- Neil's Newsletter

- Posts

- Your IMPORTANT Weekly Briefing: (18th July 2025)

Your IMPORTANT Weekly Briefing: (18th July 2025)

The Neil McCoy-Ward Newsletter

Opening Note…

Welcome back to this week’s newsletter!

This week, I’ll keep it brief. You’re here for a reason, and that’s most likely because you don’t trust the main stream media and you’re seeking more than just information. You’re likely seeking genuine insights into global events and how these affect your family, your finances and your future. So even if you’ve only read one edition of this newsletter, you’re are further ahead than most… (which is great).

This weeks newsletter sponsor is: Monetary Metals

Gold prices have been breaking all-time highs this year, but price appreciation isn’t the only way to profit from owning gold

You can earn a yield on gold, actually paid in gold, without selling your gold

Right now, you can earn 4% on gold, paid in gold in their marketplace

The interest you earn is paid in ounces of physical gold, which you get in addition to any price appreciation from gold over your holding period

You can fund an account with metal you already own or purchase it from them at less than 1% over the spot price

Join thousands of investors earning interest in physical gold every month, with Monetary Metals

Simply go to https://www.monetary-metals.com/NMW - to learn more

Let's now break down the most relevant stories from around the globe...

Table of Contents

1. Weekly Spotlight

Crypto Week: BTC Breaks $120K

Bitcoin blasted through the $120,000 mark this week, driven by the Trump administration’s full-throttle embrace of digital assets.

Just five years ago, Trump called Bitcoin “a scam,” but now he’s hosting “Crypto Week” at the White House and openly promoting Bitcoin as a cornerstone of financial freedom.

And the crypto market is loving it:

Bitcoin hit an all-time high of $123,000 on July 14, up 25% YTD.

The GENIUS Act is gaining traction in Congress, giving stablecoins a legal path into traditional finance.

Trump’s campaign has raked in over $100 million from crypto donors, and insiders say his family is invested in Bitcoin mining operations and token launches.

Major crypto firms like Ripple and BitGo are now applying for U.S. bank charters; this is a pretty big step that’s going to lead to deeper integration between crypto and the legacy banking system.

Wall Street is also on board, with money flooding into tokenised Treasury funds, and previously crypto-shy institutional investors are warming up to crypto-backed assets - another remarkable trend reversal.

Crypto is no longer on the fringe. Under Trump, it’s going mainstream and the price action is just catching up.

However, I will add here, to be cautious. By my calculations, this current bull market could end in Q3-Q4 of this year. I don’t have a crystal ball, but that’s how I’m reading the Technical and Fundamental analysis. DYOR (Do Your Own Research).

2. Quick Takes

Here are the top stories shaping the week:

NATO Chief Threatens BRICS Nations with 100% Tariffs Over Russia Ties

NATO Secretary General Mark Rutte delivered a stern warning to India, China, and Brazil, saying they could face 100% secondary tariffs if they continue buying Russian oil, gas, or other exports. He urged their leaders to pressure Vladimir Putin into accepting a peace deal within 50 days, or risk severe economic blowback. Rutte emphasised that these countries are propping up Russia’s war effort by supporting its energy sector, and that sustained trade ties “could hit very hard.” The admonition follows President Trump’s similar threat of 100% secondary tariffs on nations trading with Russia if a peace deal cannot be reached in 50 days, demonstrating an attempt by Western countries to isolate Russia and force Putin to the negotiating table.US Egg Prices Crash 61% From February Peak

Egg prices dropped nearly 20% in June alone and are now down 61% since the winter highs. This sharp reversal comes after extreme price spikes earlier in the year caused by bird flu outbreaks and supply shocks. The easing inflation is being credited to restored supply chains, reduced demand, and major egg imports from overseas. Retail prices, once over $8 per dozen, have fallen closer to $2.50, a rare case of true deflation at the grocery store.Trump says he's not planning to fire Fed's Powell

President Trump stated it's "highly unlikely" he will fire Federal Reserve Chair Jerome Powell. There are some serious concerns over a $2.5 billion Fed building renovation, which drew scrutiny from both Trump and OMB Director Russell Vought. Powell has requested an internal review of the project. Top banking CEOs, including Jamie Dimon, emphasised the importance of Fed independence.

