- Neil's Newsletter

- Posts

- This Week’s Spotlight: (Week To 23rd May 2025)

This Week’s Spotlight: (Week To 23rd May 2025)

The Neil McCoy-Ward Newsletter

Opening Note…

Welcome back!

Before diving into the newsletter below, I just wanted to check that you got my last email updating you about my Gold & Silver Course Launch a couple of days ago? I only send updates like that for important new program launches. The Gold & Silver Mastery bundle really is an extremely beneficial course for you.

I want to point out a major piece of information that will put into perspective just how important the time is for Gold & Silver Investing… although tbh, the writing is on the wall with the state of the economy, the price of gold, and the global chaos that we see not just daily, but hourly.

I’ve been mentioning it, dropping hints, but really, I normally only share this type of information in my Patreon, because it’s THAT valuable. But if you can understand this, then you can learn to make money with gold & silver investing, outpacing most investors. But you need the right strategy…

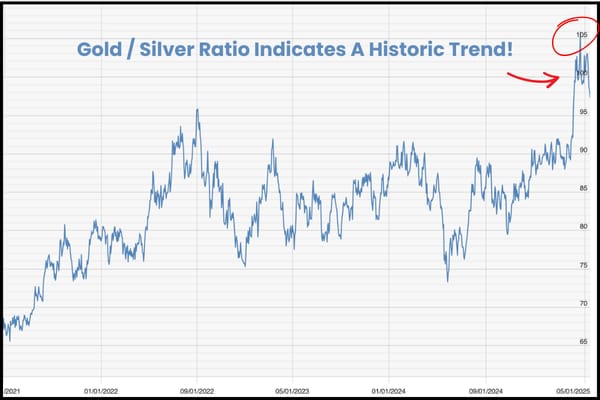

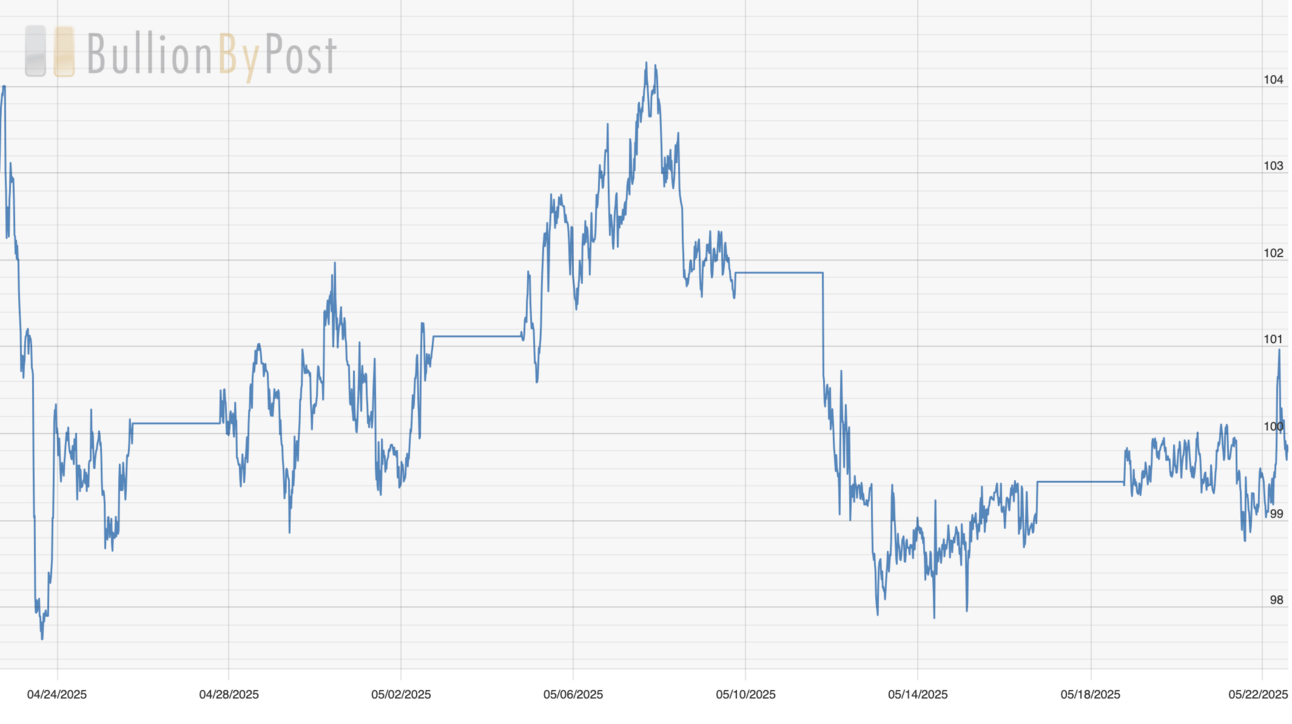

This chart below SHOWS what’s going on right now!

