- Neil's Newsletter

- Posts

- Your IMPORTANT Weekly Briefing: (26th September 2025)

Your IMPORTANT Weekly Briefing: (26th September 2025)

The Neil McCoy-Ward Newsletter

Opening Note…

Welcome back to this week’s newsletter!

Firstly, a very final reminder that the Gold & Silver courses have now been finalised with the last modules being posted tomorrow! (So the current offers will expire).

Overall, it’s been a strange week. Lot’s of dystopian measures have been pushed forward, from the digital ID (UK), to the new Ministry of Truth (EU). All we need now is a war and a CBDC to complete the package!

I’ve been doing my UK tour over the last 2 weeks, which is shortly coming to an end for this leg of the trip. What surprised me the most is just how FAST the deterioration has accelerated from last year. I was shocked at times to see what I can only call ‘no go areas’ where the Council & Police have abandoned the area. Some areas were very dangerous and filthy.

I did enjoy speaking to many subscribers that I bumped into on my trip, as well as non subscribers too - about their concerns for the Country. Their concerns centred around the same things: mass migration, crime, drugs, unsafe to go out at night & and heavy levels of taxation while infrastructure crumbles. I agree with all of these concerns.

Now let's break down the latest...

Table of Contents

1. Weekly Spotlight

Weekly Spotlight: Trump’s UN Speech in Focus

The UN General Assembly (held in New York) usually consists of a lot of long & boring speeches, and this week was no different… well, right up until Donald Trump showed up. I was watching the live broadcast and couldn't help but laugh at the bluntness of what he was saying. Yet he was honest, and a lot of us no doubt shared his thoughts on what’s happened to Europe. It is indeed sad to see what’s happened to our Towns & Cities.

I thought I would gather some of the highlights from his speech for you:

1. “The U.N. is not even coming close to living up to its potential.”

But he then quickly added that the U.S. is still “100% behind” its mission. I think he was basically saying: I’ll back you, but only if you do better.

2. “We have ended seven wars that people thought could never end.”

Many of these aren't full-scale wars that you are picturing in your head; some are more akin to disputes. But it is true that he played some part in their de-escalation: the wars he was talking about were (Cambodia and Thailand), (Kosovo and Serbia), (Democratic Republic of Congo and Rwanda), (Pakistan and India), (Israel and Iran), (Egypt and Ethiopia), (Armenia and Azerbaijan).

3. Warnings to Europe on energy and immigration.

He also gave the warning that Europe risks ruin if it pushes green energy too fast or keeps borders wide open. He also called the green energy transition a big con job.

4. He also gave a tariff threat to Russia over Ukraine.

He told Moscow that unless it comes to the table, it will face “a very strong round of powerful tariffs.” Instead of promising more weapons or troops, he’s leaning on trade as his main leverage. The trouble with this approach is that the sanctions have so far been limited in their results.

2. Quick Takes

Here are the top stories shaping the week:

Useless Newsom Claims Trump is Trying to Rig the Midterms: Appearing on The Late Show with Stephen Colbert, Newsom said Trump is “trying to rig the midterm elections” and warned, “I fear we will not have an election in 2028 unless we wake up.” He described the situation as “code red” for democracy, accusing Trump of undermining institutions like the CDC by replacing “facts with b******t and fear.” Newsom urged Democrats and voters alike to take the threat seriously before it’s too late. I don’t pay attention to anything Newsom says tbh…

Texas ICE Facility Shooting: One Dead and Two Injured, and ‘Anti-ICE’ Shell Casings Found: A sniper opened fire on a Dallas ICE field office early Wednesday, killing two detainees and critically wounding one other. The shooter, identified as 29-year-old Joshua Jahn, fired from a rooftop toward a van in the sallyport, then died by suicide. Investigators recovered unspent shell casings marked “ANTI ICE,” which FBI Director Kash Patel said suggests the attack was ideologically motivated. Officials emphasised that no ICE agents were harmed and that the detainees were the victims. A lot of the MSM, despite the fact he had written ANTI ICE on the shell, said that the motive was unclear… (no surprise there).