Senate approves $9 billion in cuts to foreign aid & public media funding

The U.S. Senate approved President Trump's $9 billion rescissions bill on Thursday, targeting cuts to foreign aid and public broadcasting. Passed by a narrow 51-48 vote, with two Republican senators opposing, the bill marks a rare use of the rescissions process. After lengthy amendment debates, it now returns to the House for final approval. Trump must sign it by Friday to enact the cuts; otherwise, original spending levels will proceed.

UK inflation is at its highest for almost a year and a half

UK inflation unexpectedly rose to 3.6% in June, the highest since January 2024, driven by rising food, clothing, travel, and modest fuel price declines. This is going to make any rate cuts complicated in August. Economists now expect inflation to peak at 4% in autumn… BUT… we’ve heard this before, so don’t count on it!

Emails Indicate FBI Invented President Trump Case Out Of Nothing

Newly released emails reviewed by the Senate Judiciary Committee suggest that senior FBI officials, including former agent Tim Thibault, pushed to open a criminal investigation into Donald Trump in 2022 without concrete evidence. The emails, first reported by legal analyst Margot Cleveland, show Thibault discussing how to pursue a broader probe into Trump’s allies' activities at the Willard Hotel during the 2020 election.

Canada’s PM Concedes on Tariff Negotiations

Prime Minister Mark Carney acknowledged that he likely won’t persuade President Trump to lift existing tariffs. Carney indicated Canadian proposals, such as agricultural and auto-sector concessions, haven’t shifted Trump’s stance. This leaves Canada in limbo, navigating uncertain trade policies and recalibrating economic forecasts under sustained U.S. relations.Beige Book Shows US Inflation Mentions at 4‑Year Low

The latest Fed Beige Book reports that references to “inflation” fell to their weakest level in four years, while phrases like “slowing” and “softening” rose sharply. Regional business contacts noted modest growth, primarily in services, while manufacturing and housing showed signs of weakness. Taken together, this casts doubt on Powell’s narrative of a strong economy and hints at a potential shift toward rate cuts.Bahrain Commits $17 Billion to U.S. Infrastructure and Tech

During a White House visit, Bahrain’s Crown Prince unveiled plans to invest $17 billion in the U.S., focusing on infrastructure, energy, and technology projects. The multi-year deal includes stakes in green energy initiatives, semiconductor fabrication, and U.S. ports. This marks one of the largest Middle Eastern direct investments in American assets to date. The announcement signals deeper strategic and economic ties, possibly foreshadowing closer alignment under a potential second Trump term.

NEIL’S TAKEAWAYS:

In the United States

With 50% tariffs on Brazil and the sudden 35% duties on Canadian goods, Trump's “America First” trade policy is hitting, and the markets aren’t taking it well. The S&P bounced back after dropping at first, but Treasury yields rose fast, and commodities were thrown around by the sudden changes.

On top of that, the talk of Trump wanting to replace Fed Chair Powell and push for interest rate cuts is making the economy feel more driven by politics than real data. At the same time, core inflation rose to 2.7% which means that rate cuts are even less likely. There have also been some major layoffs at NASA, Intel, and even major retailers like Starbucks and Amazon, suggesting the job market isn’t as strong as it seems.

Prepare

To stay ahead in the U.S. economy this week, watch how tariffs are driving up consumer prices and triggering second-order effects like margin pressure and slowing demand. Inflation is rising again, and the Fed remains cautious, caught between political pressure to cut rates and real data showing sticky costs. Track the fallout in sectors like housing, retail, and manufacturing.

Across Europe

The EU is starting to fight back against the US with its words, its laws, and potentially its wallets. The new Anticoercion Instrument may sound like bureaucratic jargon, but it’s a serious warning shot aimed directly at Washington. Brussels now has a legal path to retaliate with moves that could hit Big Tech, U.S. finance, and even intellectual property protections.