When the gold-to-silver ratio climbs above 100:1, it tells you that one ounce of gold buys more than 100 ounces of silver—a level we’ve only seen 3 times in the last century. Historically, these peaks have signalled that silver is deeply undervalued relative to gold, and that a powerful mean-reversion trade is setting up in your favour.

Each of these peaks preceded sizable silver rallies—often +20–40% within months—yet most investors who jumped in simply at “cheap” prices missed the optimal entry, overpaid premiums, or held the wrong products. But there are exceptions… it could simply mean that Gold is overpriced (which you can also make money from)

Your advantage: In the Gold & Silver Mastery Bundle, you’ll learn exactly how to:

Time your entry using real-time ratio thresholds rather than guesswork.

Choose the right vehicles (coins, bars, ETFs) to maximize your returns

Hedge with gold to protect against downside risk if your silver thesis takes time to play out

Plus, much, much more. In fact, the 2 courses combined are so detailed that even with me writing and recording every day for months, I’m still only at the stage of offering a pre-sale, that‘s why the bundle is 91% off! I can’t charge the retail price yet, because the course isn’t fully finished.

So this way we both win, you get a heavy discount, and I start to recoup some of the (HUGE) costs involved in the production of this program. I’ve even sourced experts from around the World at great expense for you…

Back to the Ratio… here’s a 2021 Case Study: By timing the ratio peak and swapping accordingly, I locked in a 100% return in 90 days—using the exact strategies I will be providing for you in the Gold and Silver Advanced Course. Imagine what this type of return would do for you if you had the information I had back then?

As we move forward… in a time when everyone else is diving in without a clear strategy, you’ll have a repeatable, historically grounded playbook for turning these extreme ratio readings into real profits.

You see, that’s why most investors fail, or avoid Gold & Silver entirely, it’s because they’ve never had a step-by-step plan. I’ve taken care of that for you in my Gold & Silver Courses. Right now, the best decision is to take action and learn as much as you can about Gold & Silver Investing… (Before the next ‘incident’ erodes your savings)…

And by the way, it’s no mystery that Gold and Silver prices are exploding. If you know, you know. The prices of Gold & Silver aren’t going up, the value of your savings and currency is going down… and that’s what terrifies most people… not having a plan.

So Here Are Your Amazing Investment Options (Limited Time Offer!) So You Can Start Building YOUR Plan Right Away!

Option 1: Lock in The FULL Gold & Silver Mastery Bundle Now - 2 Courses: Investing & Advanced: (Priced at $427) CLICK HERE

The Gold & Silver Mastery Bundle is a complete wealth-building system—decades of research, strategic insights, and in-depth video training all in one place. It’s designed to help you not just survive uncertain times, but thrive through them. Right now, you can get full access for just $427 during the presale. Once complete, it WILL retail at $5,000. This isn’t a marketing or sales tactic, just look at my other programs and you’ll see the full prices. If you’re serious about protecting your wealth and building something that lasts, this is your moment. Don’t wait until the cracks in the system widen; secure your bundle now before the prices go up.

Oh and thank you for the feedback regarding the cost of the course. As suggested, I’ve now implemented a payment plan over five months so that anyone can now afford to enroll…

Option 2: Course 1: Gold & Silver Investing Course (Priced at $197) CLICK HERE

15 Video Modules of over 100 videos! + several PDF bonuses. Master the principles of bullion investing: why precious metals preserve wealth, how to buy at the lowest premiums, and the best storage practices to protect your assets.

Option 3: Course 2: Gold & Silver Advanced Course: (Priced at $297) CLICK HERE

If you’re ready to go to the next level, the Gold & Silver Advanced Course is where the real edge begins. It has an elite-level of strategy designed for investors who want to multiply their wealth across generations. Inside, you’ll learn how to build tax-efficient portfolios, set up your own Precious Metals-backed retirement structure, and use the gold/silver ratio to optimize every entry and exit. Upon registration, at least 10 videos will be released every Friday through July & August until complete. There will be a similar number of modules and bonuses as the first course…

Thank you again for taking action on these critical courses. Learning the step-by-step strategies behind Gold/Silver investing is one of the best decisions you can ever make for your long term finances and legacy…

Let's now break down the top stories from this week...

