- Neil's Newsletter

- Posts

- Your IMPORTANT Weekly Briefing: (25th July 2025)

Your IMPORTANT Weekly Briefing: (25th July 2025)

The Neil McCoy-Ward Newsletter

Opening Note…

Welcome back to this week’s newsletter!

Did you catch my recent video this week where I went into the implications of the EU / US economic ‘WAR?’ - Yes I did use the word ‘war’, because that’s what the EU are calling it; of course, they blame the US for starting it and the US say that the EU started it because they want to keep the trade surplus they have.

The point is, and I am sure you feel this too, there’s something simmering under the surface and the US and the EU seem to be right in the middle of it.

As always, the best thing you can do is to prepare. When it comes to your finances, pay down debt, save and cut down on expenses in tough times. Also, pay close attention to the political fallout. You can use world events to your advantage if you know what to research.

In my takeaways section below, I always provide a macro view of what’s happening in the economy on a week-to-week basis. This week, the prepare section has a few pointers for you. I recommend researching those topics each week to ensure you are focusing on the right things. Even if you are not investing in the markets, you should be aware of the macro factors that are shifting based on geopolitics.

Course Of The Month:

The Psychology Of Wealth Accumulation: 90% Off - CLICK HERE - with a 30-day money-back guarantee or swap guarantee onto another course.

Let's now break down the most relevant stories from around the globe...

Table of Contents

1. Weekly Spotlight

Weekly Spotlight: US–EU Tariff Deal: A 15% Lifeline in the Making

The US and EU are looking to finalise a trade deal before August 1st that would reduce the proposed tariffs from 30% to 15% on EU exports to America. This will be a major win and mirrors a similar structure to the recent US–Japan deal.

Key carve-outs are reportedly on the table, including exemptions for:

Aircraft

Medical devices

Spirits

If this is a successful deal, it would prevent a major transatlantic trade war.

Still, the EU has a €93 billion retaliatory tariff package ready to deploy on August 7th if the deal collapses. Brussels still says it prefers a negotiated solution, but it's locked and loaded if needed, and they are ready to pull the trigger.

And while Trump has signalled progress, negotiators admit that a full legal text by August 1st is unlikely. That puts pressure on both sides to at least strike an agreement in principle, buying time and market stability.

2. Quick Takes

Here are the top stories shaping the week:

Trump Sparks Outrage by Prioritising AI Over Climate

The Trump administration has unveiled a sweeping executive order to accelerate U.S. dominance in Artificial Intelligence, aiming to streamline regulatory hurdles and increase public-private AI investment. Climate advocates, including the Sierra Club and Greenpeace, have condemned the move, warning it will sideline environmental safeguards and dramatically increase electricity demand from data centres.Chinese Hackers Breach U.S. Nuclear Security Agency

According to the U.S. Cybersecurity and Infrastructure Security Agency (CISA), a state-backed Chinese hacking group infiltrated systems belonging to the U.S. Department of Energy’s Nuclear Regulatory Commission. The breach, part of a broader campaign known as “Volt Typhoon,” raises major concerns over cyber vulnerabilities in America's energy infrastructure.Hunter Biden’s Ambien Claim Fuels GOP Investigation

House Oversight Committee Chair James Comer (R-KY) is escalating a probe into Hunter Biden after emails and testimony revealed he may have blamed prescription Ambien use for memory lapses. Republicans allege this defence is part of a broader attempt to obscure President Biden’s cognitive fitness and are demanding new testimony and medical transparency.RFK Jr. Promises Thimerosal Ban in U.S. Vaccines

Former independent presidential candidate Robert F. Kennedy Jr. announced plans to eliminate thimerosal, an ethylmercury-based preservative, from all childhood and adult vaccines if elected. The CDC maintains thimerosal is safe, but Kennedy insists it poses long-term neurological risks, reigniting a decades-old vaccine safety debate.Macron Sues Candace Owens Over Transgender Claim

French President Emmanuel Macron has filed a defamation lawsuit in Paris against U.S. commentator Candace Owens. The suit follows her viral social media claim that Macron’s wife, Brigitte Macron, is biologically male (& is actually his Father). What I found amusing and unusual about this, is that team Macron didn’t even let Candace know, instead they went on a huge PR campaign with the media… rather unusual, don’t you think?India's Modi Has The Highest Approval Rating Among World Leaders, France's Macron The Lowest