In other words, Europe is done playing defence. And perhaps most telling of the EU situation is the faith in the Euro. In Italy, nearly 40% now say they’d be better off returning to the Lira. Hungary’s Orbán is calling the euro a “straightjacket,” and even voters in the Netherlands and Slovakia are questioning whether Brussels is helping or hurting.

Prepare

Watch for these critical flashpoints: The first use of the EU’s Anticoercion tool. If Brussels pulls the trigger on retaliatory actions against the U.S., it could spark the first serious economic clash between the two superpowers in decades. The next EU crisis might not be a financial one; it could be a political revolt from within. The seeds are already being sown with rising anti-euro sentiment.

On the Global Stage

China’s slowdown is accelerating, with GDP growth now below 4% and consumer confidence collapsing. The property sector remains in crisis, youth unemployment is soaring, and even modest stimulus efforts from Beijing aren’t convincing investors.

China is starting to look like Japan’s “lost decade” 2.0. For a nation that once drove global demand, it’s a problem that affects everyone. Speaking of Japan, the Country is facing its own crisis on the currency side. The yen just hit a 30-year low against the dollar, and inflation is climbing. Import costs are hammering Japanese households and businesses, while the Bank of Japan is stuck with ultra-low rates that make the currency even weaker. Exporters are getting a short-term boost, but the broader economy is walking a dangerous line. If the BoJ loses control of the Yen, we could see it affecting everything from energy markets to tech hardware pricing.

And if that weren’t enough, global food prices are back on the rise. Droughts in Africa, crop failures in Asia, and the ongoing disruption of Ukraine’s grain exports are all pushing prices higher. Fertiliser and fuel costs are compounding the pain, and major food-producing nations like India and Argentina are now limiting exports. This is becoming a central driver of inflation, geopolitical instability, and social unrest in emerging markets.

Prepare:

Watch these three global red flags closely:

China’s fragile growth may be the most underpriced risk in global markets. If consumer spending doesn’t rebound and real estate stays frozen, ripple effects will hit commodities, global trade, and even Western tech earnings.

If the BoJ intervenes or pivots on policy, it could spark volatility across FX, bond, and equity markets, especially in Asia-Pacific.

For the global food price spike, Western economies will simply pay more for the food on the table - but developing nations could see social unrest.

For More Macroeconomic Analysis and Investment-Focused Content, Join My Patreon Here to watch my hour long monthly video and charts breakdown: Click Here

3. Important Video of The Week

🚨 You Won’t Believe What They Just Announced… More Escalation Is Expected, Because It Is Profitable… Watch the Full Video On Youtube

4. Chart of the Week

Gold’s Annual Returns (2000-2025)

Key Takeaways

Gold prices are up 1,075% from 2000 to 2025 (YTD as of July 3rd)

On average, gold has delivered a 10.9% annual return over 25 years

2025 is one of gold’s best years in terms of returns, up 27% as of July 3rd, 2025

5. Market Overview

Markets are reacting to a lot of macroeconomic uncertainty this week. The optimism that drove assets earlier in the summer, is starting to fade. It seems investors are starting to confront three major unknowns: escalating global trade tensions, stickier-than-expected inflation, and an increasingly unpredictable Federal Reserve.

