- Neil's Newsletter

- Posts

- Your IMPORTANT Weekly Briefing: (15th August 2025)

Your IMPORTANT Weekly Briefing: (15th August 2025)

The Neil McCoy-Ward Newsletter

Opening Note…

Welcome back to this week’s newsletter!

Today as I write, all eyes are on Alaska. A pivotal meeting is about to take place that could shape global headlines for months. Will President Trump and President Putin be able to arrive at some kind of plan for peace?

One thing that’s hard to deny is the shift in global power, both politically and economically, in America’s direction. Technology, diplomacy, and markets are aligning in ways that could lift prosperity for the nation, heralded as the arrival of a golden age for America. If President Trump can achieve peace in the Russia-Ukraine conflict, this will be another powerful signifier of the breakthroughs by the US in this New World.

Elsewhere it’s not so rosy. Two weeks ago I released a video on the subject of an unprecedented change to 336 years of free speech in the UK… Under the guise of protecting children online (a cause so noble that few could dare to challenge it), internet surveillance was subtly introduced which is proving to be on a par with state censorship. That’s right, we’re one step closer to being the next North Korea…

That’s why I’ve been wholeheartedly using and recommending NordVPN for the past 5 years now. It works wonderfully and is the perfect way to browse safely, protecting your data with military-grade encryption.

It’s based in the sovereign nation of Panama which gives me further reassurance. Through my discount you’ll get 4 months free usage, and with a 30-day money back guarantee if you don’t like it, it’s hard to go wrong. Here’s where you can get your special discount: CLICK HERE

I’ve learned that I can’t control the outcome on the grand stage. What I can do is ensure the sphere that I influence is well protected no matter the weather. Whether you live in a nation on the cusp of a new era of success, or whether you’re concerned by what’s unfolding before your eyes and across your screens, those who are prepared - will do well in every circumstance.

I hope you enjoy this week’s briefing, and that it helps you stay prepared and informed.

Let's break down the latest...

Table of Contents

1. Weekly Spotlight

Weekly Spotlight: Alaska Summit

This week, all eyes are on Alaska, where Donald Trump and Vladimir Putin are set to meet today, August 15th, 2025, at 11 a.m. local time (likely as you're reading this) at Joint Base Elmendorf-Richardson.

The official main focus is on ending the war in Ukraine. But actually, many believe the bigger story might be nuclear arms control, something the world hasn’t seriously tried in over a decade.

Putin has floated the idea of both countries working towards a new framework to limit strategic nuclear weapons. If it happens, it would mark the first real step towards de-escalation between Washington and Moscow in years. Trump says he’s open to “big ideas” as long as they strengthen U.S. security and create economic opportunity. He’s even put the odds of success at 75%.

To avoid disruption, the summit was kept tightly under wraps. So much so that even Anchorage’s mayor only found out through Trump’s Truth Social post.

Of course, the meeting isn’t without controversy. Some argue that any agreement reached could be politically motivated or leave NATO allies in the dark. Analysts also worry that compromises on Ukraine might be linked to nuclear negotiations, a move that could affect European security.

Still, even a partial framework could reshape the geopolitical landscape.

2. Quick Takes

Here are the top stories shaping the week:

Trump Invites Media to Ride Along with D.C. Police

President Trump told reporters they can accompany D.C. police on patrols to increase transparency. “We’re going to be very open about what we’re doing,” he said, as his administration pushes a tough-on-crime agenda in the nation’s capital.AfD Overtakes CDU as Germany’s Most Popular Party

A new Forsa poll shows the Alternative for Germany (AfD) party leading national support at 26%, ahead of Chancellor Friedrich Merz’s CDU/CSU at 24%. Discontent over economic policy, migration, and recent political missteps is fuelling the party’s historic rise.Social Security Is 90 years old—And Getting Smarter Under Trump

Social Security turns 90 this month, supporting over 67 million Americans. With its trust funds projected to run short by 2033–34, the Trump administration is rolling out AI-driven tools, digital services, and infrastructure upgrades to improve efficiency and accessibility.Scott Bessent to Push for Ban on ‘Single-Stock Trading’ in Congress