Table of Contents

1. Weekly Spotlight

The Big Beautiful Bill

In the early hours of 22nd May the U.S. House passed what’s being called the “One Big Beautiful Bill”, by the narrowest of margins: 215 to 214. It’s a big win for President Trump in his second term, and it’s anything but modest. This sweeping package rolls tax reforms, spending cuts, and a surge in funding for border security and defence all into one.

Key Provisions of the Bill:

Tax Reforms: The bill seeks to make permanent the individual income and estate tax cuts enacted in 2017. It introduces exemptions on tips, overtime pay, and interest on certain auto loans. Also, it boosts the standard and child tax deductions temporarily and increases the state and local tax (SALT) deduction cap to $40,000 for households earning up to $500,000.

Spending Cuts: To offset the cost of tax cuts, the bill proposes significant reductions in federal social programs, including nearly $800 billion from Medicaid and additional billions from food stamps and clean energy tax credits. It also imposes stricter work requirements for food aid and Medicaid, potentially reducing coverage for millions.

Border Security and Defence: The legislation allocates $46.5 billion to border security and mass deportation efforts, including new Border Patrol and ICE hires. It also provides nearly $150 billion to defence, funding a missile defence shield and naval expansion.

Healthcare Provisions: There is also a measure banning Medicaid and CHIP from covering gender-affirming care for individuals of all ages. It will remove "gender transition procedures" from the Affordable Care Act’s list of essential health benefits.

Debt Ceiling: The bill raises the U.S. debt ceiling by $4 trillion to prevent default, this also came just after Moody’s downgraded the country’s credit rating.

Bottom Line: The "One Big Beautiful Bill" represents a significant legislative victory for Trump, encapsulating his second-term agenda into a single, comprehensive package.

2. Quick Takes

Here are the top stories shaping the week, updated with more details and stories (as you requested via our poll!)

US loses perfect credit rating amid rising debt levels

Moody’s has officially downgraded the U.S. credit rating from ‘AAA’ to ‘Aa1’, bringing an end to over a century of top-tier status. The reason? The mounting deficits and soaring interest costs. This move puts Moody’s in line with Fitch and S&P, both of whom have already sounded the alarm over America’s long-term fiscal trajectory. While the agency reaffirmed confidence in the U.S. dollar’s global dominance, it warned debt could hit 134% of GDP by 2035. A lower credit rating means higher borrowing costs, because the U.S., once considered the ultimate safe bet, is now seen as carrying more risk.

Quick note: I predicted this would happen back in 2023 in co-ordination with China beginning to dump their US treasuries & Japan moving into a currency crisis… Unbelievably, the story on Japan’s currency & being the largest US T-bill holder, also broke just this week! (Gold, Silver solves this problem)The Japanese government bond market is in trouble

Long-term yields are spiking, with 40-year government bonds pushing 3.7% and older 35-year issues climbing past 4.6%. Behind the surge is weak auction demand, shrinking institutional appetite, and a sharp turn from the Bank of Japan toward quantitative tightening. Insurers are pulling back. Liquidity is drying up, and the yield curve is showing signs of severe stress. Add rising inflation, growing fiscal strain, and scaled-back bond buying from the BoJ, and you’ve got a perfect storm in the world’s third-largest economy. And it’s not staying in Tokyo. U.S. bond yields and mortgage rates are rising in tandem, dragged up by the tremors in Japan. This could also pull in more Countries if the US gets hit hard by this (yes, the UK & EU too).Trump Unveils $125B 'Golden Dome' Missile Shield

President Trump has unveiled a sweeping new missile defence initiative—$125 billion for what’s being called the “Golden Dome.” The idea is to launch a network of satellites and interceptors capable of shielding the United States from incoming threats. It’s being pitched as a 21st-century shield, part deterrent, part show of strength. As you can imagine, China has sharply condemned the move, accusing the U.S. of violating the Outer Space Treaty’s core principle: peaceful use beyond Earth. Foreign Minister Mao Ning warned that the plan risks igniting a space arms race.Protests Erupt Over 'Big, Beautiful' Budget Bill

Leftist protesters flooded Capitol Hill offices as the House prepared to vote on Trump's expansive budget bill, which includes permanent tax cuts and significant spending reductions.90% of US Companies Plan to Reshore Amid Tariffs, Allianz Survey Finds

A survey reveals that 90% of U.S. companies plan to reshore or switch to domestic suppliers following Trump’s April 2nd tariff hike. Over half of U.S. firms intend to raise prices to offset tariff costs. Only 15% of U.S. firms expect to absorb costs themselves. Tariff revenues hit a record $16.3 billion in April, though economists warn this could be offset by declining trade.UK to sign Chagos deal with Mauritius