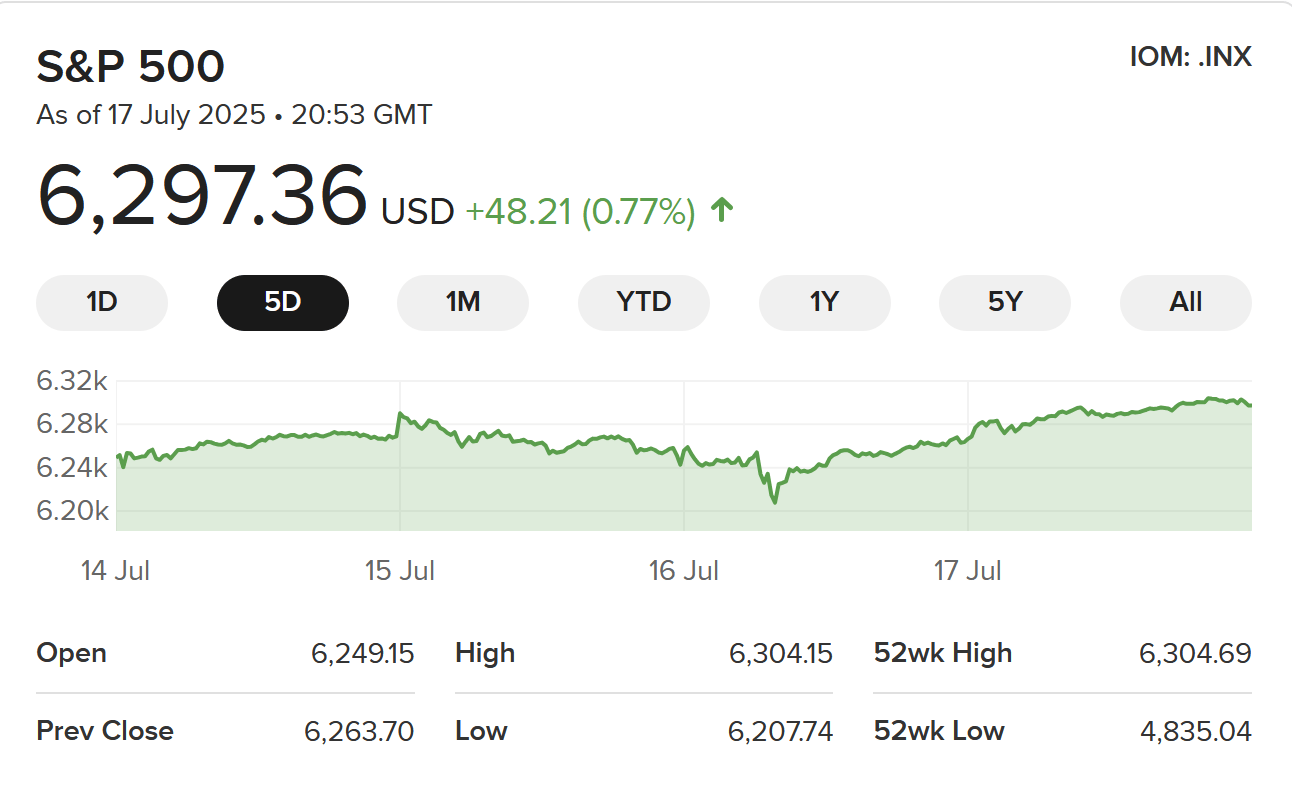

🇺🇸 United States – S&P 500

High: 6,304.15

Low: 6,207.74

🇬🇧 UK - FTSE 100

High: 9,005.93

Low: 8,934.18

🇨🇦 Canada – TSX Composite

High: 27,418.91

Low: 26,943.26

🇦🇺 Australia – ASX 200

High: 8,772.50

Low: 8,550.00

Cryptocurrency:

Bitcoin (BTC)

Trading at $120,360, up around 7% this week. Momentum is steady as institutional inflows continue and risk appetite holds.

Ethereum (ETH)

Up 21–22% this week, now priced at $3,647. Benefiting from optimism around ETH ETFs and strong DeFi performance.

XRP

Surging 38% to $3.56, lots of buying pressure has driven prices up, and there has been lots of bullish sentiment around legal outcomes and remittance use cases.

Tether (USDT) and USDC

Both stable at $1.00 (USDT) and $0.9999 (USDC). High volumes reflect continued usage in trading and cross-border transactions.

BNB

Up 7.7%, currently at $74.

Solana (SOL)

Up 10–11% to $182, mostly due to the rising DeFi activity and a resurgence in NFT use on the Solana network.