Hedge fund manager and former Soros Fund CIO Scott Bessent is preparing legislation to prohibit members of Congress from trading individual stocks. The measure would still allow diversified funds and ETFs, aiming to reduce conflicts of interest in policymaking.Over 20,000 Arrested in Iran on Espionage Charges Amid War with Israel

Iran’s judiciary announced more than 20,000 arrests for alleged espionage and subversion since the conflict with Israel began. Many detainees are accused of collaborating with foreign intelligence services, sparking human rights concerns from international observers.Netanyahu Declares Support for ‘Greater Israel’

Israeli Prime Minister Benjamin Netanyahu said he backs the vision of a “Greater Israel,” igniting condemnation from Arab states. Critics say the statement escalates regional tensions and undermines prospects for a negotiated settlement.Trump Administration Wins Court Battle to Block Foreign Aid

A federal appeals court sided with the Trump administration, allowing it to block billions in USAID foreign aid. The White House argued the funds were not in the U.S. national interest, marking a significant victory in its America First policy.UK Economy Posts Only 0.3% Growth in Q2

The U.K. economy expanded by just 0.3% in the three months to June, although outperforming forecasts of stagnation. Growth came despite higher taxes and the impact of U.S. trade tariffs, offering some relief to policymakers watching for signs of a recession.Melania Trump Threatens $1 Billion Lawsuit Against Hunter Biden

First Lady Melania Trump issued a legal notice to Hunter Biden over alleged defamatory remarks. The demand seeks up to $1 billion in damages, escalating tensions between the Biden family and the Trump White House.U.S. Gas Prices Could Dip Below $3 per Gallon This Summer

GasBuddy forecasts that average U.S. gasoline prices may fall below $3 per gallon in the coming months, citing lower crude prices and improved refinery output. Such a drop would mark the lowest summer fuel costs in four years.

NEIL’S TAKEAWAYS:

In the United States

Producer Price Index (PPI) data just came in, and it has shown an unexpected 0.9% surge in prices in July relative to the prior month. PPI measures the cost of goods and services on the wholesale side — in other words, before they reach consumers — and it’s brought back concerns that inflation is proving more stubborn than hoped.

The cause for concern is that the markets have already priced in potential rate cuts from the Federal Reserve later this year. Meanwhile, over the past five years in the retail sector, America’s clothing industry has lost over 300,000 jobs, the sharpest decline in decades. The main reason is that E-commerce continues to dominate, and operational costs have gone up, both of which have pushed a wave of store closures, particularly among the mid-range brands.

What we’re seeing now is a shift away from storefronts and into logistics and fulfilment roles. Warehouses, not high streets or malls. But there’s a catch: these newer jobs are far easier to automate to AI & robotics - and that opens the door to another wave of potential job losses down the line.

Prepare: Assuming your ‘job is safe’ simply isn’t the best approach. It’s best to start building additional income streams now, even if it’s just something small on the side; it’s about creating options.

Across Europe

European equity markets closed the week on a positive note, with modest gains across the board. The euro also firmed slightly against the dollar, which gave a bit of short-term breathing room to industries that rely heavily on imports.

The US–China tariff truce, which was due to expire this August, has just been extended by another 90 days. Export-driven economies like Germany, the Netherlands, and Italy are still walking a tightrope in their tariff status with the US. If talks unravel, we could see fresh tariffs, and that would send shockwaves through Europe’s manufacturing sector. Think disrupted supply chains, rising shipping costs, and higher prices for raw materials.

Prepare: Use this market rally to reinforce your position, whether that’s your business, your investments, or both. Europe's manufacturing core is still highly exposed to global trade tensions. It’s better to build resilience now, while things are relatively calm, rather than scramble later.

On the Global Stage

The MSCI All Country World Index, which tracks the stock market performance of around 1,300 large and mid-cap companies across 23 developed countries, hit a record high of 954.21 on August 13, 2025. The gains have been very broad and mostly powered by strong performances in Asia and Europe.

Off the back of that momentum, the Conference Board has now revised its global growth forecast for 2025 upwards to 3%. The World Bank, though, is taking a more reserved view, sticking to a more modest projection of 2.3%.

S&P Global has upgraded India’s sovereign credit rating from ‘BBB–’ to ‘BBB’. They cited India’s growing resilience in the face of global trade tensions and its expanding role in the world economy as key drivers behind the move.