As of July 2025, global polling data highlights varying approval ratings of national leaders. India’s Prime Minister Narendra Modi leads with a 75% approval. In contrast, U.S. President Donald Trump holds 44% approval rating due to economic concerns and divisive policies. French President Emmanuel Macron fares poorly with only 18% approval.US Birth Rate Hits All-Time Low

In 2024, U.S. births rose 1% to 3.62 million, up from 2023 but still well below historical highs. Despite the increase, the fertility rate dropped to a record low of 53.8 births per 1,000 women aged 15–44, less than 1.6 children per woman, far below the global average of 2.2. Declining birth rates across most age groups, except women aged 40–44.Russia and Ukraine Resume Talks in Istanbul

Delegations from Moscow and Kyiv concluded their third round of peace talks this week in Istanbul, brokered by Turkish President Recep Tayyip Erdoğan. While no formal agreement was reached, Russian Deputy Foreign Minister Sergey Ryabkov said “meaningful progress” was made on humanitarian corridors and prisoner swaps.UN Court Rules Fossil Fuels Violate Human Rights

The International Court of Justice (ICJ) in The Hague issued a landmark advisory opinion declaring that continued fossil fuel production infringes on the right to a healthy environment. The ruling, requested by Vanuatu and backed by over 100 nations, adds legal pressure on major emitters like the U.S., China, and India to accelerate decarbonisation. Next on the agenda are reparations…Germany’s Offshore Wind Plans Hit Bureaucratic Wall

Despite its 2030 green energy goals, Germany’s offshore wind sector is stalling. A new report from the German Wind Energy Association (BWE) blames bureaucratic delays, supply chain bottlenecks, and high inflation for halting new installations in the North Sea. Only 270 megawatts were added in the first half of 2025, far below the target.

NEIL’S TAKEAWAYS:

In the United States

This week, U.S. markets rallied on headlines that President Trump finalised a trade agreement with Japan, slashing auto tariffs to 15% in exchange for a $550 billion investment pledge. The deal triggered a risk-on surge: equities climbed, and Treasury yields stabilised. Investors are also watching for progress on a similar U.S.–EU framework that could lower proposed tariffs from 30% to 15% and stave off a broader trade conflict. While a final EU deal remains uncertain, it’s the potential for de-escalation that is driving investors and bolstering the market.

Prepare: This week, the markets have been very optimistic in pricing given the trade deal developments. As always, don’t let the market’s short-term optimism steer you away from longer-term risk. You don’t have to act fast, but it’s important to reduce exposure to highly leveraged positions, shift toward assets with real value, and increase your cash reserves. Focus on sectors resilient to rate pressure and trade instability. If credit tightens further or trade talks collapse, those sitting on liquidity will have the upper hand.

Across Europe

This week, EU leaders met with China in Beijing but failed to resolve any core trade tensions; instead, it was to reaffirm climate cooperation (where talks were said to be “very productive”). At home, the European Central Bank paused its rate cuts, holding at 2% as inflation steadied at 2%, while unemployment remained near 6.3%. Germany’s ZEW sentiment index rose, hinting at optimism, but it’s still looking pretty fragile and heavily dependent on securing a trade deal with the U.S. If the proposed 15–30% tariffs happen, Europe’s export-heavy model could face a major shock.

Prepare: Investors should watch closely for fallout from stalled trade talks and potential tariffs. Consider reducing exposure to European exporters and keeping a close eye on ECB policy signals. If growth stalls further or the U.S. deal collapses, the next move could easily be downward and most likely fast.

On the Global Stage

Emerging markets are outperforming the U.S. by a wide margin. While U.S. equities are up around 7%, emerging and developed international markets are climbing 16–18% this year. This is due to valuation gaps, a softening dollar, and sector leadership in AI and fintech are pulling global capital toward these regions.

At the same time, foreign bond yields are looking more attractive than ever, drawing in fixed income investors seeking real returns. Countries like India and Brazil are getting flooded with foreign inflows, as investors rotate out of overpriced U.S. assets and into faster-growing, underpriced assets.

However, it's important to be aware of some things… the Asian Development Bank just cut its growth forecast, down from 4.9% to 4.7%. There are concerns of trade friction, a softening China, and global uncertainty.

Prepare: Diversification matters. Look for long-term exposure in EM (Emerging Market) sectors driving innovation. But be aware that one geopolitical shock could trigger major volatility.