Metals Market:

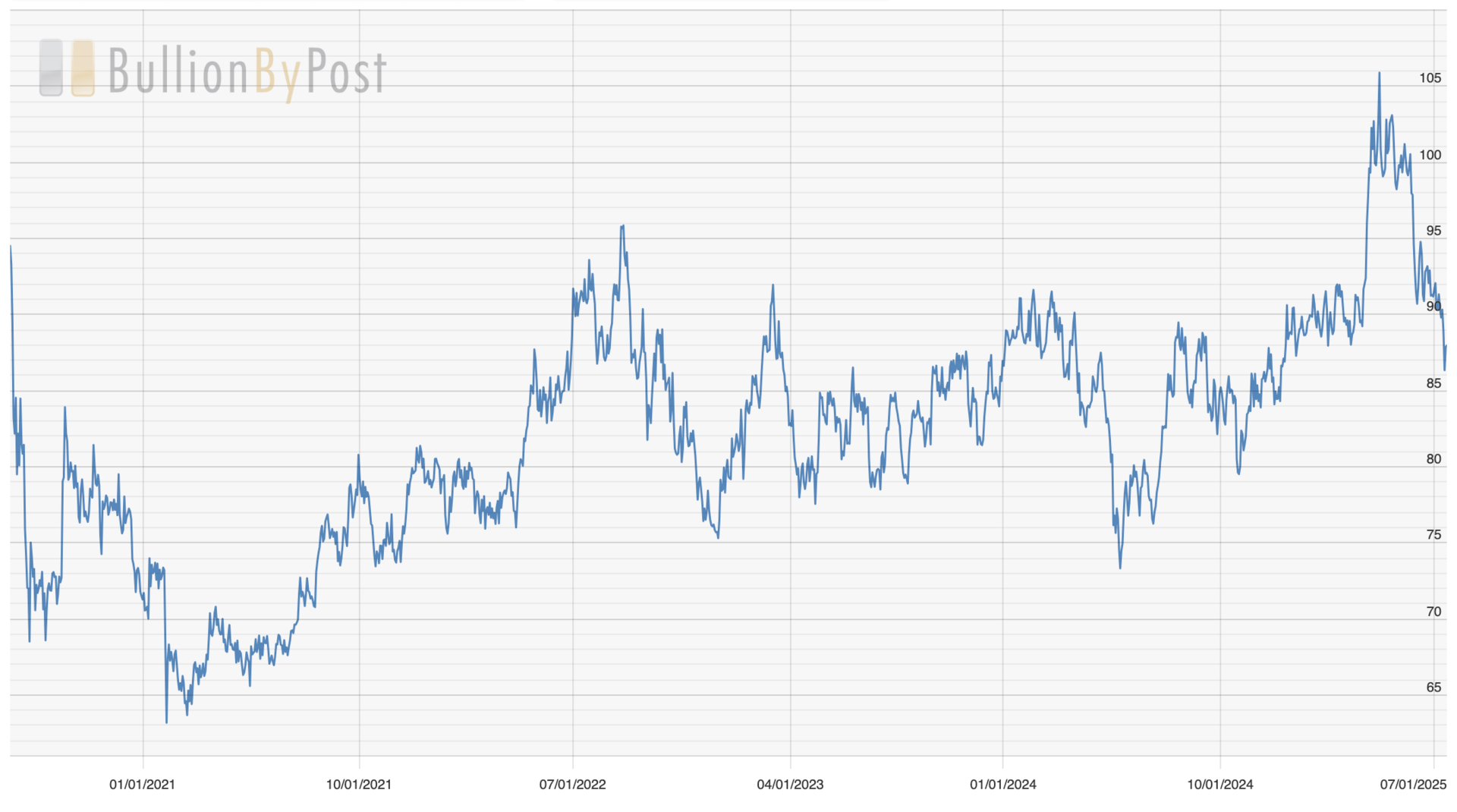

Gold Silver Ratio:

Gold & Silver

Gold

• Spot: ~$3,340 per ounce, rising from a low near $3,339 midweek to a high around $3,360 as safe-haven demand surged amid tariff and inflation anxiety.Silver

• Spot: ~$37.90–$38.50 per ounce, with a weekly low near $37.88 and a peak above $38.15, driven by renewed industrial demand and trade-driven flight to metals.

Gold sits at around $3,340, maintained by weakening Treasury yields and trade concerns, while Silver is hovering above $38. The Ratio has now dropped significantly back to below 90s, it will be interesting to see if it drops any further, or it returns to a stable balance.