Former FBI Director James Comey To Be Indicted ‘In Days’: Reports: According to MSNBC sources, Comey is expected to be indicted soon in the Eastern District of Virginia, with at least one count alleging he lied to Congress about authorising leaks during his Sept. 30, 2020, testimony. Prosecutors are reportedly racing against the statute of limitations, which expires on that same testimony date.

Tylenol Post Goes Viral: ‘We Actually Don’t Recommend Using Any of Our Products While Pregnant’: An old tweet from Tylenol resurfaced that read, “We actually don’t recommend using any of our products while pregnant,” sparking panic and social media frenzy among expecting mothers. Many shared it across X and TikTok, alongside videos of pregnant women defying the warning. The post gained traction just as Trump publicly claimed a link between prenatal acetaminophen use and autism. In response, Tylenol’s parent company, Kenvue, denied endorsing the message in its current context, insisting the original tweet was taken out of context and reaffirming their commitment to safety. Personally, I can’t remember the last time I even took any medication…

Boris Johnson Says Farage’s Stance on Russia is ‘Extremely Dangerous’: Johnson accused Nigel Farage and his Reform UK party of undercutting Western unity by suggesting NATO “provoked” Putin’s invasion. He warned that this narrative is “extremely dangerous” for national security and criticised Reform for what he called unrealistic welfare and defence policies. I wonder if this is the start of Reform is too dangerous for democracy, like AfD in Germany?

World Leaders and U.N. Push Climate Agenda Forward Despite Trump’s Attacks: During a U.N. climate summit, global leaders adopted new emissions reduction commitments, China pledged a 7–10 % cut from peak levels by 2035. They rallied around their typical slogan, “science demands action,” directly pushing back on Trump’s speech on climate change as a hoax.

Uzbekistan and Kazakhstan - Major U.S. Deals: Kazakhstan agreed to a $4.2 billion rail equipment deal with U.S. firms (buying locomotives), and Uzbekistan committed to purchasing at least 14 Boeing aircraft as part of a broader ~$12 billion package. Trump celebrated the deals, calling them evidence of renewed U.S. leadership in global infrastructure. I’ve noticed a lot of Trump’s diplomatic wins have not been shown in the MSM. A lot of people are unaware of the travelling he or his team are doing to create trade deals and resolve issues between countries.

The EU won’t Be Able To Keep Its Promise To Buy ‘Vast Amounts’ Of U.S. Weapons: Analysts say Europe’s hefty defence procurement plans are mostly going to European firms, leaving limited room to fulfil earlier promises to buy U.S. weapons. Germany’s €80 billion defence shopping list is skewed toward domestic producers.

UK Defence Stocks Soar as Trump Shifts Stance on Ukraine: Following Trump’s newly aggressive posture, defence stocks across Europe and the UK jumped. In London, shares rallied as the UK committed to spending 5% of GDP on defence by 2035.

Keir Starmer’s Relationship with His Chief of Staff Faces Biggest Test Yet: Starmer’s chief advisor, Morgan McSweeney, is under fire after emails surfaced suggesting a legal adviser instructed him to downplay £740,000 in undisclosed donations as an “admin error.” Labour ministers defended McSweeney, calling the attacks partisan. Yet another blow to Labour’s integrity…

Family of Three Are First Arrivals in UK Under ‘One In, One Out’ Immigration Deal: A family of three, one child among them, arrived in Britain under the new deal with France, making them the first to enter under that system (revolving doors anyone?)