Prepare: Yes, markets are up, but that doesn’t mean risk has vanished. This is the moment to reassess. Remember, Investing 101: buy low, sell high. Too many people do it the other way around. That’s why I have exited my crypto currency positions now for this cycle. I made great gains, and I have now capitalised on those gains. I will repeat the cycle again in the next bear to bull market.

3. Important Video of The Week

🚨 Migrants Are Taking Over… Watch the Full Video On Youtube

4. Chart of the Week: U.S. Business Growth by Industry (2019-2024)

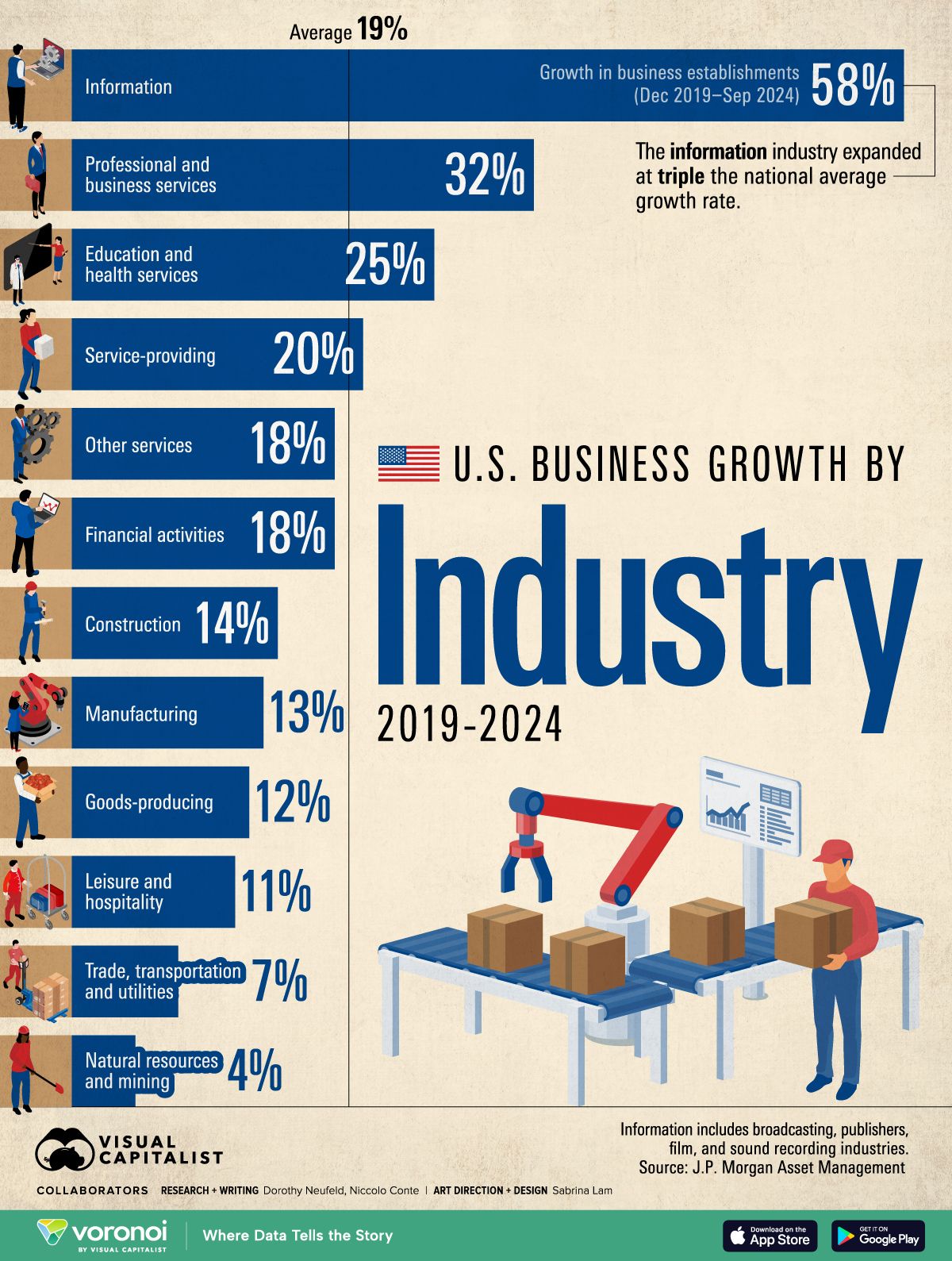

Business creation in America has jumped 19% in the past five years with the tech sector growing at the fastest rate. Over the past three decades, small businesses generated about 60% of new jobs in the U.S., serving as a critical pillar in the economy. However, a significant share of this growth was driven by a narrow group of companies.