For More Macroeconomic Analysis and Investment-Focused Content, Join My Patreon Here and watch my hour-long monthly video and charts breakdown: Click Here

3. Important Video of The Week

🚨 They Don’t Want You To Know What’s Happening In Rural Britain… Watch the Full Video On Youtube

4. Chart of the Week

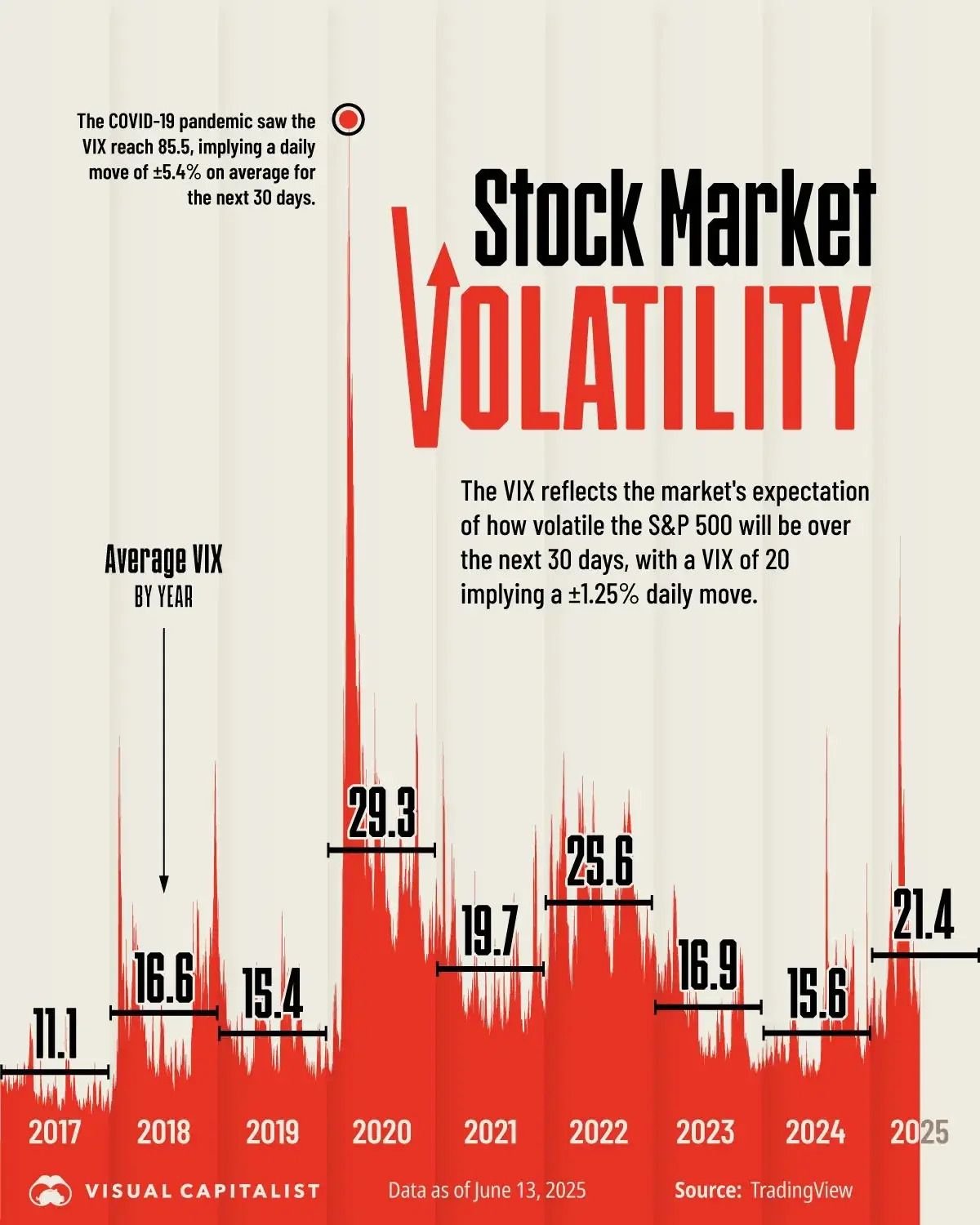

Stock Market Volatility has Risen in 2025

Key Takeaways

Volatility has risen on average in 2025 so far, with just 2022 and 2020 having higher volatility in the previous eight years.