The UK is set to transfer sovereignty of the Chagos Islands to Mauritius under a new agreement. While Mauritius gains control, the UK and US will retain use of the Diego Garcia military base for 99 years, in exchange for a multi-billion pound payment. The deal, delayed by political changes in both countries and US security concerns over China ties, is now backed by President Trump.NSW Floods Isolate Nearly 50,000 Residents

Record-breaking floods in New South Wales have left approximately 48,800 people isolated. The Bureau of Meteorology warns of an additional 200mm of rain expected in the next 24–48 hours. It’s not looking good - we keep the residents in our prayers.Australia Passes Unrealised Gains Tax, But Politicians Stay Exempt

Australia will introduce a 15% tax on unrealised gains in balances over $3 million from 1st July 2025. The Treasury Laws Amendment aims to raise $40 billion over ten years. The part they fail to mention is that there are exemptions for top officials. The bill is going to be facing ‘Senate debate’ and may see amendments from the Greens pushing for a lower cap and affecting more people: ‘Do as we say, just don’t watch what we do’Germany Tightens Border Controls Amid Migration Crisis

Germany's new government has ordered border police to turn away undocumented immigrants, including some asylum seekers, in an effort to reduce illegal migration. Interior Minister Alexander Dobrindt stated the policy aims to "protect against the acute dangers posed by terrorism and serious crime."Comer: White House Withheld Biden's Medical Records

House Oversight Committee Chairman James Comer claimed the Biden White House obstructed investigations by denying access to President Biden's medical records and refusing to make aides available for interviews.M&S warns cyber attack disruption will last until July and hit profits by £300m

Marks & Spencer expects disruption from its recent cyber attack to continue into July, potentially reducing profits by £300 million. Online sales, especially in fashion, home, and beauty, have been heavily affected, with order services paused for over three weeks. While M&S aims to partially restore operations soon, full recovery will take weeks. Analysts estimate current losses at £4 million per day in sales.

NEIL’S TAKEAWAYS:

In the United States

All eyes are now on the “big, beautiful, bill”. Republicans are cheering it as a catalyst for growth, while Democrats are warning it could result in an extra $3.3 trillion in debt over the next ten years. That, they say, would push the debt-to-GDP ratio from 98% to a hefty 125%. The gamble really is that growth will outpace the rising tide of debt. But if history’s anything to go by, lasting economic strength comes from three pillars: productivity, stable trade, and trust in how the books are balanced over time. All three, we’re told, are central to the Trump Administration’s pitch. Time will tell…

Research:

Now, if history is a guide, we've seen this film before. Reagan in '81, Bush in 2001—both ushered in sweeping tax reforms with promises of booming growth. And we can see what followed. A short-term rush… and a steady climb in the deficit. Of course, not everyone loses. Corporate giants tend to come out smiling, and sectors like finance, energy, and tech usually pocket the gains. But it begs the question: if someone's winning, who's paying? Well, it’s often public programmes. Think healthcare, infrastructure, and education. These are the usual suspects when budgets tighten and debt ceilings loom. I’m not saying it’s a bad thing… I believe in projects because they raise the living standards of all in general, but it’s just not equal across the board.

Across Europe

The UK is waking up to the hard truth that printing currency didn’t fix the system—it just delayed the pain and made it hurt more. Inflation is climbing again, and the Bank of England is cornered. Cut rates and you fan the flames. Raise them and you choke a fragile economy. I’ve said it before… Their QE program was not a good idea. Now the withdrawal symptoms are here. Across Europe, central banks are running out of tools. Fiscal policy is fragmented, which squeezes your savings even more.

Prepare: Expect continued currency instability and a growing divide between policy elites and the public. Real assets, not paper promises, are where capital is starting to flow. Learn as much as you can about tangible assets.

On the Global Stage

Asia’s picture is more fractured than the headlines suggest. China’s stimulus is a sign of weakness, not strength. They’re trying to reduce the slowdown without triggering capital flight. India, on the other hand, is becoming the “safe play” in global emerging markets—but rising too fast brings its own risks. Japan is experiencing a meltdown in its bond market simply because no one wants to buy bonds. And Australia’s interest rate cuts show even commodity-backed economies are feeling the global drag.

Research: Here are some things to think about: What does China’s recent rate cuts say about their internal demand and global trade health? Why is India’s growth attracting capital, and how long can it last? What’s driving Japan’s economic contraction despite the stimulus? How will commodity-exporting nations like Australia respond to global tightening cycles?

The global economy isn’t moving in sync anymore. It’s fragmenting. That creates opportunities, but also volatility.