With a 32% increase in new companies, professional and business services witnessed the second-highest growth. Meanwhile, education and health services experienced a 25% increase. Interestingly, new business applications stood at 240,000 on average each month in 2024, 50% higher than in 2019.

5. Market Overview

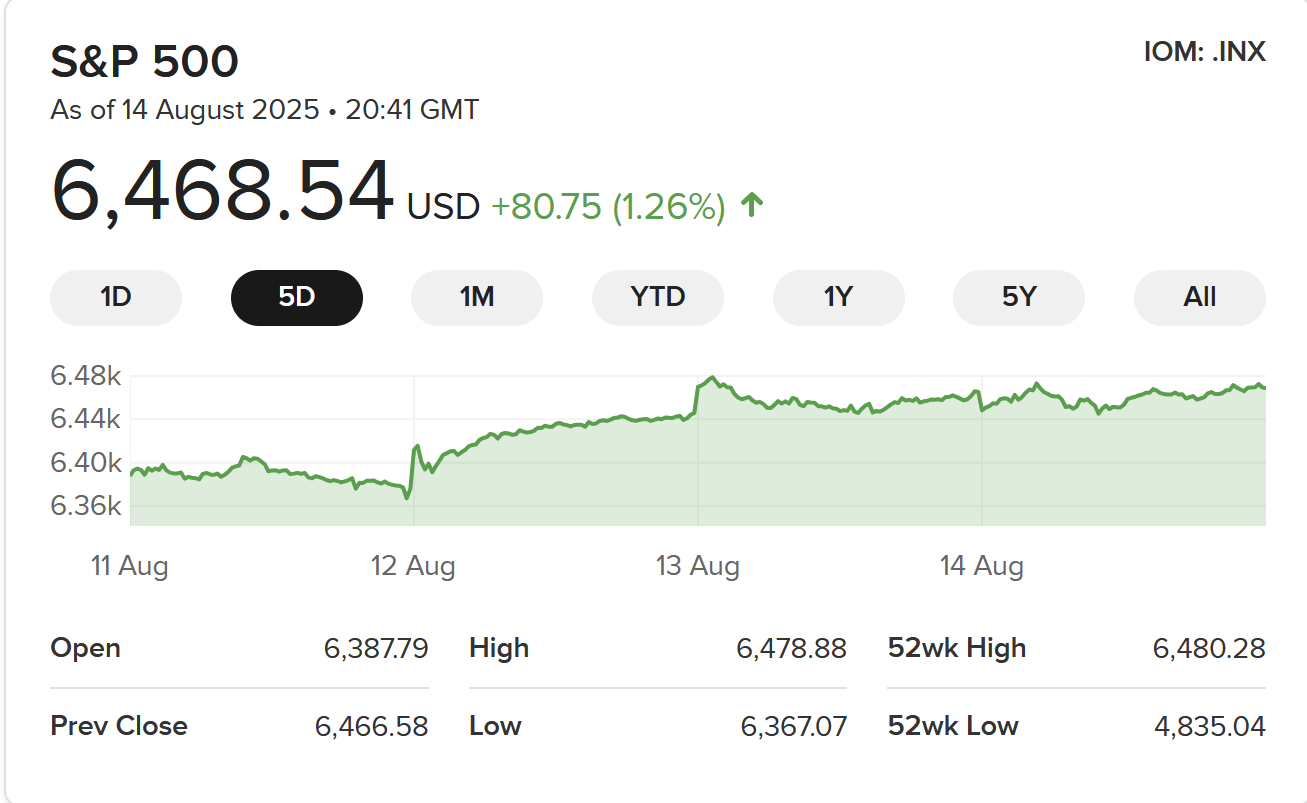

Small-caps stole the spotlight this week, with the Russell 2000 rising to multi-month highs, outpacing the S&P 500 and Nasdaq as traders bet on a friendlier Fed. Mega-cap tech still held its ground. Across the Atlantic, European markets climbed to five-month highs, powered by strong miners and upbeat corporate results, while chipmakers faltered. The UK’s FTSE 100 touched fresh intraday records before easing, as strength in healthcare and defence was offset by weakness in insurers and housing. Canadian and Australian markets were quieter, offering few clear signals.