Waltz Warns Putin, Trump is ‘Not Messing Around’ with Call to Shoot Down Russian Aircraft in NATO Airspace: Rep. Mike Waltz doubled down on Trump’s threat to shoot down Russian jets violating NATO airspace, saying the message must be “taken seriously” and suggesting the administration isn’t bluffing. Analysts see Trump’s shift toward a more confrontational stance on Ukraine as one of the sharpest foreign-policy reversals of his career. It’s even taken me by surprise… can you imagine if the US joins the war?

NEIL’S TAKEAWAYS:

In the United States

The Commerce Department just revised second-quarter GDP growth upward, 3.8% instead of the earlier 3.3%. Now, this matters because the change came from stronger consumer spending and a sharp drop in imports. Immediately, the U.S. dollar reacted. It rallied against major currencies as markets started recalibrating their expectations on the Fed. Rate cuts that once seemed inevitable may not come quite as quickly.

There’s something else worth paying attention to, and that’s business investment. Core durable goods orders rose, and companies are ploughing more money into areas like AI and software. They are saying this is a way to counteract things like tariffs. However, I think it’s more to do with layoffs and money saving.

The OECD didn’t change its bigger picture. Its 2025 U.S. GDP forecast is still 1.8%. And it suggested the Fed still has room to cut rates if needed, even in a softer growth environment. The way I see it, we have a tug-of-war with growth on one hand, and stuck inflation on the other.

Prepare: So what does all of this mean for you? The stronger GDP data and signs of business investment picking up do support taking on a little more risk compared to a purely defensive stance. But I don’t want you to misinterpret that; this is not the time to go all in. The smarter approach is to stay flexible with your allocations. Because in this environment, rate moves and central bank messaging are going to drive markets more than anything else.

Across Europe

The eurozone just posted its strongest PMI reading in sixteen months, 51.2. But there is a catch to this, as German business sentiment actually slipped at the same time. And because Germany is Europe’s largest economy, when confidence there falters, it casts a shadow over the entire bloc.

Markets picked up on this immediately. European shares dropped lower, and financial stocks in particular came under pressure. We also need to consider how policy is playing a role. Last week, we saw the EU announcing a new round of sanctions on Russia, this time targeting LNG with a phase-out by 2027. Now this week, we see Germany is pushing forward with a “Buy European” strategy.

Prepare: So, how should we think about this as investors? Expect volatility. Banks, energy companies, and exporters are the sectors most likely to feel the impact. Germany’s data points will be critical in the weeks ahead because they’ll set the confidence level across the continent. And policies like “Buy European” could create changes for U.S. firms trying to sell into Europe.

On the Global Stage

Japan’s factory activity has slipped further into contraction. Remember, Japan is the world’s third-largest economy. So when production slows there, it has effects on regional trade. In a similar way to what's happening in Germany, investors noticed. Asian equities sold off as markets started to question how much room the Fed really has to keep cutting rates.

At the same time, we’re seeing a split picture across emerging Asia. The IMF pointed out that countries like South Korea still have space to ease policy, while others remain boxed in by debt and inflation. And this is the world we’re in right now: some regions are able to stimulate growth, others have their hands tied.

Prepare: Keep a close eye on Japan and China, because if their slowdowns deepen, it will weigh heavily on the rest of the region. On the other side, India continues to expand, and South Korea has the policy tools to support growth. Both of these could be bright spots. And don’t overlook the resources in Central Asia and the Gulf, which are striking new deals, positioning themselves as power centres in trade and energy. That adds yet another layer of opportunity and risk in the months ahead.

3. Opportunity Of The Week… (CLOSING!) Gold & Silver Mastery Program

Filming Is Done: Lock in Your Access Before The Price Goes Up

Thanks for reading my emails this week. As you’re aware, I rarely send multiple emails unless I am truly closing down a sale or I feel the opportunity is seriously urgent. This time it is. The Gold & Silver Investing & Advanced Courses are completed, and the price will be increasing from the pre-filming discount. If you are serious about mastering metals, get your course today before the sale closes.