3. Important Video of The Week

Trump’s ‘Recommended’ 50% EU Tariff…

My latest video discusses the tariff announcement between the US & EU. Plus I cover many important market updates, as well as my take on the Big Beautiful Bill… Watch the Full Video On Youtube

4. Chart of the Week

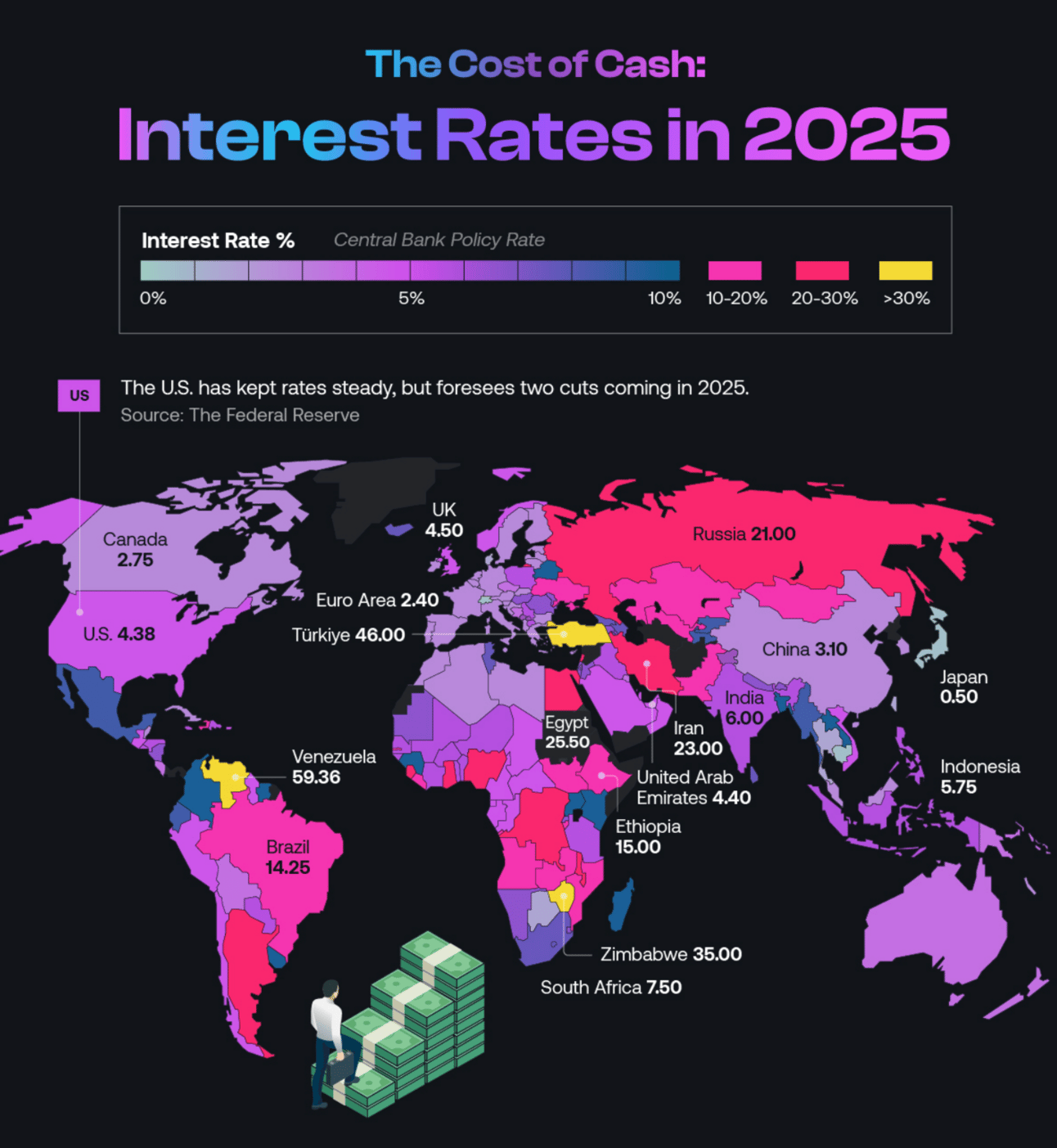

Interest Rates by Country in 2025

Key Takeaways

The U.S. has kept the interest rate steady, but foresees two cuts coming in 2025.

Venezuela has the highest interest rate of 59.4% as the country continues to battle high inflation.

Switzerland and Fiji have the lowest interest rates of 0.25%.