🇺🇸 United States – S&P 500

High: 6,478.88

Low: 6,367.07

🇬🇧 UK - FTSE 100

High: 9,212.79

Low: 9,106.71

🇨🇦 Canada – TSX Composite

High: 28,056.42

Low: 27,769.30

🇦🇺 Australia – ASX 200

High: 8,939.10

Low: 8,817.60

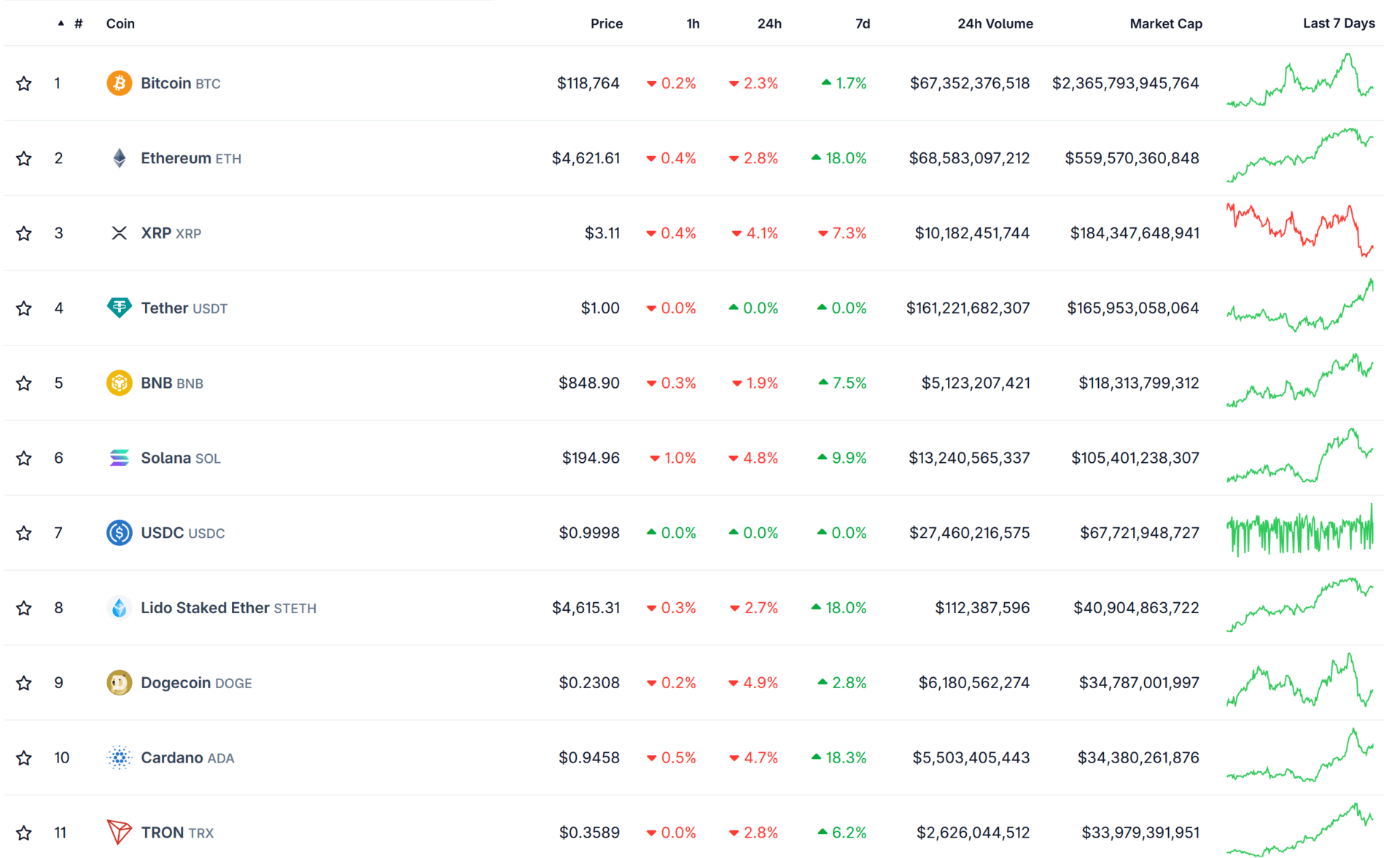

Cryptocurrency:

Bitcoin (BTC): Up 1.7% – Modest gains after early-week volatility, holding above $118K.