Neil’s Summary:

A lot of investors are struggling to interpret the data being presented by the media and institutions because it’s contradictory: one report shows growth cooling, another shows prices heating up. This is classic macro uncertainty, and in environments like this, smart money typically reduces risk and shifts toward capital preservation.

The S&P 500 and FTSE barely moved, and both the TSX and ASX traded within tight ranges. Meanwhile, crypto has come back to life with BTC, Ethereum, XRP, and Dogecoin all having surged. Mostly due to the bills being passed through Congress, such as the GENIUS Act, CLARITY Act, and Anti‑CBDC Surveillance Act.

Something that has been more overlooked in the mainstream this week is metals: gold stayed firm above $3,340, while silver is gaining momentum. The gold-to-silver ratio has now fallen from over 105 to below 90. This is a metals rotation (something I teach in my course - I hope you were able to take advantage of the offer, which has now closed).

While the Gold & Silver Investing Program is now at the full price of $2,000, you can still access it for a bulk discount within the Mastery bundle.

Also, the Gold & Silver Advanced Course is now ready for you… The timing has never been better to dive deeper and master precious metals investing…

Here are your opportunities this week:

The Gold & Silver Mastery Bundle: 91% Off - CLICK HERE (Now Including An Affordable 5-Month Payment Plan) with a 30-day money-back guarantee or swap guarantee onto another course.

Gold & Silver Advanced Course: 90% Off - CLICK HERE (Launching July 12th)

6. Faith & Success

“If you faint in the day of adversity, your strength is small.” — Proverbs 24:10

Everyone looks strong when things are easy, but it’s adversity that reveals what you're truly made of. This verse is a powerful reminder: the right challenges can refine you. In business, in finances, and in faith, persistence is key. However, this shouldn’t be misinterpreted. This doesn’t mean take on more than you can handle. Just remember that if you are on the right path, even when it is difficult, stay the course and keep going.

This week, don’t shrink in the face of pressure. Lean in. Because real strength is forged through resistance.

Find Out Which Course Is Best For You…

I understand that many readers have confusion over which course would be right for you. Where to start? Which course to do first? There are just so many courses Neil that it’s overwhelming…

Here are a few tips:

If you want to master stock investing and macro trends — The Ultimate Stock Market Investing Program teaches you how to decode economic signals and build a high-performance portfolio.

If you're serious about gold and silver investing — My Gold & Silver courses provide clear, beginner-friendly through to advanced strategies to get positioned in physical bullion & mining stocks for long-term security.

If you need to generate fast, sustainable income — The Rapid Cashflow Builder offers a proven blueprint to build steady monthly revenue streams without waiting years.

If you want to reshape your mindset about money — The Psychology of Wealth Accumulation rewires limiting beliefs and installs the mental habits of financially successful people to make you earn and keep more money.

If you’re struggling to build credit or eliminate debt — The Credit Hacks & Debt Annihilation programs show you how to demolish debt and establish credit strength, even with no prior experience.

If you’re seeking comprehensive financial transformation — The Financial Success Super Bundle gives you lifetime access to all seven core programs at massive savings, covering investing, cashflow, mindset, credit, and debt strategies.

Also, remember to check out Monetary Metals: go to https://www.monetary-metals.com/NMW - to learn more…

Closing Thoughts 💬

It’s summertime. The weather is nice for most in the northern hemisphere. I hope you get the chance to enjoy a bit of fresh air and spend some time away from the screen.

After a very hectic 6 months of courses creation and YouTube videos, I will certainly be taking some time for myself this Summer, long walks, Sea swimming, kayak fishing and visiting with friends and family. True blessings indeed.

To Your Success In Business And In Life,

See You Next Time, God Bless,

Your Friend,

Neil,

DISCLAIMER

This newsletter is 100% FREE & is designed to help your thinking, not direct it. These newsletters shall NOT be construed as tax, legal, or financial advice and may be outdated or inaccurate; all decisions made as a result of this information are yours alone.

Trading/Liability: Neil McCoy-Ward operates/trades under a private Ltd company within the Isle of Man.