5. Market Overview

This week, the U.S. bond market came under serious strain, spooked by fresh warnings over spiralling federal debt. Some of the main causes are the newly passed House tax-cut bill, projected to pile on as much as $4 trillion to the deficit over the next decade. This led to Investors bolting, treasury bonds selling off sharply, and sending yields to fresh highs. Then came another blow: Moody’s issued a downgrade to the U.S. credit rating, citing long-term fiscal risks. It’s a warning shot that global lenders are watching and worrying about. What does that mean for Countries holding US debt? Long term, I think you know…

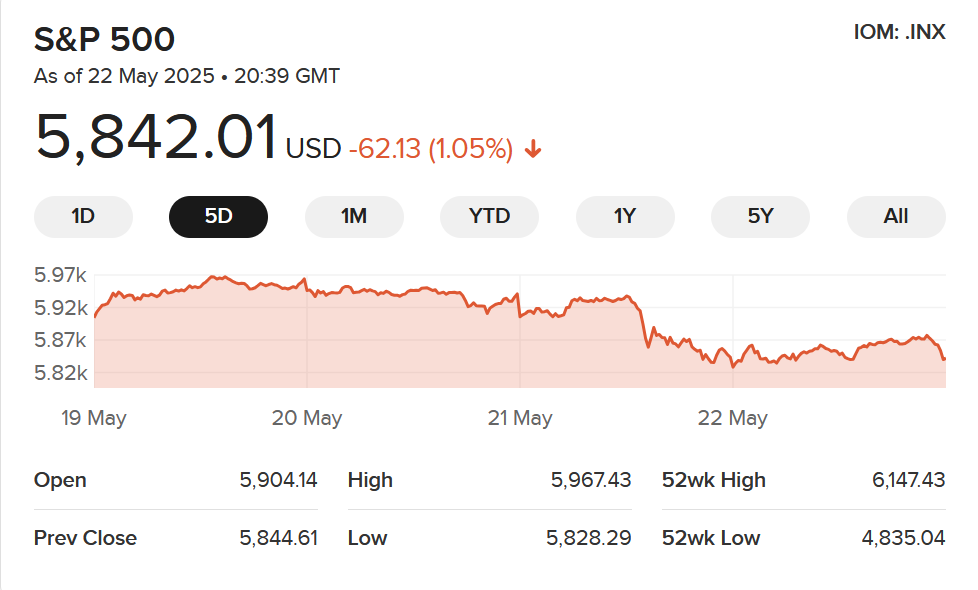

🇺🇸 United States – S&P 500

High: The S&P 500 reached its weekly high around May 20th, estimated at 5,964 points.

Low: The weekly low occurred on May 21st at 5,835 points.

Trend: The index peaked mid-week before declining toward the end of the week, reflecting the volatility we are seeing from bonds market.

🇬🇧 United Kingdom – FTSE 100

High: The FTSE 100 hit its weekly high on May 21st at 8,794 points

Low: On May 19th the index was at 8,616 points.

Trend: The index saw a modest increase over the week despite economic challenges.

🇨🇦 Canada – TSX Composite

High: The TSX Composite reached a record high of 26,089 points on May 20th.

Low: The lowest point in the week was 25,684 on May 15th.

Trend: The index showed strength early in the week, potentially peaking on May 20th, but saw a slight dip by May 21st.

🇦🇺 Australia – ASX 200

High: The ASX 200’s weekly high was 8,421 points on May 21st

Low: The weekly low was 8289 points on May 19th.

Trend: The index declined slightly by the end of the week removing any major gains.