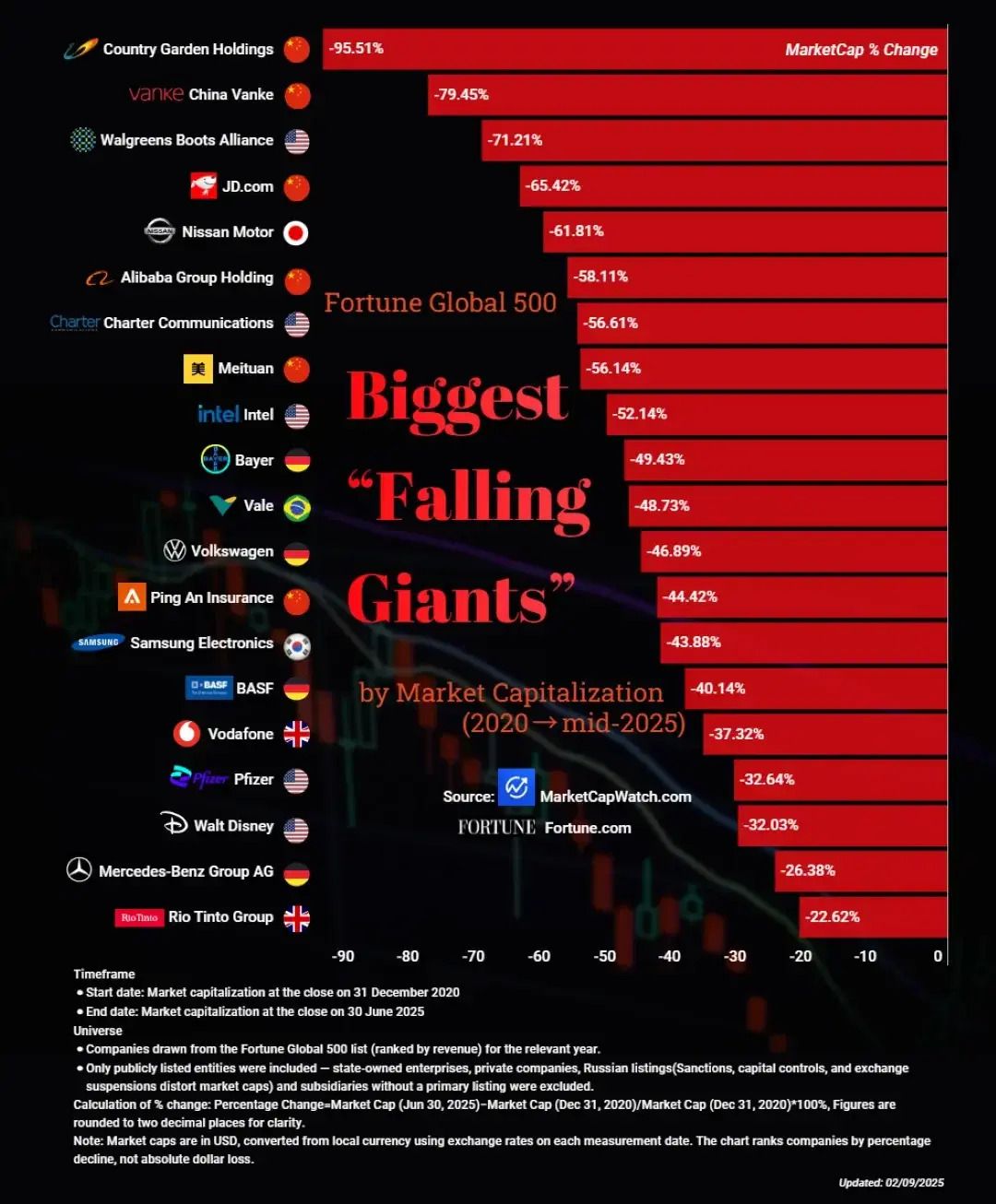

4. Chart Of The Week: Biggest ‘Falling Giants’: Fortune Global 500 Companies With the Sharpest Market Cap Drops

Some of the world’s largest revenue‑generating companies have seen their market value collapse by 25%–95% in just three years. The steepest declines are concentrated in China’s real estate and internet sectors, U.S. retail and telecom, and select European industrials.