Ethereum (ETH): Up 17.9% – Strong rally, driven by institutional inflows.

XRP: Down 7.4% – Big drop this week, mostly from big investors moving coins to exchanges. This has a tendency to make people panic.

BNB: Up 7.4% – Benefiting from renewed activity on Binance’s DeFi ecosystem.

Solana (SOL): Up 9.9 % – Sharp rebound as developer activity and transaction volumes climb.

Lido Staked Ether (stETH): ▲ 18.0% – Tracking ETH’s surge with additional staking demand.

Dogecoin (DOGE): ▲ 2.5% – Gains on speculation over potential payment integrations.

TRON (TRX): ▲ 6.2% – Positive momentum from rising stablecoin transactions on its network.

Summary:

Metals Market:

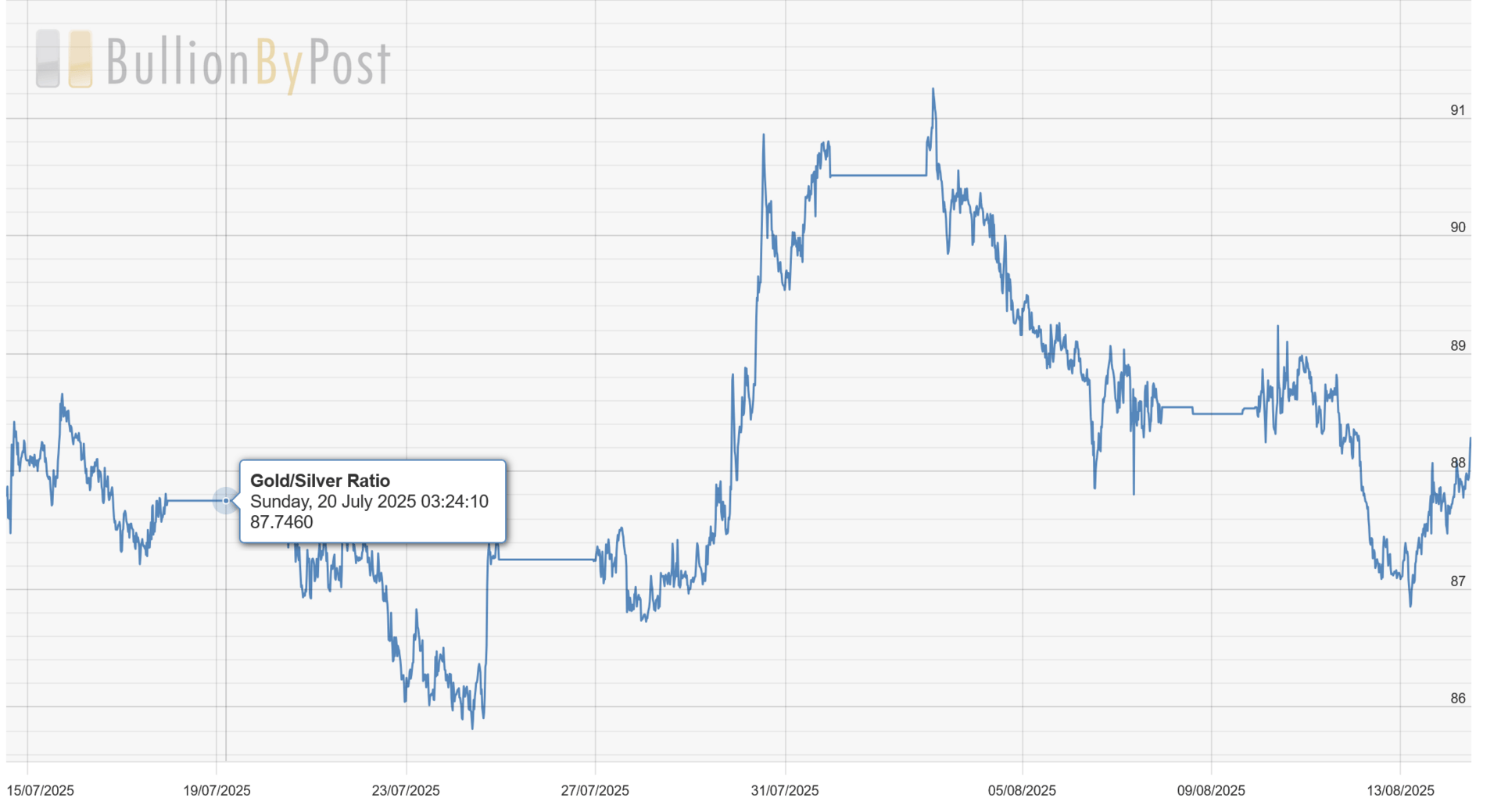

Gold Silver Ratio:

Gold & Silver

Gold: Trading between $3,314.30 and $3,534.10 per ounce

Silver: Trading between $37.58 and $39.64 per ounce

Neil’s Investor Takeaways:

For investors, this is one of those moments where a bit of optimism is fine, so long as it’s paired with a healthy dose of prudence. If you’ve seen strong gains in your assets, think about whether you have taken your eye off the ball. Assess those gains. Lock in some of those wins.

Now, it’s also wise to hold a solid core in real, tangible assets, precious metals, for instance as a hedge. But definitely keep an eye on inflation data at the same time. We just had a surprise reading yesterday…

And just to be clear, I’m not here to give financial advice. Just remember that the roadmap is fairly straightforward: stay in the game, protect the downside, take gains on the upside and don’t get drawn into any single scenario.

Last chance for this special offer…

The Ultimate Stock Market Investing Program: 90% Off - CLICK HERE - with a 30-day money-back guarantee or swap guarantee onto another course.

6. Faith & Success

"Do not despise these small beginnings, for the Lord rejoices to see the work begin." — Zechariah 4:10

In business, investing, and life, it’s easy to feel like small steps are insignificant compared to big wins. But we’re reminded that progress often starts with small, faithful actions that build momentum over time. Whether you’re saving your first $/£/€100, learning a new skill, or making your first investment, it all adds up.