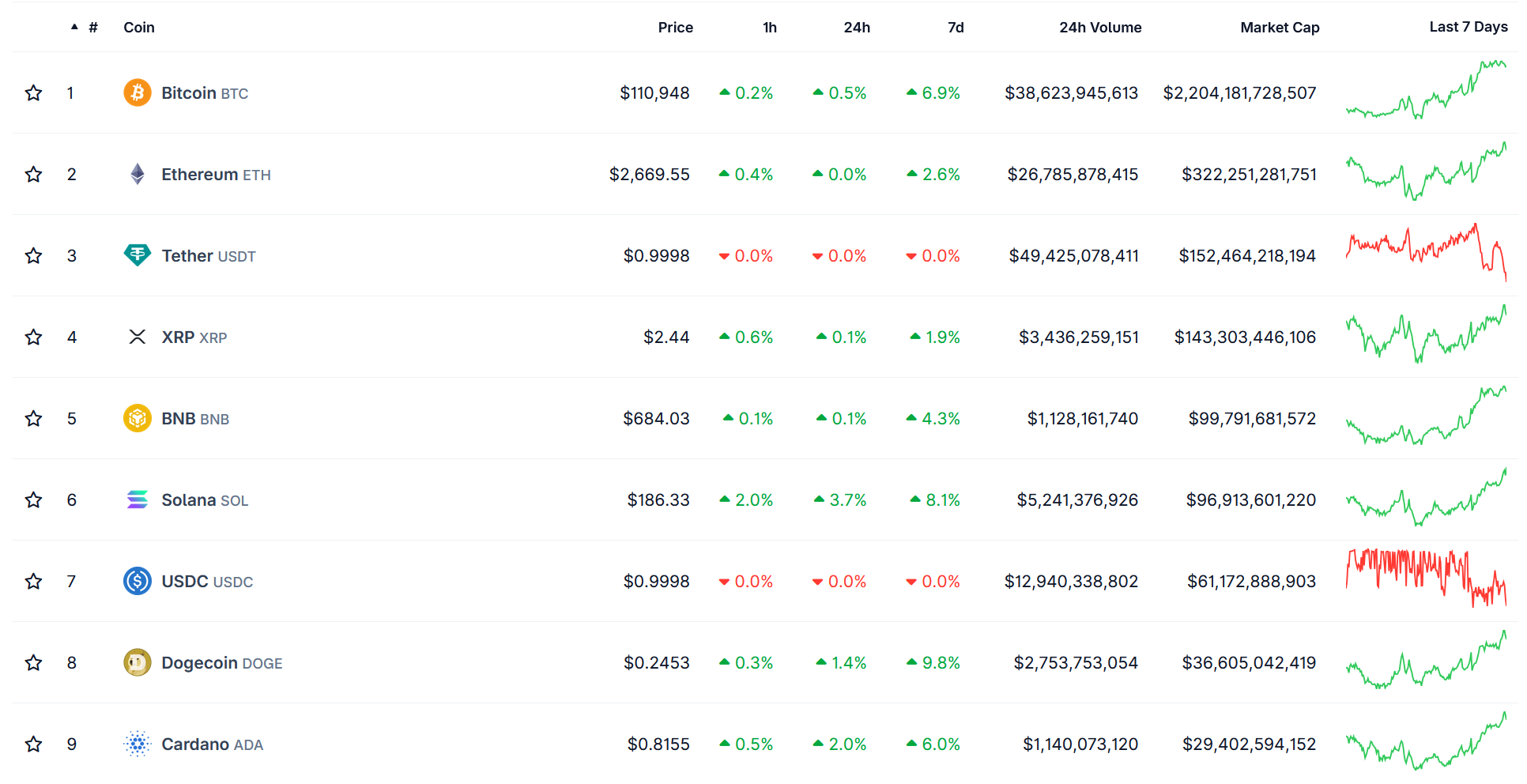

Cryptocurrency:

Bitcoin (BTC)

Bitcoin had an amazing week, now floating around the $111,000 mark, up 0.4% over the past 24 hours and 7% on the week. Institutional momentum remains a driving force, with trading volumes topping $67 billion.Ethereum (ETH)

Ethereum rose 0% in the last 24 hours, currently trading at $2,669. Its 7-day gain sits at 2.6%, Despite the daily fluctuations, it’s holding on quite strongly.XRP (XRP)

XRP is lagging behind the majors, posting a 1.9% weekly gain. XRP this week has been quite volatile compared to other major cryptos.BNB (BNB)

BNB saw modest gains this week, rising 4.3% over 7 days, trading at $684. The gain really only came in the last couple of days. Initially it was off to a bad start this weekSolana (SOL)

Solana jumped 3.7% in 24 hours and 8% over the week, trading near $186.66. This, much like BNB, had a large growth at the end of the week and a slow start.Cardano (ADA)

ADA gained 6% over the week, closing in at $0.815. This has also followed the general wave of the crypto market.

Metals Market Recap: April–May 2025

Data from Last Month 4/22-5/22 - Gold/Silver Ratio = 99.99 (21st of May)

Gold: From Record Highs to Strategic Consolidation

In April, gold prices soared to an all-time high of $3,500 per ounce, driven by heightened geopolitical tensions and a weakening U.S. dollar. However, by mid-May, prices corrected to approximately $3,180, marking a 10% decline from the peak. Despite this pullback, gold remains up 21% year-to-date, bolstered by sustained central bank purchases, particularly from China, and ongoing retail & hedge fund investor demand.

Silver: Underperforming but Poised for Potential Upside

Silver has lagged behind gold, trading around $33 per ounce in late May. While it has experienced a 15% increase year-to-date, its performance has been subdued compared to gold. I believe that silver's dual role as both a precious and industrial metal could position it for tactical gains (long-term forecast), especially with rising industrial demand in sectors like electronics and AI. Just remember that Silver isn’t an ‘in and out’ investment like stocks; it’s highly volatile, and you have to plan carefully and long term.