The stock market tends to see volatility increase when uncertainty rises, exemplified by the VIX's surge to 85.5 at the onset of the COVID-19 pandemic in 2020.

With an average volatility of 21.4 in 2025, this translates to an expected ±1.35% move in the S&P 500 each trading day.

5. Market Overview

This month, we’ve seen the Big Tech sector have its strongest investor inflows since the post-2009 rebound. A month ago, only a minority of fund managers were overweight tech; now 14% are, reflecting a sharp pivot toward AI-heavy names. The “Magnificent Seven” (Apple, Amazon, Meta, Alphabet, Microsoft, Nvidia, and Tesla) are doing the heavy lifting, fueling a 33% NASDAQ surge since Trump’s April tariff announcement. This is an extreme level of concentration on a few stocks in the S&P 500 and has never occurred before to such a level.

🇺🇸 United States – S&P 500

High: 6,378.78

Low: 6,284.37

🇬🇧 UK - FTSE 100

High: 9,155.69

Low: 9,155.69

🇨🇦 Canada – TSX Composite

High: 27,475.95

Low: 27,283.17

🇦🇺 Australia – ASX 200

High: 8,745.60

Low: 8,654.20

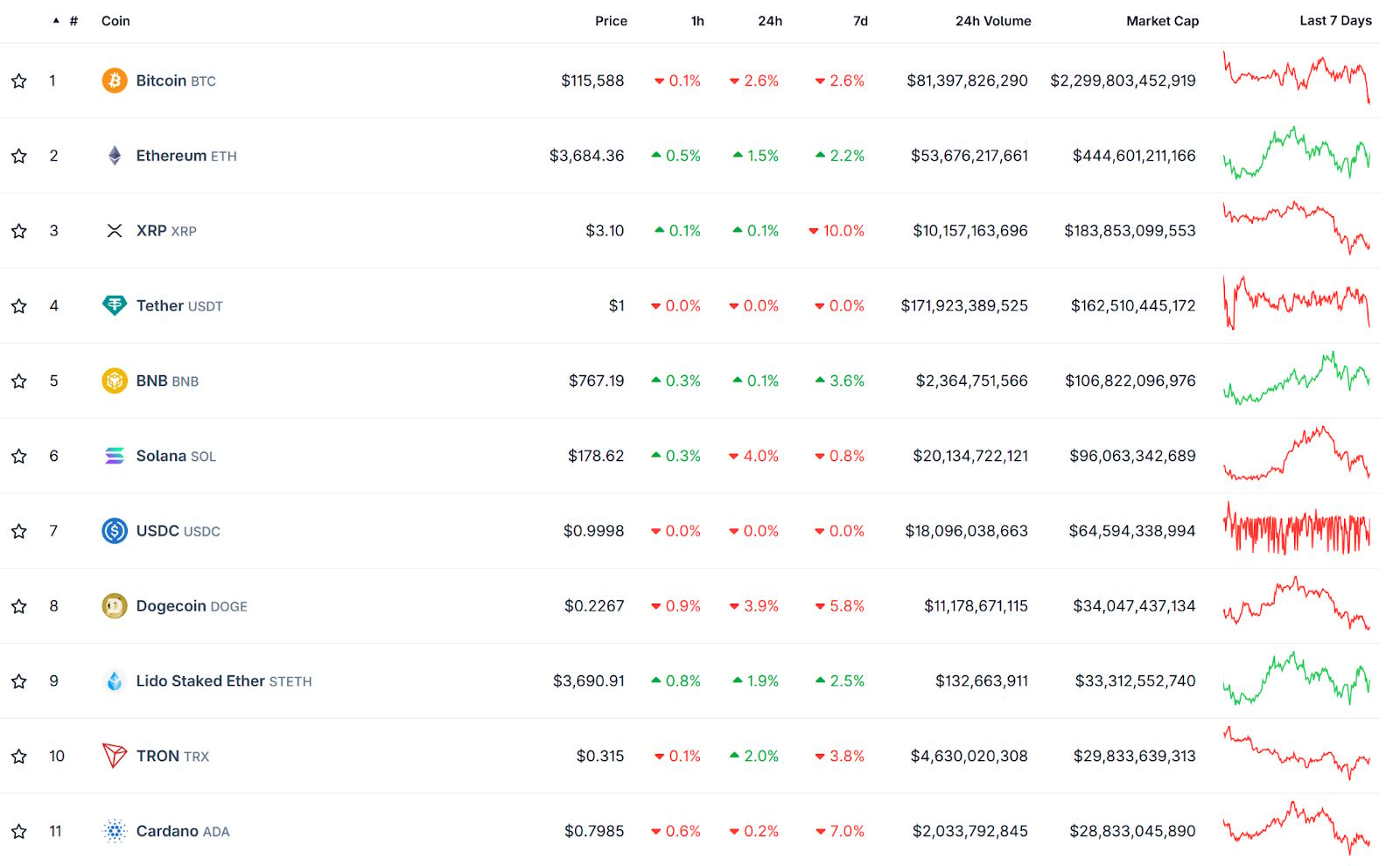

Cryptocurrency:

Bitcoin (BTC): ▼ 2.6% — Currently trading at $115,588

Ethereum (ETH): ▲ 2.2% — Up strongly this week to $3,684, showing renewed momentum in smart contract sectors.

XRP (XRP): ▼ 10% — After a huge surge earlier in the week its had a significant pullback. Volatility remains high.

Tether (USDT): Flat at $1.00, maintaining its peg.

BNB (BNB): ▲ 3.6% — Rising to $767.19, leading altcoins in strength this week.

Solana (SOL): ▼ 0.8% — Pulling back to $178.62 after the climb earlier in the week

USDC (USDC): Stable at $0.9998, no significant movement.

Dogecoin (DOGE): ▼ 5.8% — Another coin that has experienced a large pullback this week.

Lido Staked Ether (stETH): ▲ 2.5% — Trading at $3,690.91, closely tracking ETH.

Cardano (ADA): ▼ 7.0 % — another initial climber before falling back to $0.7985, still remains well below year highs.

Metals Market:

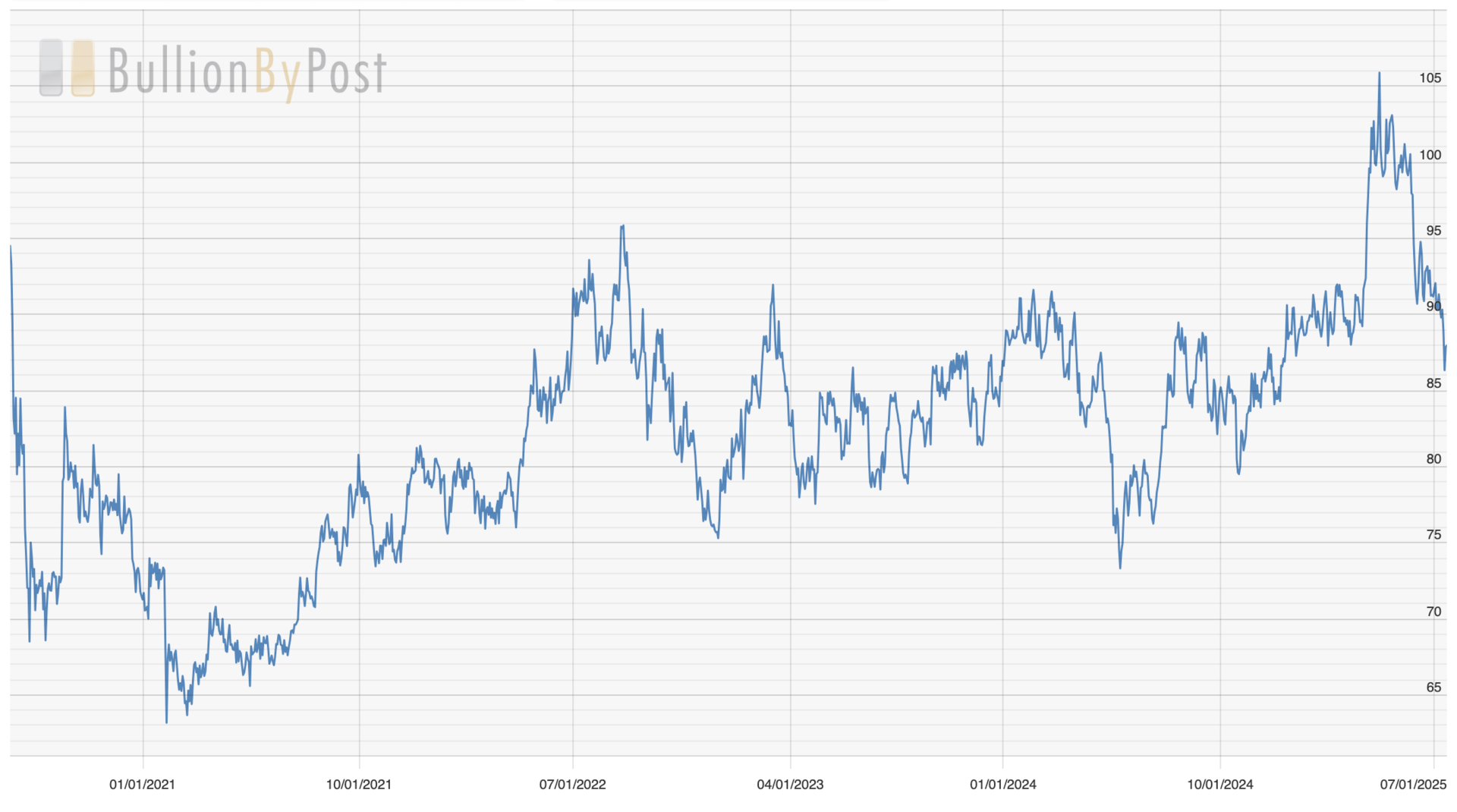

Gold Silver Ratio:

Gold & Silver

Gold saw some gains early this week, rising to around $3,390 per ounce, before pulling back slightly, most likely due to positive trade deal headlines. It’s still trading near recent highs, settling around $3,363 per ounce. The support here is from softer Treasury yields, a weaker dollar, and ongoing geopolitical uncertainty.

Silver continued its breakout trend, holding above $39 per ounce, its highest level in over a decade. Year-to-date, it’s up more than 36% from strong industrial demand, constrained supply, and broader interest in hard assets. Short-term pullbacks toward $35 are possible, but current momentum remains firmly bullish, with analysts eyeing potential upside toward $42–45 per ounce into year-end.

Neil’s Summary:

This week’s rally felt more like relief than conviction. U.S. markets climbed on trade optimism and strong earnings beats. In Europe, sentiment ticked up, but it’s propped up by wishful thinking, growth is barely moving, and risks of U.S. tariffs remain real. Meanwhile, crypto has fractured, with some coins like XRP plummeting after significant gains earlier in the week. Silver is outperforming gold, a classic signal of late-cycle rotation and industrial anxiety.

Here is your opportunity this week:

The Psychology Of Wealth Accumulation: 90% Off - LINK - with a 30-day money-back guarantee or swap guarantee onto another course.

