews from the best in the World on advanced strategies

- Go beyond simply buying and holding metals

- Pension & even ‘Trusts’ solutions

- Trading strategies (including the gold to silver ratio)

- Professional Tools & Tactics

- Completely avoid confiscation

- Plus much much more…

Gold & Silver Mastery Bundle:

- 2 Courses (above) in 1 bundle

- Go from Beginner to Pro

- The most detailed Gold/Silver Program on the PLANET! (Guaranteed)

- 25+ Hours of Content

- Save BIG by getting the bundle

Now’s the best time to get fully versed in metals and truly protect your wealth... This offer will be closing soon as the courses are nearing 100% completion. So act now and lock in this discount, before the price goes up…

Closing Thoughts 💬

My prayers are with the families impacted by recent events in Minnesota, US, which will have caused unimaginable suffering. We live in what can sometimes seem like terrible times.

See you again next week!

Onward and Upward,

God Bless, Your Friend,

Neil,

Enjoying this Newsletter? Share with a Friend…

DISCLAIMER

This newsletter is 100% FREE & is designed to help your thinking, not direct it. These newsletters shall NOT be construed as tax, legal, or financial advice and may be outdated or inaccurate; all decisions made as a result of this information are yours alone.

Trading/Liability: Neil McCoy-Ward operates/trades under a private Ltd company within the Isle of Man.

1