Neil’s Summary:

Markets may appear stable, but underneath, the system is indeed cracking. Real interest rates remain negative, debt is accelerating, and there is continued spending with no regard for long-term consequences. As confidence erodes, capital is quietly rotating into assets that still hold trust—gold, silver & tangible stores of value.

Find Out Why Gold & Silver Are The Ultimate Vehicle For Financial Freedom, Learn As Much as You Can - Before the System Glitches…

6. Faith & Success

“The wise store up choice food and olive oil, but fools gulp theirs down.” — Proverbs 21:20 (NIV)

As I was reading over Proverbs this week, this verse really hit me. It’s a great example of ‘there’s nothing new under the sun’ - because if you look around you right now, people are still living exactly the same way as they have been living. They don’t change, they don’t adapt. We live in a multi-species World, but aren’t congruent with the seasons of the World. Watch the squirrel, how he collects the nuts at harvest and is cautious through Winter; even an animal can read the signs!

The writing is on the wall, yet people don’t read it. The crime is in the streets, yet people say “oh you’re just targeting that group”. We get a warning from a National Farmers Association and the ‘dumb dumbs’ say “well my store has my Cocoa Puffs & sugar water every day when I go in, they are talking nonsense” - they just don’t get it. They think everything just comes at the push of a button without understanding the bigger picture.

The Bible speaks of stewardship, but even if you aren’t a believer, you’ll see the same patterns elsewhere too: Storing value, managing risk, and preparing for the future are just as much financial strategies as they are biblical principles. And right now, when so much feels uncertain, returning to those truths gives you clarity that headlines can’t offer.

Did you know that there’s currently a mass revival going on throughout the UK of young men? No, most people aren’t even aware because the media doesn’t report on it. Churches are full of young men. I’ve spoken to them, I asked why they were there that day. It’s the same answers over and over again: Young men feel LOST. They can’t be men because they get shot down for ‘toxic masculinity’ - they trusted the media for their moral compass and instead received insecurity, indecisiveness and powerlessness. They’re lost, their mental health is in a shocking state. They don’t even know how to act anymore. But this soon will be fixed!

7. Discounted Courses Of The Week 90% OFF Presale

Here’s What’s Inside:

How to invest into Gold & Silver effectively and safely—learn from over 25 years of my gold and silver investing experience

Deep-dive bullion strategies—from paying the lowest premiums to timing tactical trades with the gold/silver ratio…

Crisis-proof storage blueprints—including offshore vault options and legal workarounds to keep your metals completely secure…

Generational wealth planning—build a bullion pension that passes smoothly to your heirs, no probate required…

Expert Interviews & Industry Insights—conversations/interviews with top bullion experts, vault operators, mining specialists, traders, and industry pioneers…

Real-world crisis case studies—learn from Weimar Germany, Zimbabwe, and modern hyperinflations so you know exactly what to do BEFORE the panic hits…

How I doubled my precious metals portfolio—(£1M+) by timing and trading the Gold to Silver ratio (and how you can too)

Here are your investment options:

Gold & Silver Mastery Bundle: 91% Off - CLICK HERE (Now Including An Affordable 5-Month Payment Plan)

Gold & Silver Investing Course: 90% Off - CLICK HERE

Gold & Silver Advanced Course: 90% Off - CLICK HERE

I’ve poured over 4 years of research into these courses, ensuring that they are the most comprehensive programs anywhere in the World! To make it even easier for you, I’ve provided a 30-day money-back guarantee… It’s a no-brainer. Take action now, you won’t regret it.

Closing Thoughts 💬

My thoughts today are with those who have been impacted by the various worldwide natural disasters, blackouts, and widespread chaos. Especially those in Australia. I pray that everyone stays out of harm’s way. Actually, whether you are a believer or not, I pray for each of you and your families every day.

This newsletter, and my purpose here is to support those in need and empower you with the right information and ideas. I hope to continue to do so for as long as my health continues.

Stay Informed, Stay Empowered! Stay Blessed!

See you next time,

Your Friend,

Neil,

DISCLAIMER

This newsletter is 100% FREE & is designed to help your thinking, not direct it. These newsletters shall NOT be construed as tax, legal, or financial advice and may be outdated or inaccurate; all decisions made as a result of this information are yours alone.

Trading/Liability: Neil McCoy-Ward operates/trades under a private Ltd company within the Isle Of Man.