Success is rarely an instant leap—it’s the accumulation of consistent, purposeful steps repeated over a long period of time. I didn’t go from living in a run down apartment in the worst part of town to living in a Castle overnight, it took a lot of time, effort and patience.

Keep showing up, even when the progress feels slow, because every seed planted today has the potential to grow into something extraordinary tomorrow.

7. Opportunity Of The Week…

🚨 IMPORTANT — I use NordVPN to keep my data safe and access content securely wherever I am. I highly recommend you use this product. It’s easy to set up and very reliable…

Why I Recommend NordVPN:

Keeps your data safe on public Wi-Fi or when travelling

Protects your privacy with a strict no-logs policy

Works on all your devices with one account

Can help you avoid certain UK age verification checks by masking your IP and encrypting your traffic

It works anywhere, keeps your connection private, and you can try it risk-free with their 30-day money-back guarantee.

Closing Thoughts 💬

Like many people, I had a tough week this week. I really tried my best, but kept hitting challenge after challenge. And then this morning as I was researching and writing the walk & talk, I was disturbed constantly with even more problems that required my attention. Life can be stressful at times, no matter how ‘put together’ one’s life is.

As I started my walk earlier and was pondering over my notes, I began to laugh - luckily there was no one around for miles or I would have looked like a crazy person, ha! I laughed at just how unimportant all of these things were. And I remembered my mantra that ‘TIME Solves All Problems’

Onward and Upward,

See You Next Time, God Bless,

Your Friend,

Neil,

DISCLAIMER

This newsletter is 100% FREE & is designed to help your thinking, not direct it. These newsletters shall NOT be construed as tax, legal, or financial advice and may be outdated or inaccurate; all decisions made as a result of this information are yours alone.

Trading/Liability: Neil McCoy-Ward operates/trades under a private Ltd company within the Isle of Man.