5. Market Overview

U.S. markets were mixed, swinging as investors weighed strong data against shifting Fed expectations. The U.K. slipped about 0.7% under the weight of inflation and rate worries, while Canada stood out with a stronger week. Australia lagged on weak jobs data, and Asia sold off on trade tensions and fading hopes of Fed easing.

🇺🇸 United States – S&P 500

High: 6,697.97

Low: 6,569.93

🇬🇧 UK - FTSE 100

High: 9,265.95

Low: 9,182.21

🇨🇦 Canada – TSX Composite

High: 30,065.26

Low: 29,559.40

🇦🇺 Australia – ASX 200

High: 8,872.30

Low: 8,737.90

Cryptocurrency:

Bitcoin (BTC): -6.9%

Ethereum (ETH): -14.1%

XRP (XRP): -10.4%

Tether (USDT): 0.0%

BNB (BNB): -6.4%

Solana (SOL): -21.1%

USDC (USDC): 0.0%

Dogecoin (DOGE): -18.9%

Lido Staked Ether (STETH): -14.1%

TRON (TRX): -3.8%

Chart:

Metals Market:

Gold Silver Ratio: 83.5 (This Still Favours Silver)

Gold & Silver:

Gold: traded between roughly $3,740 and $3,775 per ounce this week.

Silver: traded between roughly $42.00 and $45.60 per ounce this week (I hope you read my Patreon post on this before the spike happened!) If you didn’t, you can read it here: LINK

Neil’s Investor Takeaways:

Right now, capital preservation should stay front of mind. I'm not saying you should be running for the exit, but look to sectors that have policy and geopolitical motions behind them, whether that be: defence, energy, or infrastructure. You can also, if you haven’t already, anchor your long-term wealth with precious metals or other tangible assets. Remember, a rising gold & silver price is an indicator…

6. Faith & Success

Greater love has no one than this: to lay down one’s life for one’s friends.” — John 15:13

Sacrifice is never easy, yet it is often the soil in which lasting success takes root. In faith, we’re reminded that the highest form of love is the willingness to give up something precious for the sake of others. In life and business, the same principle holds true: real progress usually requires letting go of comfort, leisure, or even short-term gain to build something greater. The people who create enduring legacies are those willing to make sacrifices today for a future that others can share in tomorrow.

Reflection: Ask yourself what you might need to release? A habit, distraction, or fear, so that your effort and energy can be invested in the things that matter most. Fear was always my biggest one. Fear crippled me at times, especially in the Army. People assume I was always a fearless person, not true. When I first joined, I was petrified - and bullied for being the youngest recruit. I was 17, training with 30 year olds… It was brutal. And when I first went out ‘on the ground’ in Iraq & Afghanistan at 19 years old, I was shaking and sweating (and not from the heat either), it’s because I was scared. I had fear.

I may not have overcome all of my fears today, there are still a couple of things that might shake me from time to time, but I have made it a point to work on these areas further. To get our Countries back, we will all need to be brave when that time comes.

Closing Thoughts 💬

A final reminder for you to take action on the Gold & Silver Mastery Program, as this is your last chance before the price increases! Link Here

God Bless,

Neil,

Enjoying this Newsletter? Share with a Friend…

DISCLAIMER

This newsletter is 100% FREE & is designed to help your thinking, not direct it. These newsletters shall NOT be construed as tax, legal, or financial advice and may be outdated or inaccurate; all decisions made as a result of this information are yours alone.

Trading/Liability: Neil McCoy-Ward operates/trades under a private Ltd company within the Isle of Man.