6. Faith & Success

“Better a little with righteousness than much gain with injustice.” — Proverbs 16:8

In a world chasing shortcuts, quick profits, and viral wins, it's easy to believe that more is always better. But success without integrity is a hollow victory. True wealth, financial and spiritual, isn’t measured by what you stack, but by how you earn it and what it makes of you. The person you become in the process matters more than the rewards at the end. Remember the verse a couple of weeks ago about ‘True Riches?’ It fits right in with this theme.

Stay grounded. Even if the path appears to be slower, your foundation is your most valuable asset.

7. Discounted Course Of The Month…

If you want to transform your mindset about money — The Psychology of Wealth Accumulation rewires limiting beliefs and installs the mental habits of financially successful people to make you earn and keep more money.

Here is what you will focus on:

Reprogram Your Mind

Study & Think Like The 1%

The Unlimited Wealth Hack

Beat The Rigged System

Amplify Your Net Worth

Pinpoint Your True Passion

Eliminate Your Debt

Overcome Fears & Blocks

Become Irreplaceable

Live In Gratitude

Leverage Multiple Incomes

Winning Business Systems

Closing Thoughts 💬

The distractions seem to continue popping up, as we’ve seen before. I’m sure you know what I am talking about… News stories that grip your emotions rather than help you understand what’s really going on.

For me, those topics don’t fit my foundation, which has always been based on common sense and logic. If I could change something in the world, it would be to help people think rationally and beat the system that continues to cleverly misdirects them.

Pick up a book. Dive into history, and avoid the junk!

To Your Success In Business And In Life,

See You Next Time, God Bless,

Your Friend,

Neil,

DISCLAIMER

This newsletter is 100% FREE & is designed to help your thinking, not direct it. These newsletters shall NOT be construed as tax, legal, or financial advice and may be outdated or inaccurate; all decisions made as a result of this information are yours alone.

Trading/Liability: Neil McCoy-Ward operates/trades under a private Ltd company within the Isle of Man.